Property Taxes Documents

Property Taxes

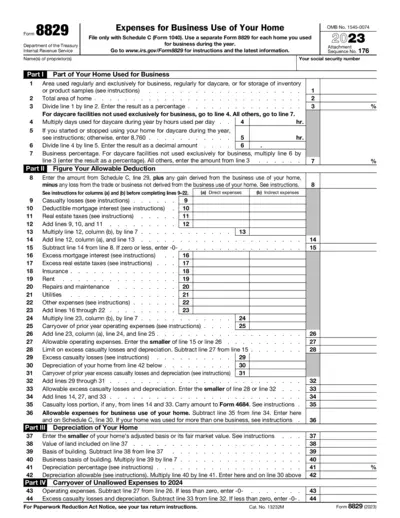

Form 8829: Expenses for Business Use of Your Home

IRS Form 8829 is used to claim expenses for the business use of your home. It includes sections on calculating the allowable deduction, depreciation, and carryover of unallowed expenses. Be sure to follow the instructions to ensure accuracy.

Property Taxes

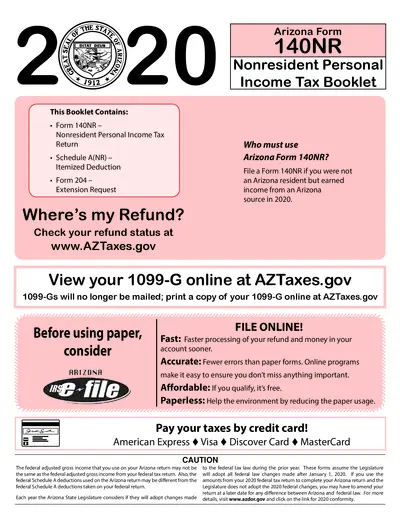

Arizona Form 140NR Nonresident Personal Income Tax Booklet 2020

This document contains the Arizona Form 140NR for nonresident personal income tax filing for the year 2020. It includes details on itemized deductions, extension requests, and instructions on how to file and submit the form. It is essential for nonresidents who earned income from an Arizona source in 2020.

Property Taxes

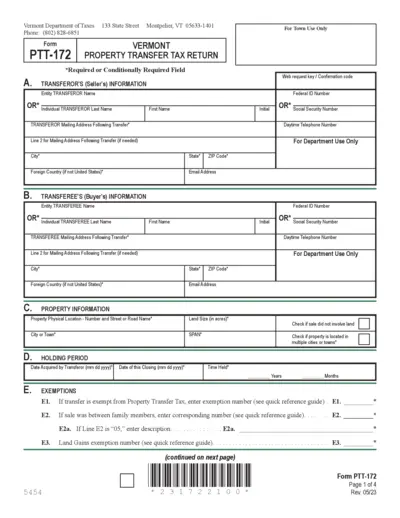

Vermont Property Transfer Tax Return Form PTT-172

This form is used for reporting the transfer of property in Vermont and calculating the property transfer tax due. Included are sections for both the transferor's and transferee's information, property details, exemptions, transfer information, and tax calculation. It is essential for buyers and sellers to complete this form accurately to comply with Vermont tax laws.

Property Taxes

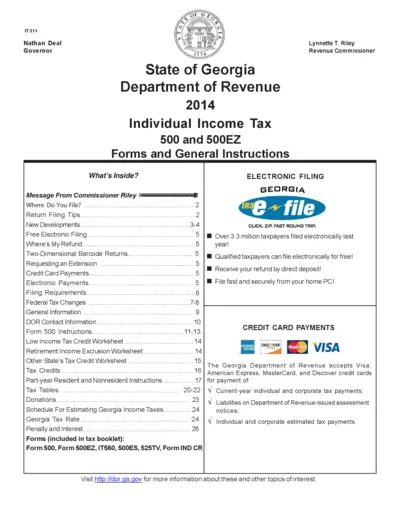

Georgia Individual Income Tax Forms and Instructions 2024

This document provides detailed instructions and forms for filing Georgia individual income tax for the year 2024. It includes information about electronic filing, payment methods, and tax credits. The guide also highlights new developments and offers tips for filing your tax return accurately.

Property Taxes

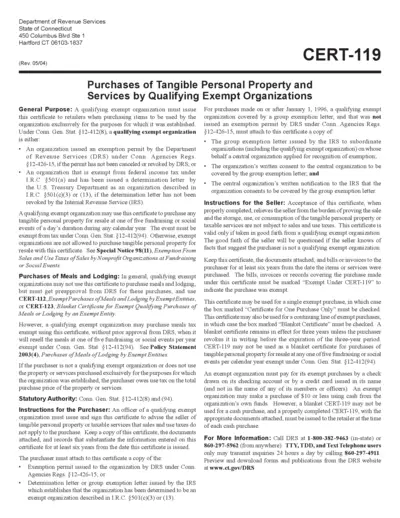

Connecticut CERT-119: Exempt Purchases by Qualifying Organizations

This document is Connecticut's CERT-119 form for exempt purchases by qualifying organizations. It provides guidelines for organizations on how to issue this certificate when purchasing items. It also includes instructions for both the purchaser and the seller.

