Property Taxes Documents

Property Taxes

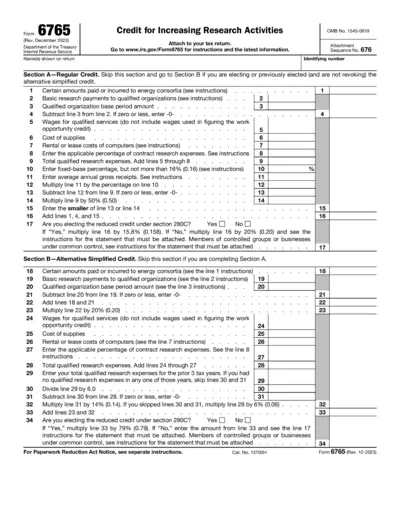

Form 6765 Credit for Increasing Research Activities

Form 6765 is used to claim a tax credit for increasing research activities. It helps businesses to leverage tax incentives associated with their research investments. Users must attach this form to their tax return for proper processing.

Property Taxes

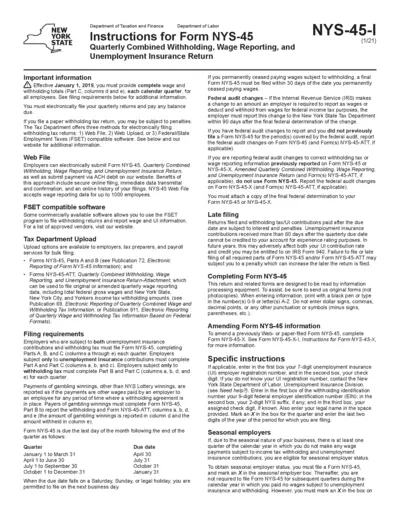

Instructions for Form NYS-45: Tax Reporting

Form NYS-45 provides essential instructions for employers in New York State regarding their quarterly combined withholding and unemployment insurance returns. This file outlines filing requirements, methods for electronic submission, and payment responsibilities. Understanding how to correctly fill and submit this form is vital for compliance and avoiding penalties.

Property Taxes

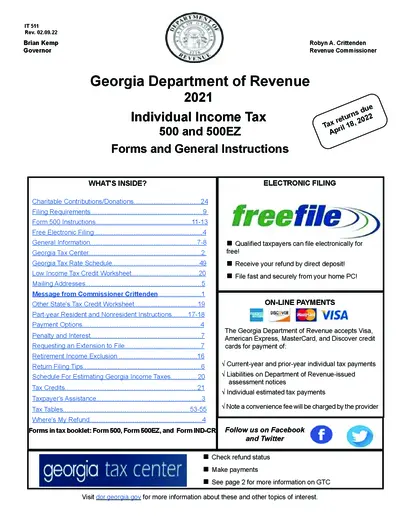

Georgia Individual Income Tax Forms and Instructions

This file provides essential guidelines for Georgia individual income tax filing, including forms and timelines. Users can find detailed instructions for Forms 500 and 500EZ, important dates, and online services. Refer to this document for a step-by-step approach to file your tax returns efficiently.

Property Taxes

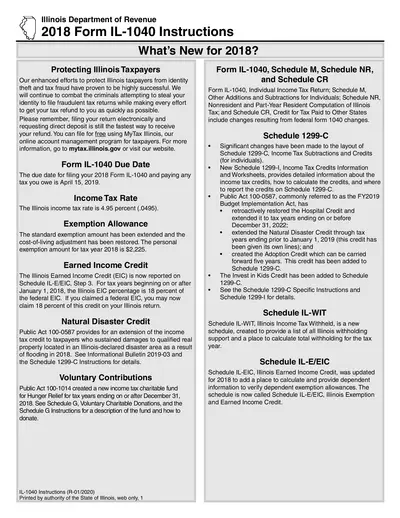

Illinois 2018 Form IL-1040 Instructions Overview

Discover the Illinois Department of Revenue's instructions for the 2018 Form IL-1040. This document provides guidance on filing taxes, understanding rates, and crucial deadlines. Ensure accurate tax submission and optimize your tax refund process.

Property Taxes

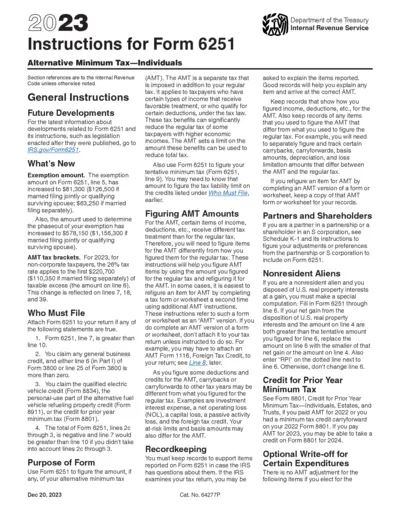

Instructions for Form 6251 Alternative Minimum Tax

This file contains detailed instructions for individuals filling out Form 6251 for the Alternative Minimum Tax (AMT). It provides essential information on who needs to file and how to compute the AMT. Stay updated with the latest tax guidelines and exemption amounts.

