Tax Services Documents

Tax Filing

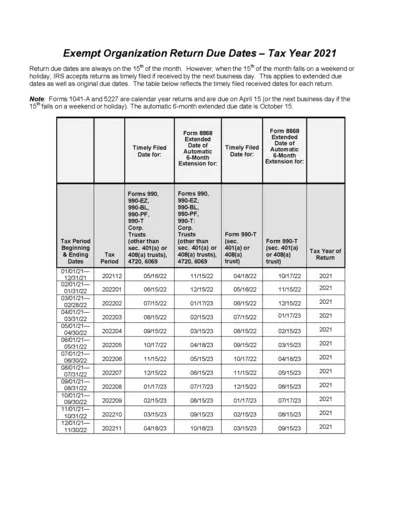

Exempt Organization Return Due Dates - Tax Year 2021

This file provides detailed information on return due dates for exempt organizations for the tax year 2021. It includes original and extended due dates, along with specific forms and filing periods. Use this guide to ensure timely submission of your tax returns.

Tax Filing

IRS Direct File: Simplified 2023 Federal Tax Filing

IRS Direct File allows eligible taxpayers to file their 2023 federal tax return online for free. This service provides step-by-step guidance and live customer support. Access it easily from any device to file in English or Spanish.

Tax Preparation

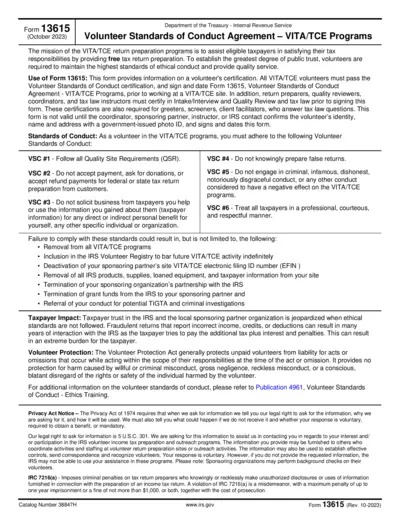

Volunteer Standards of Conduct Agreement Form 13615

The Form 13615 outlines ethical conduct standards for volunteers in VITA/TCE programs. It ensures volunteers are trained and certified to provide quality tax assistance. Complete this form prior to participating in VITA/TCE services.

Tax Consulting

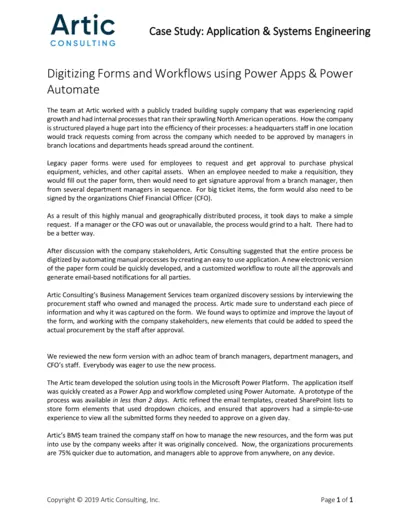

Digitizing Forms and Workflows with Power Apps

This file provides a case study on how Artic Consulting helped a building supply company optimize its procurement process through automation. It details the challenges faced by the company with manual paper forms and how a digital solution was implemented. The case study illustrates the steps taken by Artic Consulting to streamline workflows using Microsoft Power Apps and Power Automate.

Tax Consulting

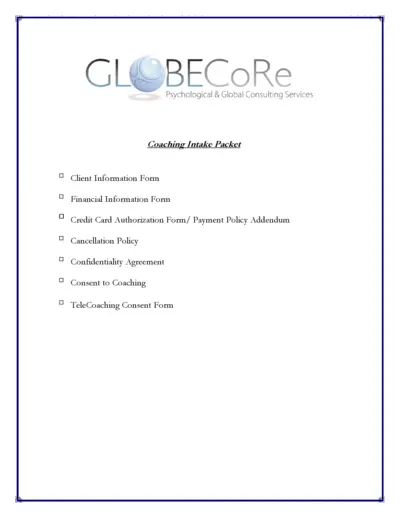

Client Information and Coaching Forms

This document includes essential forms for coaching services, such as the Client Information Form, Financial Information Form, and Consent Forms. It ensures that clients provide necessary details for effective service delivery while maintaining confidentiality. Completing these forms accurately helps facilitate the coaching process.

Tax Preparation

HowardSoft Tax Preparer User's Guide 2015

This user's guide contains essential information and instructions for using the HowardSoft Tax Preparer software. It outlines system requirements and offers assistance for both installation and software updates. Ideal for new users as well as those upgrading from previous versions.

Tax Consulting

Scentsy Policies and Procedures for Consultants

This document outlines the Scentsy Policies and Procedures for Independent Consultants. It provides essential information regarding agreements, compliance, and business conduct. Understanding these policies is crucial for anyone looking to succeed as a Scentsy Consultant.

Tax Filing

Understanding Form W-2 Box 12 Tax Reporting Codes

This file provides detailed information about IRS Form W-2 and Box 12 reporting codes. It's essential for employees and employers to report taxable amounts accurately. Learn about how to fill out W-2 forms effectively.