Tax Forms Documents

Tax Forms

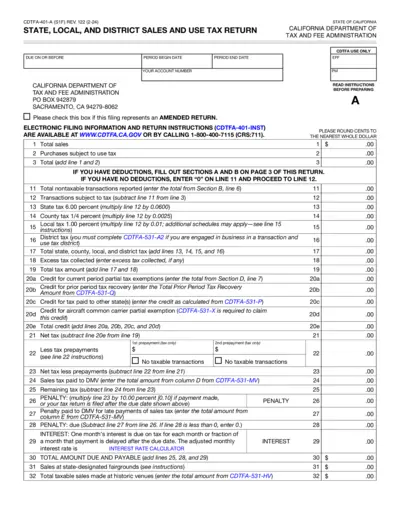

California Sales and Use Tax Return - CDTFA-401-A

The CDTFA-401-A form is essential for businesses in California to report their statewide and local sales and use taxes. It provides guidance on calculating total sales, deductions, and tax owed. Accurate submission ensures compliance with tax regulations set by the California Department of Tax and Fee Administration.

Tax Forms

Investment Interest Expense Deduction Form 4952

Form 4952 allows taxpayers to deduct their investment interest expenses. This form is essential for accurately reporting investment income. Use it to ensure compliance with IRS regulations.

Tax Forms

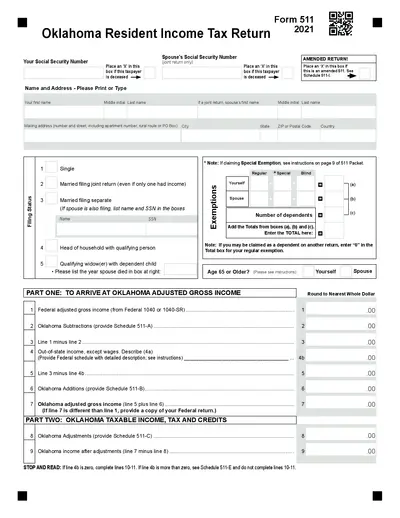

Oklahoma Resident Income Tax Return Form 511

This PDF outlines the 2021 Oklahoma Resident Income Tax Return Form 511. It provides comprehensive instructions on filling out the tax return accurately. Essential for residents seeking to file their taxes in compliance with state regulations.

Tax Forms

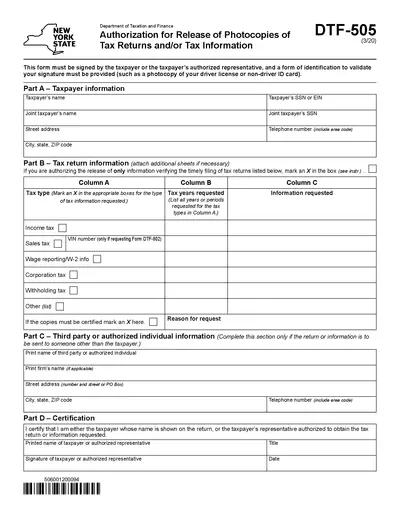

New York State Tax Authorization for Release

This form allows taxpayers to authorize the release of their tax information or copies of their tax returns. It must be signed by the taxpayer or their authorized representative along with identification. This is essential for anyone needing access to their tax records.

Tax Forms

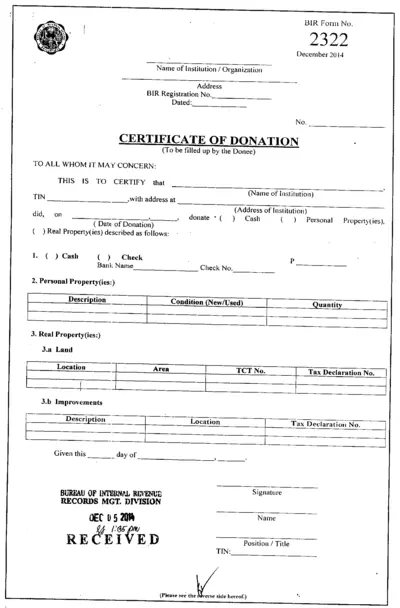

BIR Form 2322 Certificate of Donation

This BIR Form No. 2322 is used to certify donations made by institutions or organizations. It includes sections for both the donor and the donee to fill out relevant details. This form is essential for tax declaration purposes.

Tax Forms

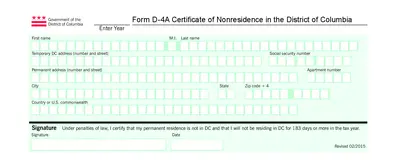

Form D-4A Certificate of Nonresidence in DC

The Form D-4A is essential for nonresidents of DC to ensure they are not liable for DC income tax withholding. This form must be filed with employers to validate nonresidency status. Proper completion of this form helps maintain tax compliance and avoids unnecessary withholdings.

Tax Forms

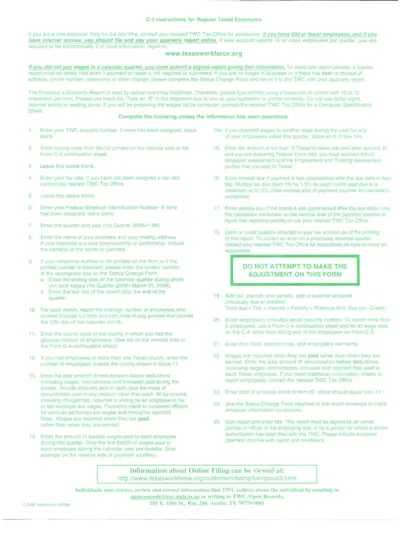

C-3 Instructions for Taxed Employers

This file provides essential instructions for regular taxed employers when filing their quarterly reports. It outlines the necessary steps and requirements to ensure compliance with TWC regulations. Employers can learn about online filing, deadlines, and reporting criteria within this comprehensive guide.

