Property Taxes Documents

Property Taxes

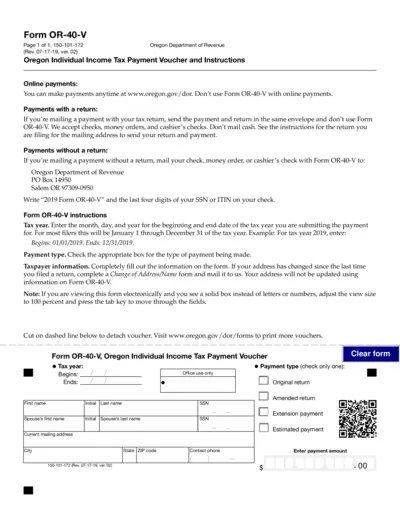

Oregon Individual Income Tax Payment Voucher Instructions

The Oregon Individual Income Tax Payment Voucher is a form required for submitting individual income tax payments in Oregon. It includes detailed instructions for filling out the form, submitting payments, and necessary tax year information. Use this form to ensure your tax payments are processed correctly.

Property Taxes

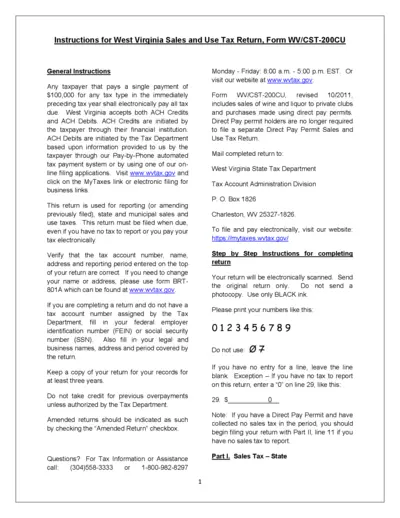

West Virginia Sales and Use Tax Return Instructions

This file contains detailed instructions for the West Virginia Sales and Use Tax Return, Form WV/CST-200CU. It includes guidelines for submission, exemptions, and payment methods applicable to sales and use taxes in West Virginia. Designed for both taxpayers and businesses, this document simplifies the reporting process.

Property Taxes

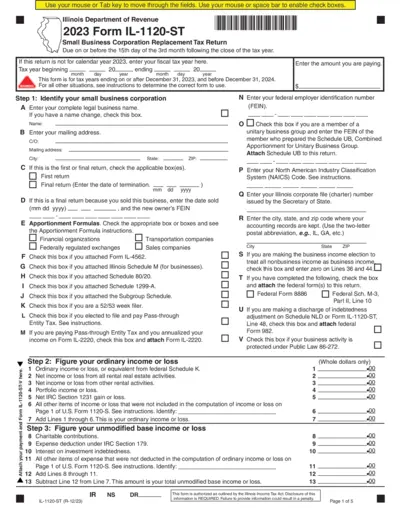

Illinois Form IL-1120-ST Small Business Tax Return

The Illinois Form IL-1120-ST is a tax return for small business corporations. It must be submitted by the 15th day of the third month following the tax year end. This form is essential for businesses operating in Illinois to report their taxes accurately.

Property Taxes

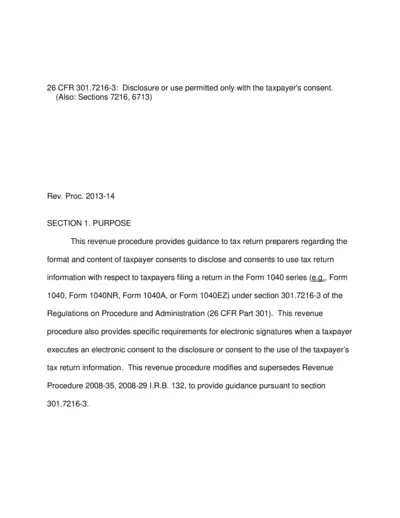

Guidance on Taxpayer Consent for Information Disclosure

This revenue procedure offers essential guidance for tax return preparers on taxpayer consent for disclosing or using tax return information. It outlines specific requirements for consents related to Tax Form 1040 and provides clarity on electronic signatures. Understanding these consents is crucial for compliance with regulations under section 301.7216-3.

Property Taxes

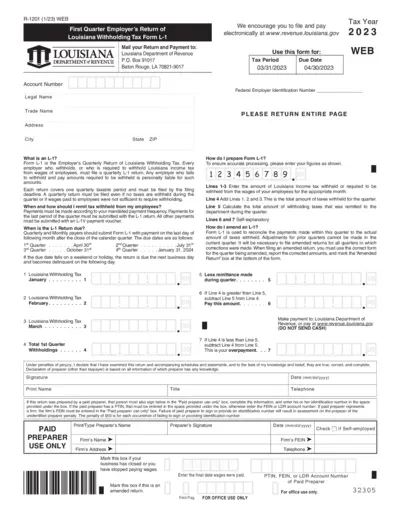

Louisiana Withholding Tax Employer's Return Form L-1

Form L-1 is the Employer's Quarterly Return of Louisiana Withholding Tax. It is mandatory for all employers who withhold Louisiana income tax to file this form quarterly. This document provides important information necessary for proper tax reporting.

