Property Taxes Documents

Property Taxes

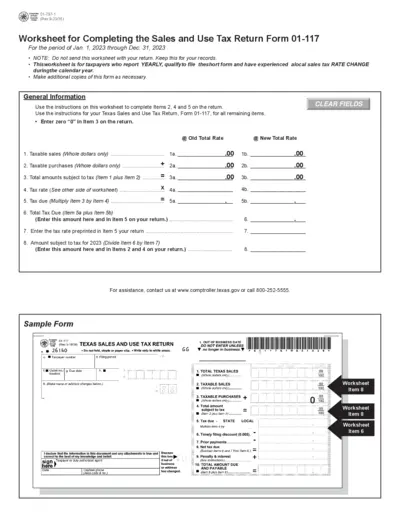

Texas Sales and Use Tax Return Form 01-117 Instructions

This document provides instructions for completing the Texas Sales and Use Tax Return Form 01-117. It includes guidelines for taxpayers who report yearly and details on local sales tax rate changes. It also contains a sample form and information about the new tax rates imposed by various cities and special purpose districts in 2023.

Property Taxes

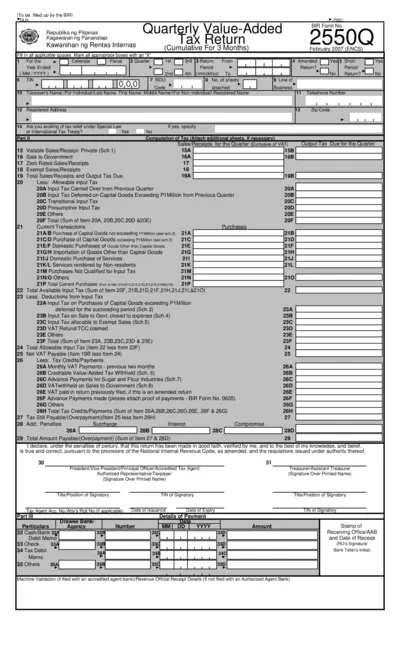

BIR Form No. 2550Q - Quarterly Value-Added Tax Return

This file is the BIR Form No. 2550Q, used for quarterly value-added tax returns. It is filled out by taxpayers to report and pay VAT. The form covers sales, purchases, input and output tax details, and more.

Property Taxes

Massachusetts Estimated Income Tax Payment Instructions

The purpose of this file is to guide taxpayers in Massachusetts on how to make estimated income tax payments. It includes information on who needs to make these payments, when they are due, and how to make them. The file also details the penalties for failing to make estimated tax payments on time.

Property Taxes

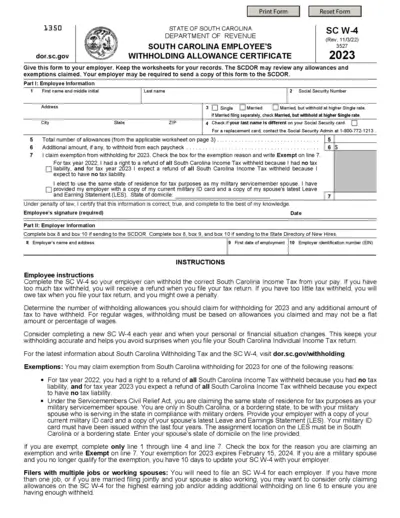

South Carolina Employee's Withholding Allowance Certificate SC W-4 (2023)

This document is the South Carolina Employee's Withholding Allowance Certificate, also known as SC W-4. It is used to determine the amount of South Carolina Income Tax to withhold from an employee's paycheck. Employees should complete this form with accurate information and provide it to their employers.

Property Taxes

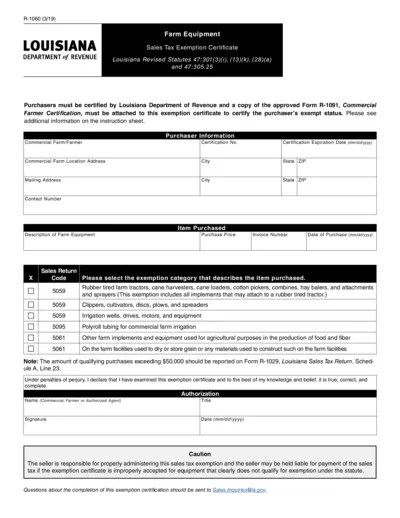

Louisiana Form R-1060: Farm Equipment Sales Tax Exemption Certificate

This document outlines the requirements for Louisiana farm equipment sales tax exemption. Commercial farmers must attach their certification. Learn about qualifying equipment and submission details.