Property Taxes

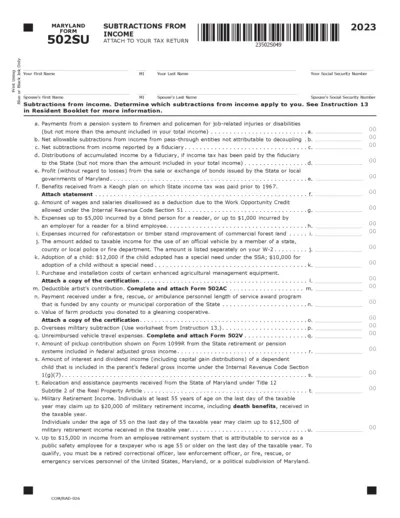

Maryland Form 502SU Subtractions from Income 2023

The Maryland Form 502SU allows taxpayers to report subtractions from their income. This form is essential for claiming eligible deductions on state tax returns. Ensure you understand all the subtractions applicable to your situation before filing.

Property Taxes

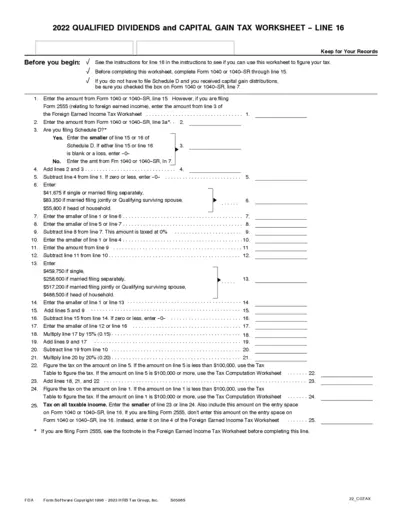

2022 Qualified Dividends and Capital Gain Tax Worksheet

This worksheet helps you determine the tax on your qualified dividends and capital gains. Complete Form 1040 or 1040-SR before using this worksheet. For accurate tax calculation, follow the outlined instructions carefully.

Property Taxes

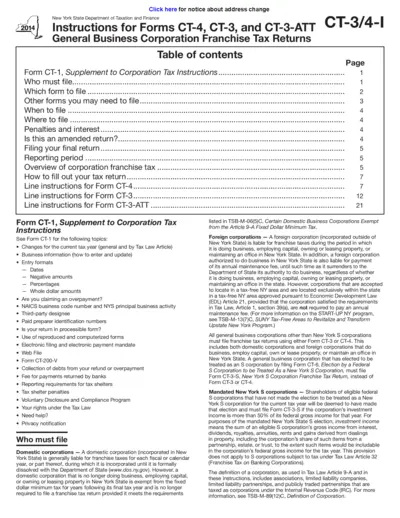

Instructions for New York State Tax Forms CT-4 and CT-3

This file provides necessary instructions and forms for filing New York State franchise tax returns. It covers details on who must file, what forms to use, and line-by-line filing instructions. Business owners and corporations will benefit from following these guidelines to ensure compliance.

Property Taxes

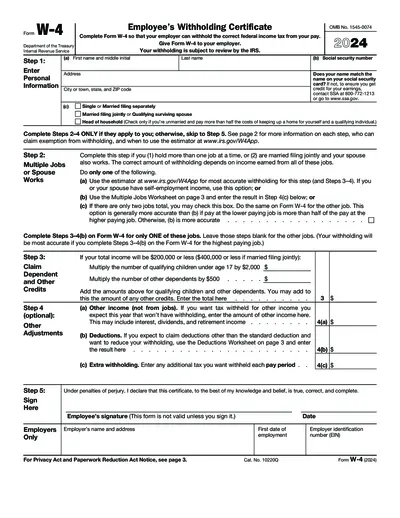

Employee's Withholding Certificate - Form W-4 (2024)

The W-4 form is essential for employees to determine federal income tax withholding from their pay. It helps ensure the right amount is deducted to avoid penalties or large refunds. Complete the form accurately to reflect your tax situation.

Property Taxes

IRS Non-Filing Verification Tax Form

This file is a verification of non-filing for Form 1040. It contains information regarding the taxpayer's status and instructions from the IRS. Essential for taxpayers needing proof of non-filing, especially for specific tax periods.

Property Taxes

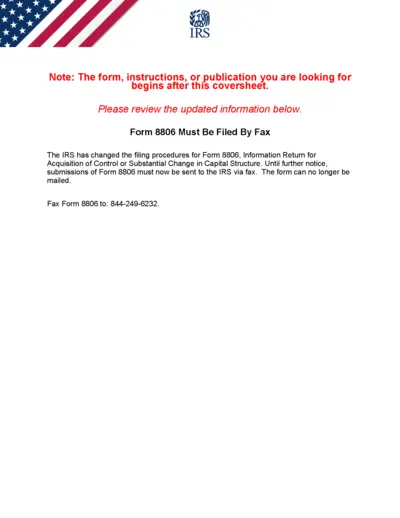

Filing Guidelines for IRS Form 8806 Submission

This document outlines the necessary instructions for submitting IRS Form 8806, Information Return for Acquisition of Control or Substantial Change in Capital Structure. It details the requirements and processes for corporations involved in significant ownership changes. Ensure compliance to avoid penalties by submitting via fax.

Property Taxes

Kentucky Individual Income Tax Forms 2023

This file provides essential instructions and information for filing your individual income tax in Kentucky for the year 2023. It includes various filing options, taxpayer assistance details, and guidelines for various tax credits. Perfect for individuals and families preparing their tax returns.