Property Taxes

Schedule O Form 1120 Instructions for Controlled Groups

This document provides essential instructions for completing Schedule O for Form 1120, required for corporations within controlled groups. It outlines consent plans, apportionment schedules, and compliance requirements. Ensure accurate submission by following detailed guidance provided in this file.

Property Taxes

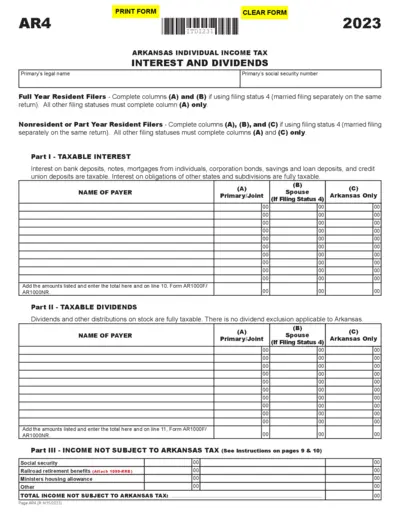

Arkansas Individual Income Tax Filing Instructions

This file provides essential details on how to file Arkansas individual income tax. It outlines the instructions for filling out interest and dividends disclosures. Use this form if you are a resident or a part-year resident of Arkansas.

Property Taxes

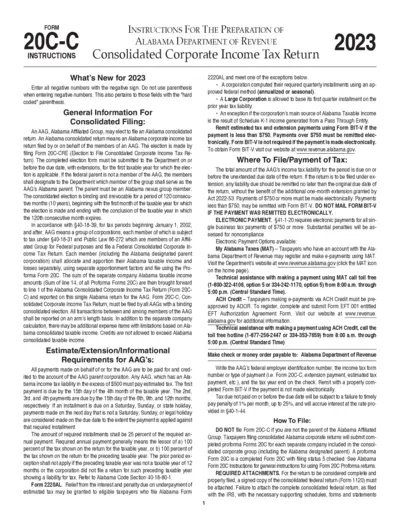

Alabama Corporate Income Tax Return Instructions

This document provides comprehensive instructions for filing the Alabama Consolidated Corporate Income Tax Return. It includes details on eligibility, filing requirements, and important deadlines. Businesses must understand these instructions to ensure compliance with Alabama tax laws.

Property Taxes

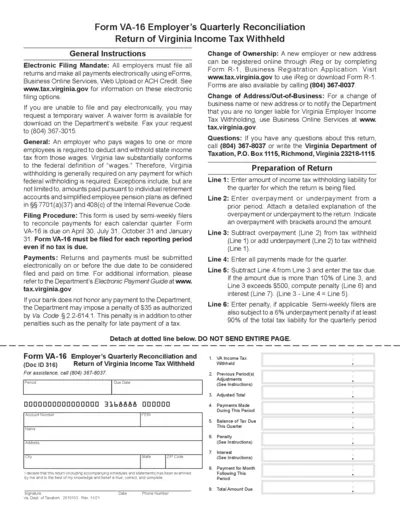

VA-16 Employer's Quarterly Reconciliation Form

The VA-16 form is used by employers for quarterly income tax reconciliation in Virginia. It details the income tax withheld and payments made during the quarter. Employers must file electronically to comply with Virginia law.

Property Taxes

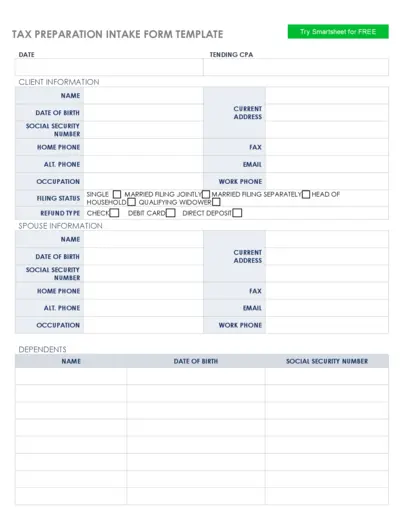

Tax Preparation Intake Form Template

The Tax Preparation Intake Form Template is essential for efficiently gathering client information and income details. This form streamlines the tax preparation process, ensuring all necessary data is collected. Ideal for both individuals and businesses seeking structured tax documentation.

Property Taxes

Instructions for Hawaii Form N-848 Power of Attorney

Form N-848 allows individuals to grant authority to a representative for tax matters in Hawaii. This form is essential for taxpayers needing assistance with confidential tax information. Follow the guidelines carefully to ensure proper submission and representation.

Property Taxes

California Franchise Tax Board Form 568 Instructions

This document provides comprehensive instructions for completing Form 568, the Limited Liability Company Return of Income in California. It includes vital reporting requirements, important deadlines, and guidance on how to navigate the form. Suitable for LLCs in California and their tax preparers.