Property Law Documents

Property Taxes

Form W-7 COA IRS Taxpayer Identification Number

Form W-7 (COA) certifies the accuracy of documentation for ITIN applicants. This form is essential for Certifying Acceptance Agents submitting for IRS ITIN. Complete the form accurately to avoid processing delays.

Zoning Regulations

Army Cybersecurity Regulation 25-2 Overview

This document serves as the regulation for Army Cybersecurity management. It outlines the necessary responsibilities and policies for safeguarding Army's information technology. Effective from April 4, 2019, it addresses compliance with defense directives.

Property Taxes

Arizona Form 120S 2022 Income Tax Return

Arizona Form 120S is the official S Corporation income tax return form for 2022. This form is essential for S Corporations to report their income, deductions, and credits. Proper completion ensures compliance with Arizona tax regulations.

Property Taxes

Ohio IT 4738 UPC Pass-Through Entity Income Tax

The Ohio IT 4738 UPC is a required form for making pass-through entity and fiduciary income tax payments. This form ensures that payments are accurately applied to your account with the Ohio Department of Taxation. Ensure compliance by filling it out correctly to avoid delays in processing.

Property Taxes

New York State ST-100 Quarterly Sales and Use Tax Return Instructions

This document provides detailed instructions for completing the New York State ST-100 form, a quarterly sales and use tax return. It outlines filing requirements, exemptions, and important changes in tax rates. Ensure compliance and accuracy while filing your taxes.

Real Estate

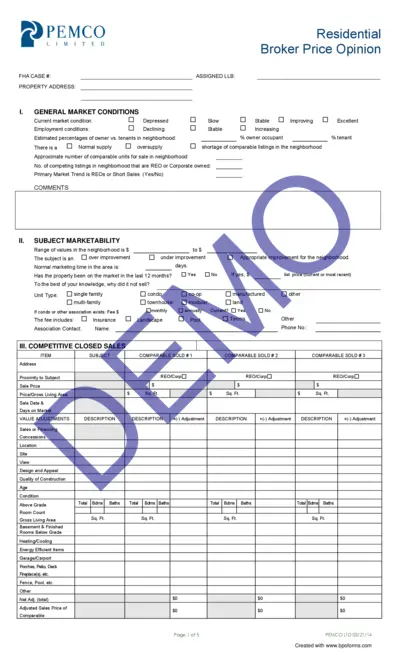

Residential Broker Price Opinion Document

This document provides a comprehensive broker price opinion for residential properties. It includes market conditions, competitive listings, and necessary repairs. Ideal for both buyers and sellers to assess property values.

Property Taxes

Schedule A Form 940 2023 Multi-State Employer Guide

Schedule A (Form 940) for 2023 provides multi-state employer and credit reduction information. Follow the instructions to accurately complete your form. Ensure compliance with FUTA taxable wages and state unemployment taxes.

Real Estate

Guide to Assigning Contracts in California

This guide provides essential information on how to assign contracts in California real estate transactions. It outlines the steps, requirements, and relevant forms. Ideal for buyers needing to manage their contractual obligations effectively.

Property Taxes

2023 Form 1041-V Payment Voucher for Estates

This file contains the 2023 Form 1041-V which is a payment voucher required when submitting payments related to estates and trusts. It provides detailed instructions for filling out the form and mailing it to the IRS. Essential for fiduciaries, this form helps streamline the payment process.

Property Taxes

Form 2441 Child and Dependent Care Expenses 2021

Form 2441 is essential for taxpayers claiming child and dependent care credits. It provides detailed instructions for tracking qualifying expenses. Use this form to ensure you maximize your tax benefits legally.

Property Taxes

Pennsylvania Mortgage Foreclosure Inheritance Tax Form

This file serves as an application for mortgage foreclosure inheritance tax release of lien. It is designed for mortgagees to report real property under Pennsylvania law. Complete this form to establish any inheritance tax obligations on the property.

Property Taxes

NYC Department of Finance Payment Voucher Form

The NYC-200V form is a payment voucher for individuals and businesses owing taxes in New York City. It is essential for submitting your payment along with your tax returns. Ensure timely submission to avoid penalties.