Tax Forms

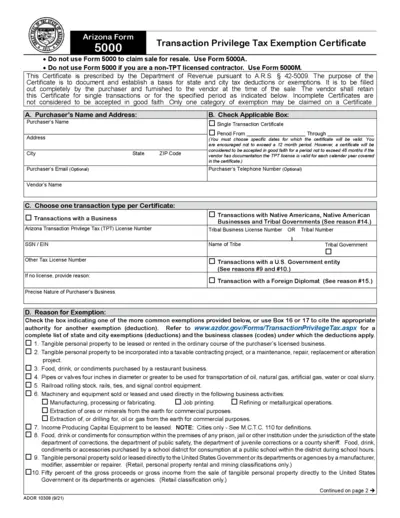

Arizona Transaction Privilege Tax Exemption Certificate

This document serves as the Transaction Privilege Tax Exemption Certificate for Arizona. It helps businesses and individuals document and establish tax deductions or exemptions. Complete this form accurately to comply with state tax laws.

Tax Forms

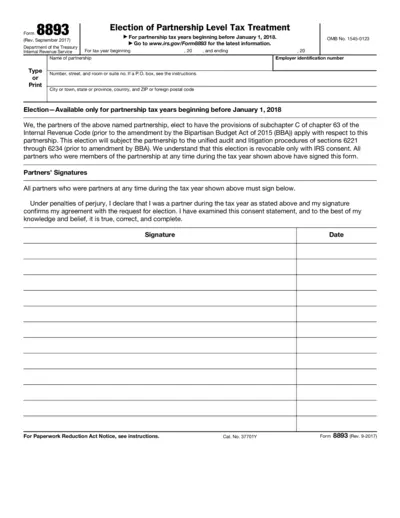

Form 8893 Election of Partnership Level Tax Treatment

Form 8893 allows partnerships to elect provisions under the Internal Revenue Code prior to 2018. This election enables unified audit and litigation procedures. It’s primarily for small partnerships with 10 or fewer individual partners.

Tax Forms

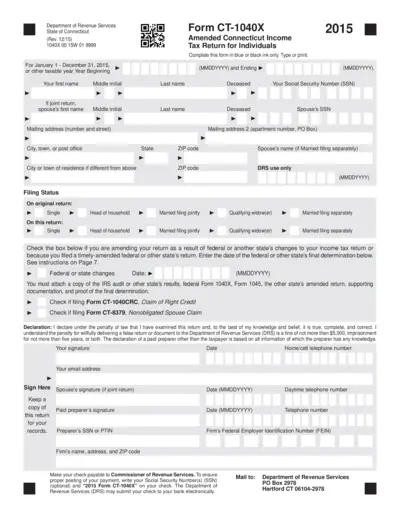

Form CT-1040X Amended Connecticut Income Tax Return

Form CT-1040X is used for filing an amended income tax return for individuals in Connecticut. It lets taxpayers correct previous tax returns for the year 2015. Ensure to follow the instructions carefully to complete the form accurately.

Tax Forms

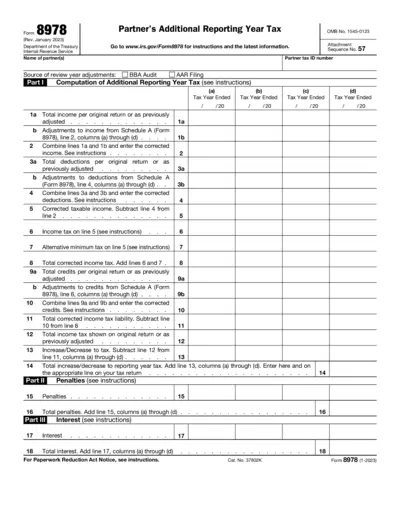

Form 8978 Additional Reporting Year Tax Instructions

Form 8978 provides detailed instructions for partners regarding Additional Reporting Year Tax. It outlines the necessary steps for computation and submission. This form is essential for ensuring accurate reporting during tax assessments.

Tax Forms

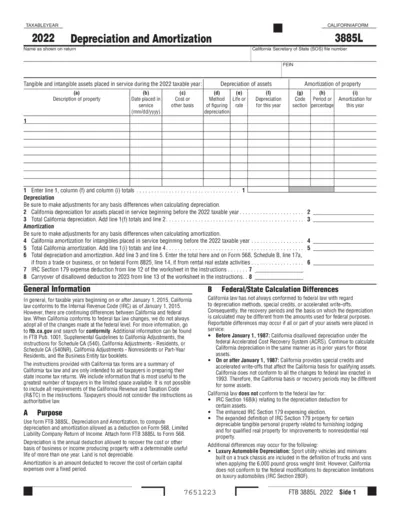

California Form 3885L - Depreciation and Amortization

California Form 3885L is used for computing depreciation and amortization deductions for the 2022 taxable year. This form assists businesses in calculating allowable deductions for tangible and intangible assets. It provides guidance on how to report these deductions accurately on the tax return.