Property Taxes

Form 8863: Education Credits - IRS 2023

Form 8863 is used to claim education credits, including the American Opportunity and Lifetime Learning Credits. It's essential for taxpayers seeking education-related tax benefits. This guide helps you understand how to fill it out.

Property Taxes

TRACES PDF Converter V1.3L Light e-Tutorial

This e-tutorial provides guidance on using the TRACES PDF Converter V1.3L Light. It is intended for users who need to manage their TDS/TCS accounts. All information is for informational purposes only.

Property Taxes

Texas Franchise Tax Forms and Instructions for 2023

This file contains important information and instructions for Texas Franchise Tax reporting. It includes forms such as the Ownership Information Report (OIR) and the E-Z Computation Report. Essential for entities needing to comply with Texas tax regulations.

Property Taxes

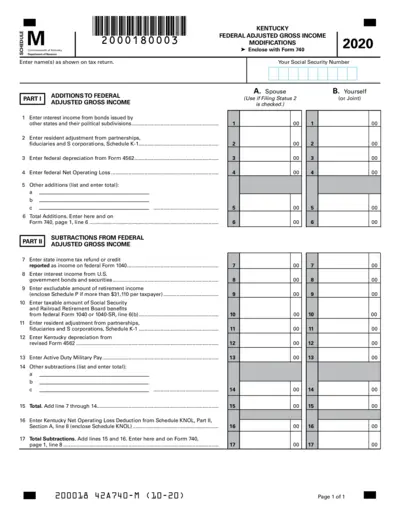

Kentucky State Tax Form Schedule M Instructions and Details

This file contains instructions and details for completing the Kentucky State Tax Form Schedule M. It includes information on additions and subtractions to federal adjusted gross income. This form is crucial for accurate state tax filings.

Property Taxes

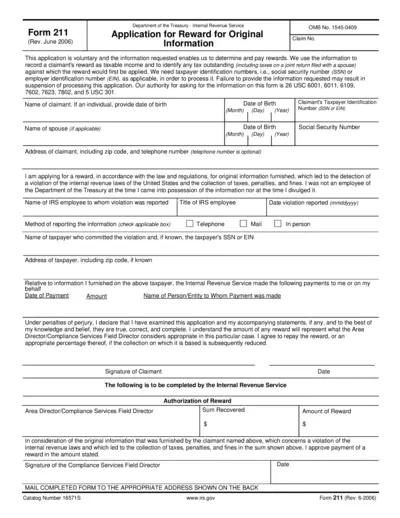

IRS Form 211 - Application for Reward for Original Information

IRS Form 211 is used by individuals to apply for a reward for providing original information that leads to the detection of a violation of internal revenue laws. This form collects claimant's personal details and information about the reported violation. It is submitted to the IRS for approval and processing.

Property Taxes

Wisconsin Schedule WD Instructions for Capital Gains and Losses

This document provides detailed instructions for completing Wisconsin Schedule WD, which is used to report capital gains and losses. It includes updates, general and specific instructions, and information on required adjustments. It is essential for individuals and entities dealing with capital gains and losses in Wisconsin.

Property Taxes

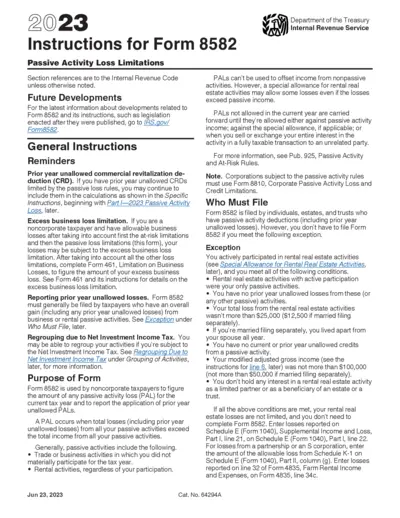

Form 8582 Instructions for Passive Activity Loss Limitations

This document provides detailed instructions for filling out Form 8582, which is used to calculate passive activity loss (PAL) limits for noncorporate taxpayers. It also offers guidance on who must file the form, the purpose of the form, and defines key terms and activities related to the form. Additionally, it includes specific rules and exceptions for rental activities, trade or business activities, and more.