Property Law Documents

Property Taxes

Connecticut Corporation Business Tax Return Form CT-1120

Form CT-1120 is the Corporation Business Tax Return for Connecticut. It is essential for corporations to report their income and determine tax obligations. This form must be filed electronically through the myconneCT portal.

Real Estate

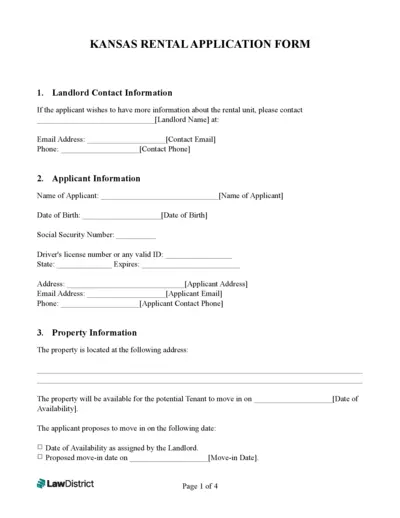

Kansas Rental Application Form for Prospective Tenants

The Kansas Rental Application Form is a crucial document for individuals looking to rent a property. It collects applicant information, rental history, financial details, and more to assist landlords in the tenant selection process. By completing this form accurately, applicants can facilitate a smooth application process.

Property Taxes

NYC 202 Unincorporated Business Tax Return Instructions

This document provides essential instructions for completing the NYC-202 Unincorporated Business Tax Return. It offers detailed guidance on who must file, how to fill out the form, and important tax law changes. Perfect for individuals and LLCs operating within New York City.

Real Estate

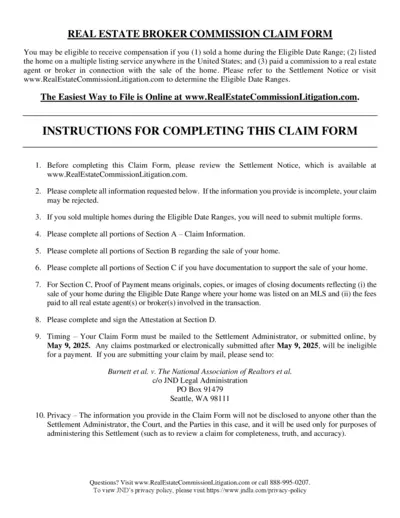

Real Estate Broker Commission Claim Form

This form allows individuals who sold homes during the eligible date range to claim compensation for commissions paid. Interested users can fill out the form online or by mail to request their compensation. Ensure all information is provided accurately to avoid any claim rejection.

Property Taxes

Delaware Tax Withholding Return W1A Form Instructions

The Delaware Division of Revenue Withholding Tax Return - Form W1A is vital for reporting and remitting Delaware income tax withheld. This form is necessary for employers who need to file taxes periodically. Use this guide to navigate the completion and submission of this form effectively.

Real Estate

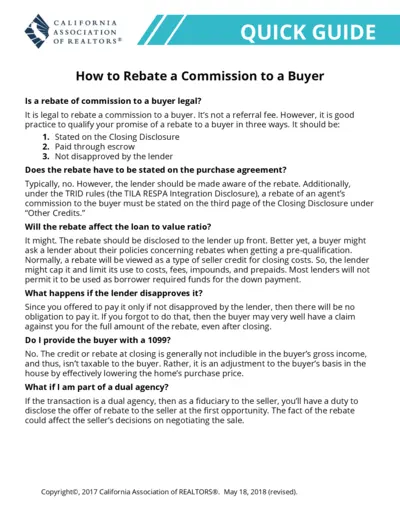

California REALTORS Commission Rebate Guide

This quick guide outlines the legal aspects of rebating a commission to a buyer in California. It covers important practices and lender communications. Ideal for real estate professionals and buyers seeking clarity on rebates.

Property Taxes

Missouri Sales Tax Return Form 53-1 Instructions

The Missouri Sales Tax Return Form 53-1 is essential for businesses to report and pay sales tax. This document provides necessary fields and instructions for accurate submission. Ensure compliance with state regulations while filling out this form.

Property Taxes

Instructions for Form 8959 Additional Medicare Tax

This document provides detailed instructions for Form 8959, which is used to calculate Additional Medicare Tax. It's essential for taxpayers who exceed certain income thresholds. Follow the guidelines to ensure correct filing and compliance.

Property Taxes

South Carolina S Corporation K-1 Instructions

This file provides instructions and details for shareholders of S Corporations in South Carolina. It includes information on filling out the SC1120S K-1 form, essential for reporting income and deductions. Shareholders can learn about their pro-rata share of the corporation's income here.

Property Taxes

New York State IT-112-R Instructions 2022

This file provides comprehensive instructions for Form IT-112-R, allowing New York State residents to claim credits for taxes paid to other jurisdictions. It details eligibility, processing information, and necessary forms. Essential for ensuring correct state tax credits and compliance.

Property Taxes

New York Estate Tax Domicile Affidavit Instructions

This document provides important information on the New York State Estate Tax Domicile Affidavit. It is essential for proper filing when claiming the decedent was not domiciled in New York State. Make sure to follow the guidelines carefully.

Real Estate

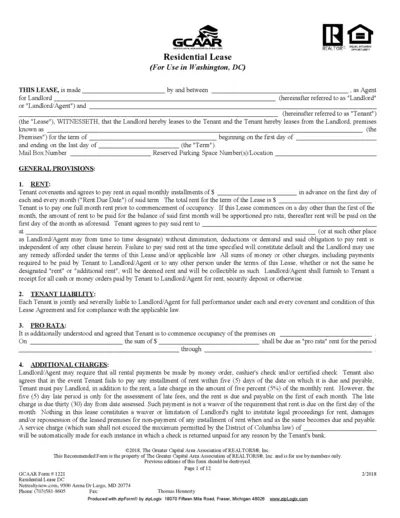

Residential Lease Agreement for Washington DC

This Residential Lease Agreement outlines the terms and conditions between the landlord and tenant in Washington DC. It is crucial for legal habitation arrangements. This form ensures both parties understand their rights and responsibilities.