HowardSoft Tax Preparer User's Guide 2015

This user's guide contains essential information and instructions for using the HowardSoft Tax Preparer software. It outlines system requirements and offers assistance for both installation and software updates. Ideal for new users as well as those upgrading from previous versions.

Edit, Download, and Sign the HowardSoft Tax Preparer User's Guide 2015

Form

eSign

Add Annotation

Share Form

How do I fill this out?

To fill out this form, begin by collecting all necessary financial documents related to your tax situation. Ensure that you have your Lifetime Serial Number handy for proper registration. Follow the on-screen prompts to enter your financial information accurately.

How to fill out the HowardSoft Tax Preparer User's Guide 2015?

1

Gather necessary financial documents.

2

Enter your Lifetime Serial Number.

3

Fill out all mandatory fields.

4

Review your entries for accuracy.

5

Submit your completed form.

Who needs the HowardSoft Tax Preparer User's Guide 2015?

1

Individuals preparing their taxes for the first time.

2

Small business owners filing for their business taxes.

3

Tax preparers assisting clients with tax filings.

4

Students learning about tax preparation software.

5

Accountants looking for reliable tax preparation tools.

How PrintFriendly Works

At PrintFriendly.com, you can edit, sign, share, and download the HowardSoft Tax Preparer User's Guide 2015 along with hundreds of thousands of other documents. Our platform helps you seamlessly edit PDFs and other documents online. You can edit our large library of pre-existing files and upload your own documents. Managing PDFs has never been easier.

Edit your HowardSoft Tax Preparer User's Guide 2015 online.

Editing this PDF on PrintFriendly is simple and efficient. With our intuitive tools, you can adjust text, add annotations, or remove unneeded sections. Enjoy full control over your document to make it fit your needs perfectly.

Add your legally-binding signature.

You can sign the PDF effortlessly on PrintFriendly. Just use our easy-to-navigate signing tool to add your signature where needed. Make your documents legally binding in no time with just a few clicks.

Share your form instantly.

Sharing your PDF is a breeze with PrintFriendly. Once your document is ready, you can easily share it via email or other social platforms directly. It's perfect for collaborating with others or distributing important documents.

How do I edit the HowardSoft Tax Preparer User's Guide 2015 online?

Editing this PDF on PrintFriendly is simple and efficient. With our intuitive tools, you can adjust text, add annotations, or remove unneeded sections. Enjoy full control over your document to make it fit your needs perfectly.

1

Open the PDF document in PrintFriendly.

2

Select the edit tool from the toolbar.

3

Make your desired changes using the provided features.

4

Preview the document to ensure all edits are correct.

5

Save or download the edited document when finished.

What are the instructions for submitting this form?

To submit this form, please send it via email to submissions@howardsoft.com. Alternatively, you can fax your completed form to (555) 123-4567. For online submissions, visit our submission portal at howardsoft.com/submit and follow the instructions provided.

What are the important dates for this form in 2024 and 2025?

Important dates for filing taxes in 2024 include the deadline for filing individual income tax returns, which is April 15, 2024. For 2025, expect similar deadlines, usually around the same date. It's essential to keep track of these deadlines to avoid penalties.

What is the purpose of this form?

The purpose of this form is to provide a comprehensive guide for users of the HowardSoft Tax Preparer software. It assists individuals and businesses in accurately preparing their taxes while adhering to relevant regulations. Additionally, it supports users in understanding the features and functionalities of the software, ultimately helping them streamline their tax preparation processes.

Tell me about this form and its components and fields line-by-line.

- 1. Lifetime Serial Number: A unique identifier required for software registration.

- 2. User Information: Personal details such as name, address, and contact information.

- 3. Income Details: Fields to input various sources of income.

- 4. Deductions: Areas to specify eligible deductions.

- 5. Signature: Space for user signature to validate the submission.

What happens if I fail to submit this form?

Failing to submit this form could result in penalties from tax authorities due to late filings. Incomplete submissions may also lead to inquiries or audits from the IRS. It's crucial to ensure accurate and timely submission to avoid any complications.

- Penalties: Late submissions may incur fines and additional fees.

- IRS Audits: Improper filings can trigger audits by the IRS.

- Delayed Refunds: Not submitting on time can lead to delays in tax refunds.

How do I know when to use this form?

- 1. Annual Tax Filing: Use this form for filing your annual income taxes.

- 2. Reporting Additional Income: Applicable when you have received new income sources.

- 3. Claiming Deductions: Utilize this form to claim various deductions effectively.

Frequently Asked Questions

How do I edit my PDF?

You can edit your PDF by uploading it to PrintFriendly and using the available editing tools to make changes.

Can I sign the PDF online?

Yes, you can use our online tool to add your signature directly onto the PDF.

How can I share my PDF?

You can easily share your PDF via email or social media directly from PrintFriendly.

Is there a limit to how many times I can edit the PDF?

There is no limit to how many times you can edit your document on PrintFriendly.

Can I save my edited PDF?

