Property Taxes Documents

Property Taxes

Partner's Instructions for Schedule K-1 Form 1065

This file contains essential instructions for partners regarding Schedule K-1 (Form 1065). It outlines how to report income, deductions, and credits from partnership activities. Follow these guidelines to accurately file your taxes as a partner.

Property Taxes

Instructions for Form 2848 Power of Attorney

This file provides detailed instructions for Form 2848, which is used to authorize individuals to represent taxpayers before the IRS. The instructions include filling out the form to grant authority, specify tax matters, and submission guidelines. It is essential for taxpayers needing assistance with their tax legalities.

Property Taxes

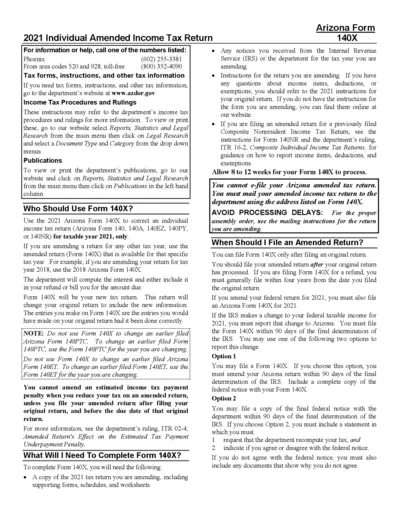

Arizona Form 140X 2021 Individual Amended Income Tax Return

The Arizona Form 140X is used for amending individual income tax returns filed in 2021. It is essential for taxpayers who need to correct previously submitted tax information. This form allows for adjustments to ensure accurate tax reporting and compliance.

Property Taxes

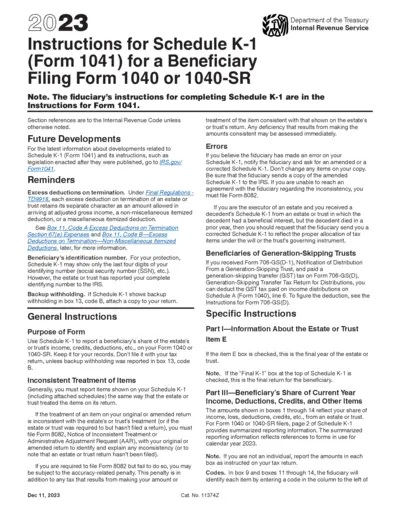

Schedule K-1 Form 1041 Instructions for Beneficiaries

This file contains essential instructions for completing Schedule K-1 related to Form 1041. Beneficiaries will find detailed information on how to report their share of income, deductions, and credits. It is a crucial document for tax reporting purposes for estates and trusts.

Property Taxes

Instructions for Schedule K Form 1118 Tax Year 2018

This document provides detailed instructions for filling out Schedule K (Form 1118) for tax years involving foreign tax carryover. Essential for corporations handling foreign taxes, it outlines the necessary forms and steps to complete the process accurately. It is crucial for compliance with IRS regulations regarding tax credits.

Property Taxes

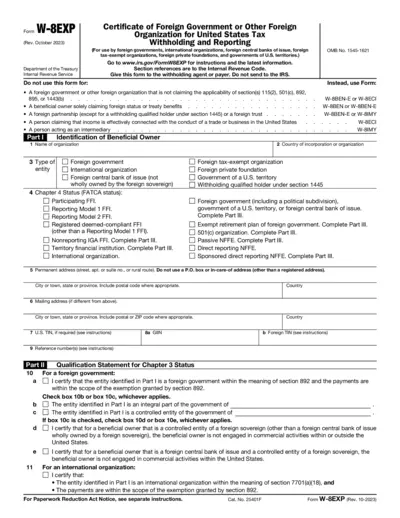

W-8EXP Foreign Government Tax Form Instructions

The W-8EXP form is a certificate for foreign government entities for tax purposes. It is used to claim exemption from U.S. tax withholding. This form must be provided to the withholding agent or payer.

Property Taxes

Instructions for IRS Form 709 Gift Tax Return 2023

This file provides essential instructions for completing IRS Form 709, the United States Gift Tax Return. It outlines who must file, the filing process, and important updates for 2023, ensuring accurate reporting of gifts. Follow these guidelines to ensure compliance with tax regulations related to gift and generation-skipping transfer taxes.

