Property Taxes Documents

Property Taxes

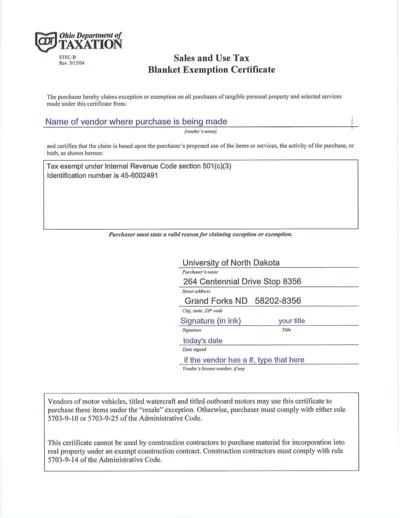

Ohio Sales and Use Tax Blanket Exemption Certificate

This document serves as the Ohio Sales and Use Tax Blanket Exemption Certificate, allowing eligible purchasers to claim tax exemptions on certain purchases. Designed for diverse entities, including non-profits and farmers, this certificate simplifies the process of exemption claims. Ensure proper completion to comply with Ohio tax laws.

Property Taxes

2020 Michigan Composite Individual Income Tax Return

This file contains the 2020 Michigan Composite Individual Income Tax Return form. It is used to report income and calculate tax liabilities for partnerships and S corporations. This return must be submitted by April 15, 2021.

Property Taxes

North Carolina Sales and Use Tax Exemption Guide

This document outlines the North Carolina procedures for exemption certificates related to sales and use tax. It provides essential details for vendors and purchasers on how to properly process exemption certificates. Ensure compliance with state regulations using the streamlined process described here.

Property Taxes

2023 South Carolina Individual Income Tax Return Form SC1040

This file contains the official 2023 Individual Income Tax Return form for South Carolina, known as SC1040. It provides detailed instructions and information required to properly file your income taxes in South Carolina. Ideal for residents and non-residents alike, it assists in ensuring compliance with state tax regulations.

Property Taxes

Instructions for Form 8949 Sales and Dispositions

This file provides instructions for Form 8949, which is used to report sales and exchanges of capital assets. It includes details about how to fill out the form correctly, along with guidelines for various entities. Users will find helpful information about the purpose of the form and the process involved.

Property Taxes

Nonresident or Part-Year Resident Tax Booklet 540NR 2022

The 2022 California 540NR Tax Booklet provides essential information and instructions for nonresidents and part-year residents filing their taxes. This document includes important dates, filing requirements, and tax credits. Use this booklet to guide your tax filing process for income earned in California.

Property Taxes

Instructions for Forms 1099-R and 5498

This document provides essential guidelines for completing Forms 1099-R and 5498 related to pension distributions, IRAs, and more. It includes updates about new laws and instructions for various situations. Users will find detailed instructions and necessary codes for accurate reporting.

Property Taxes

2022 Instructions for Form 8824 Like-Kind Exchanges

This file provides detailed guidelines on how to fill out Form 8824 for reporting like-kind exchanges. It includes important updates and specific instructions for different asset types. Understanding this form is essential for accurate tax reporting related to property exchanges.

Property Taxes

IRS Form 8879 e-file Signature Authorization

Form 8879 is used for IRS e-file signature authorization. This form allows taxpayers to authorize their electronic return originator (ERO) to file their tax returns electronically. Completing this form ensures your return is properly submitted to the IRS.

Property Taxes

2023 Instructions for Schedule D Form 1040

The file provides detailed instructions for completing Schedule D, which is used for reporting capital gains and losses to the IRS. It includes information on various forms, filing requirements, and important guidelines for taxpayers. Essential for individuals managing investment properties or capital assets.

Property Taxes

2023 Form 1040-ES Estimated Tax for Individuals

Form 1040-ES is designed for individuals to calculate and pay their estimated taxes for the tax year 2023. It is essential for income not subject to withholding. Ensure you follow the guidelines to avoid penalties.

Property Taxes

Utah State Tax Exemption Certificate Form TC-721

This PDF file contains the Utah Exemption Certificate for sales and use taxes, including detailed instructions and necessary exemptions. It is a vital document for businesses and organizations claiming tax exemptions in Utah. Use this file to claim exemptions related to purchases of tangible personal property or services.