Property Taxes

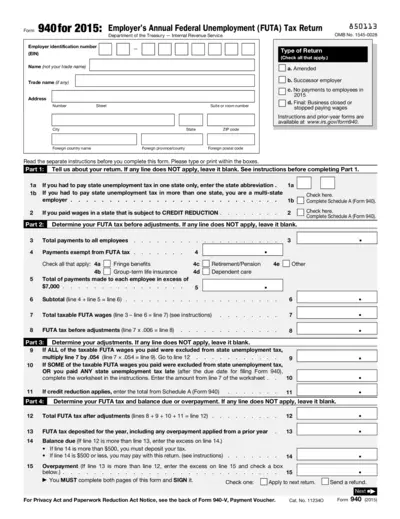

Employer's Annual Federal Unemployment (FUTA) Tax Return 2015

Form 940 for 2015 is used by employers to report their annual Federal Unemployment (FUTA) tax. It includes details about payments to employees, taxable FUTA wages, and adjustments. Employers must file this form with the IRS.

Property Taxes

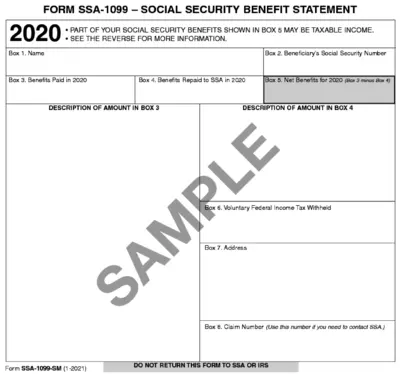

Form SSA-1099 - Social Security Benefit Statement 2020

The Form SSA-1099 is a document sent by the Social Security Administration. It details the total benefits paid and any amounts repaid in 2020. Use this form for tax reporting purposes.

Property Taxes

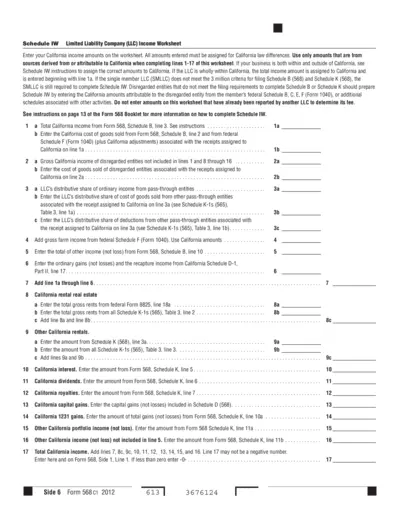

Schedule IW LLC Income Worksheet

This file provides the Schedule IW form for Limited Liability Company (LLC) Income Worksheet. It details how to enter California income amounts and contains instructions for proper completion. If your business operates within and outside of California, ensure to follow the instructions to assign the correct amounts.

Property Taxes

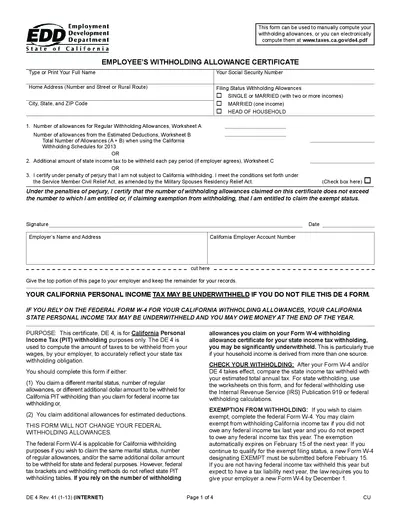

California Employee's Withholding Allowance Certificate

The California DE 4 form is used to determine the amount of state income tax to be withheld from an employee's wages. This form helps employees compute their withholding allowances for California Personal Income Tax. It also provides the option to claim exemptions from withholding.

Property Taxes

Uniform Sales & Use Tax Resale Certificate - Multijurisdiction

This file is a Uniform Sales & Use Tax Resale Certificate for multiple jurisdictions, detailing which states accept it as a resale/exemption certificate. It includes instructions on how to properly complete and use the certificate. Additionally, it provides information on state-specific requirements and regulations.

Property Taxes

Illinois Department of Revenue 2023 IL-1040-X Instructions

The 2023 Illinois Form IL-1040-X Instructions provide guidance for amending individual income tax returns. This document explains when and how to file amended returns. It includes details on the necessary attachments and timing considerations.

Property Taxes

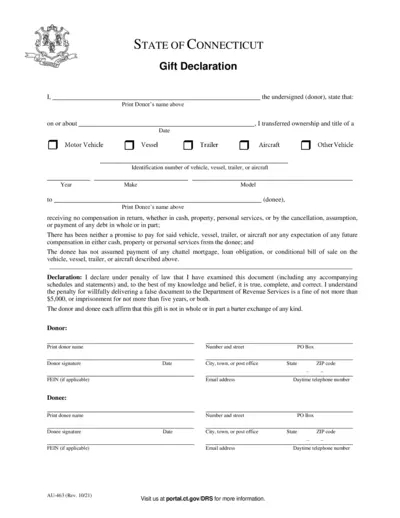

Connecticut Gift Declaration Form for Motor Vehicles

This form is used in Connecticut for declaring the gift of a motor vehicle, vessel, trailer, or aircraft. It requires signature and information from both the donor and donee. This form ensures there is no compensation expected from the gift.