Property Taxes

Instructions for Schedule B Form 941

This file provides instructions for completing Schedule B of Form 941. It outlines tax liability for semiweekly schedule depositors. Users will find essential guidance for filing their quarterly federal tax return.

Property Taxes

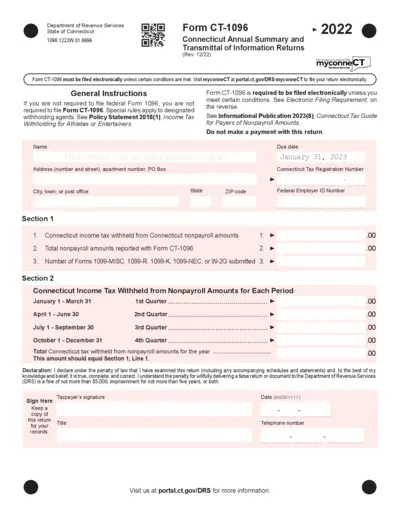

Connecticut Form CT-1096 Annual Summary Instructions

Form CT-1096 is essential for reporting nonpayroll amounts in Connecticut. It must be filed electronically via myconneCT. Ensure accurate filing to avoid penalties and ensure compliance.

Property Taxes

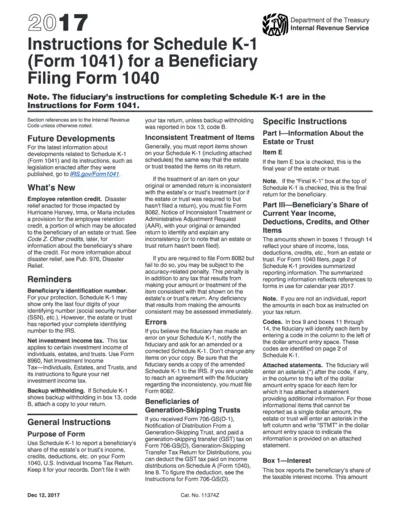

2017 Instructions for Schedule K-1 (Form 1041)

This document provides comprehensive instructions on how to fill out Schedule K-1 (Form 1041) for beneficiaries. It outlines important tax information and lists the necessary forms needed for proper filing. Ideal for estate or trust beneficiaries who need clarity on reporting income and deductions.

Property Taxes

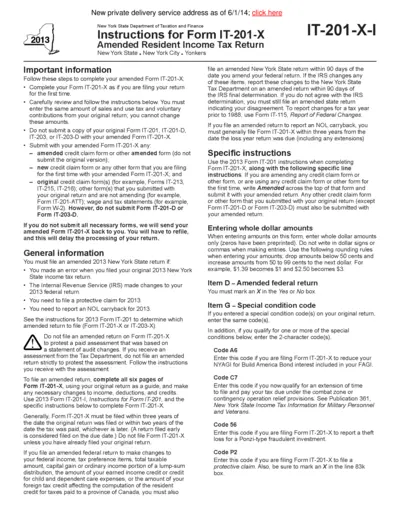

New York State IT-201-X Amended Tax Return Instructions

This file provides detailed instructions for filing Form IT-201-X, which is the amended resident income tax return for New York State. It includes important steps, requirements, and tips for successful submission. Understanding these guidelines ensures compliance and minimizes delays in processing your amended return.

Property Taxes

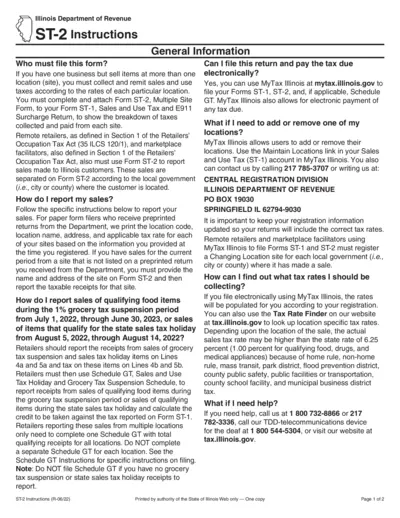

Illinois Department of Revenue ST-2 Instructions

The Illinois ST-2 form provides essential instructions for reporting sales and use taxes in Illinois. It details the requirements for remote retailers and multiple site sellers. This guide ensures compliance with state tax regulations for businesses operating in Illinois.