Yes, you can download your edited PDF after making changes.

What formats can I edit with PrintFriendly?

You can edit PDFs and adjust them as needed using our tools.

Is it easy to navigate the editing tools?

Yes, our tools are designed for user-friendliness, making it easy for anyone to edit their PDFs.

Do I need an account to edit PDFs?

No, you do not need an account to edit PDFs on PrintFriendly.

How do I ensure my PDF looks right before sharing?

You can preview your PDF before sharing to make sure everything looks correct.

What do I do if I encounter issues while editing?

If you experience any issues, you can contact our support for assistance.

Related Documents - HowardSoft Tax Guide

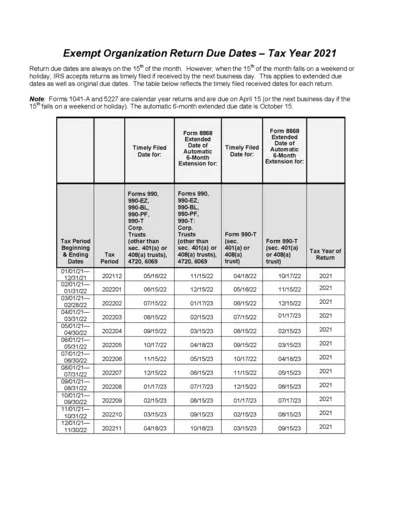

Exempt Organization Return Due Dates - Tax Year 2021

This file provides detailed information on return due dates for exempt organizations for the tax year 2021. It includes original and extended due dates, along with specific forms and filing periods. Use this guide to ensure timely submission of your tax returns.

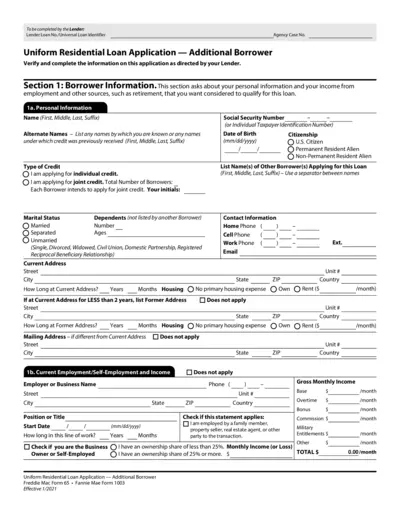

Uniform Residential Loan Application - Additional Borrower

This file is a Uniform Residential Loan Application for an additional borrower. It includes sections to fill out personal information, employment details, income sources, and other financial information required for a loan application. The file is intended to be completed by the lender and borrower.

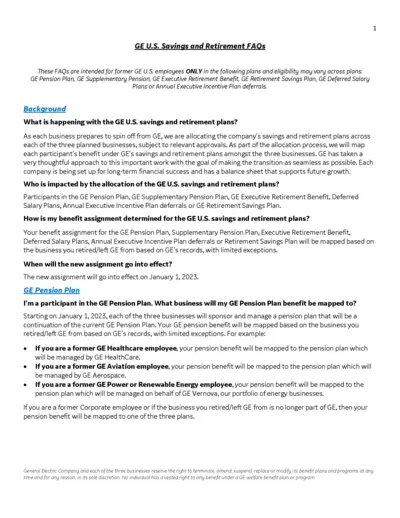

GE U.S. Savings and Retirement FAQs

This document contains essential FAQs about GE U.S. savings and retirement plans, tailored for former GE employees. It provides critical information regarding benefit assignments, pension plan mappings, and upcoming changes affecting retirement resources.

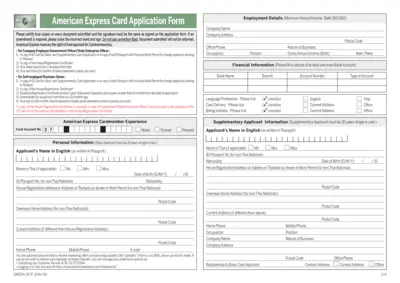

American Express Card Application Form Instructions

This file contains essential information on how to apply for an American Express Card. It includes required documents and guidelines for successful submission. Ensure you provide accurate details to avoid delays in processing.

NatWest Bereavement Services Account Closure Guide

This document provides comprehensive details on how to close an account following a bereavement. It outlines the necessary steps and required documents for beneficiaries. Stay informed on the process to ensure a smooth account closure.

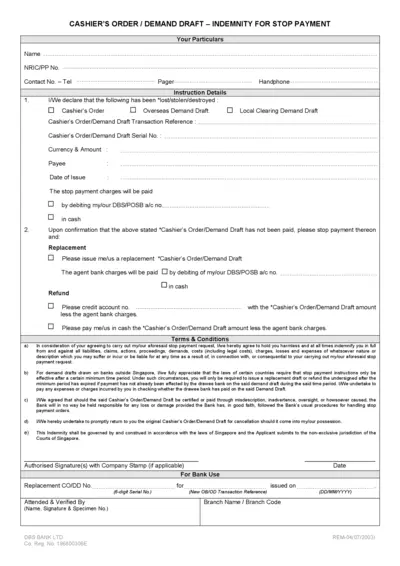

Cashier Order Demand Draft Indemnity Form

This document serves as an indemnity form for stop payment requests on cashier's orders or demand drafts. Ensure that you provide all required details accurately to facilitate the request. This form is essential for those who have lost or need to replace their cashier's order or demand draft.

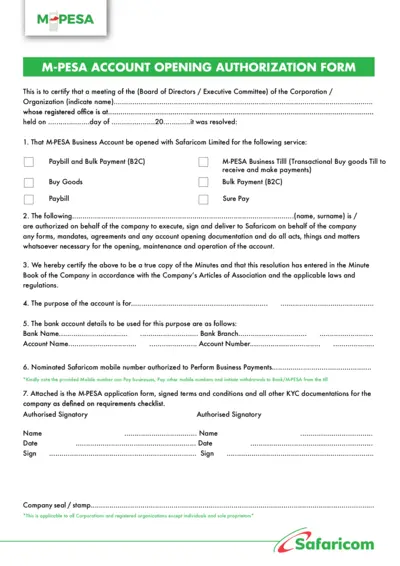

M-PESA Account Opening Authorization Form

This M-PESA Account Opening Authorization Form is essential for corporations or organizations looking to open a business account with Safaricom. It includes required authorizations and details necessary for account setup. Utilize this form to ensure compliance with Safaricom’s requirements for business transactions.

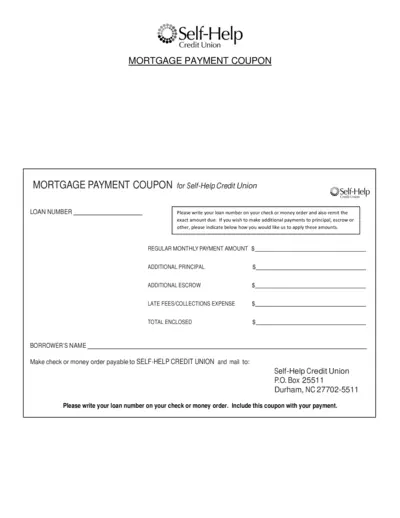

Mortgage Payment Coupon for Self-Help Credit Union

This Mortgage Payment Coupon is essential for members of Self-Help Credit Union. It allows you to make your mortgage payments easily and conveniently. Follow the instructions for accurate submission.

Distributor Services Manual - KFintech

The Distributor Services Manual offers comprehensive guidance for using distributor services on the KFintech platform. It covers essential client and transaction information to enhance your distribution experience. Unlock the potential for customized reporting and informed business decision-making.

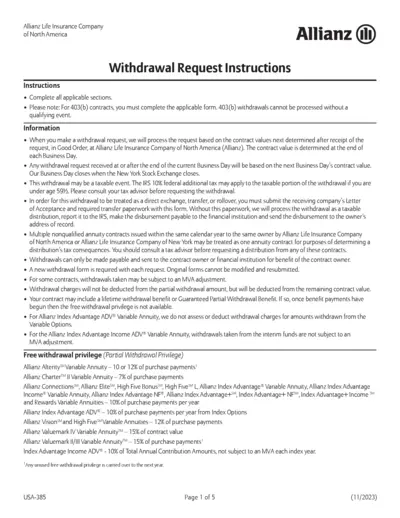

Allianz Life Insurance Withdrawal Request Instructions

This file contains detailed instructions for completing the Allianz Life Insurance Withdrawal Request. It guides users through the withdrawal process for their annuity contracts. Ensure to follow the instructions carefully for smooth processing.

IRS Direct File: Simplified 2023 Federal Tax Filing

IRS Direct File allows eligible taxpayers to file their 2023 federal tax return online for free. This service provides step-by-step guidance and live customer support. Access it easily from any device to file in English or Spanish.

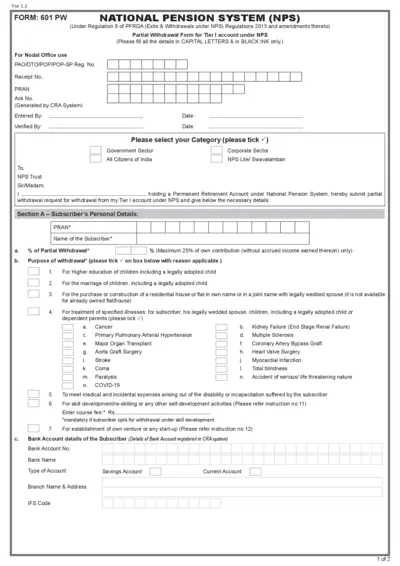

Partial Withdrawal Form for NPS Tier I Account

This form is essential for subscribers of the National Pension System (NPS) to request a partial withdrawal from their Tier I account. It includes detailed personal information, reasons for withdrawal, and bank account details. Ensure all mandatory fields are filled out accurately for successful processing.