Uniform Residential Loan Application - Additional Borrower

This file is a Uniform Residential Loan Application for an additional borrower. It includes sections to fill out personal information, employment details, income sources, and other financial information required for a loan application. The file is intended to be completed by the lender and borrower.

Edit, Download, and Sign the Uniform Residential Loan Application - Additional Borrower

Form

eSign

Add Annotation

Share Form

How do I fill this out?

To fill out this form, gather all necessary personal and financial information. Follow the instructions provided in each section, ensuring all required fields are completed accurately. Review the completed application carefully before submitting it to your lender.

How to fill out the Uniform Residential Loan Application - Additional Borrower?

1

Collect personal and financial information required for the form.

2

Complete Section 1 with your personal information and employment details.

3

Fill out Section 2 with your financial information, including assets and liabilities.

4

Answer the questions in Section 5 about your property and finances.

5

Review the entire application and submit it to your lender.

Who needs the Uniform Residential Loan Application - Additional Borrower?

1

Borrowers who are applying for a residential loan and need to provide additional borrower information.

2

Lenders who require detailed financial and employment information from their borrowers.

3

Financial advisors helping clients prepare for a residential loan application.

4

Real estate agents assisting clients in the home buying process.

5

Loan officers processing loan applications and gathering necessary documentation.

How PrintFriendly Works

At PrintFriendly.com, you can edit, sign, share, and download the Uniform Residential Loan Application - Additional Borrower along with hundreds of thousands of other documents. Our platform helps you seamlessly edit PDFs and other documents online. You can edit our large library of pre-existing files and upload your own documents. Managing PDFs has never been easier.

Edit your Uniform Residential Loan Application - Additional Borrower online.

You can easily edit this PDF on PrintFriendly using our PDF editor. Open the PDF file in PrintFriendly and click on the text fields to begin editing. Make any necessary changes and save the updated version.

Add your legally-binding signature.

With PrintFriendly, you can sign your PDF documents digitally. Open the PDF file in PrintFriendly, click on the signature field, and use the digital signature tool to sign the document. Save the signed PDF when finished.

Share your form instantly.

PrintFriendly allows you to share PDF documents effortlessly. Open the PDF file in PrintFriendly and click on the share icon. Choose your preferred sharing method, such as email or direct link, and send the document to your desired recipients.

How do I edit the Uniform Residential Loan Application - Additional Borrower online?

You can easily edit this PDF on PrintFriendly using our PDF editor. Open the PDF file in PrintFriendly and click on the text fields to begin editing. Make any necessary changes and save the updated version.

1

Open the PDF file in PrintFriendly.

2

Click on the text fields to start typing.

3

Make any necessary changes to the form.

4

Review the edited document for accuracy.

5

Save the updated version of the PDF.

What are the instructions for submitting this form?

Submit the completed form to your lender as per their submission instructions, which may include email, fax, or online submission. For email submission, attach the filled form to your email and send it to the lender's provided email address. For fax submission, print the filled form and fax it to the lender's provided fax number. For online submission, upload the filled form to the lender's online submission portal. Follow your lender's specific guidelines for each submission method to ensure timely processing of your loan application.

What are the important dates for this form in 2024 and 2025?

The important dates for this form in 2024 and 2025 are the deadlines set by your lender for submitting the completed application. Ensure you meet these deadlines to avoid delays in processing your loan.

What is the purpose of this form?

The Uniform Residential Loan Application for an additional borrower is intended to provide detailed personal, employment, and financial information for a comprehensive loan assessment. This form enables lenders to evaluate the borrower's ability to repay the loan based on their financial situation. The additional borrower application complements the primary application by capturing necessary data for joint credit assessments and ensuring all parties involved in the loan are accounted for.

Tell me about this form and its components and fields line-by-line.

- 1. Personal Information: Includes name, alternate names, social security number, date of birth, citizenship, marital status, and dependents.

- 2. Contact Information: Requires current address, housing status, phone numbers, and email address.

- 3. Employment/Self-Employment and Income: Includes details about current and previous employment, income sources, and business ownership.

- 4. Financial Information - Assets and Liabilities: Requires information about assets, liabilities, and real estate owned by the borrower.

- 5. Declarations: Asks questions related to the property, funding, and financial history of the borrower.

- 6. Military Service: Inquires about the borrower's or their deceased spouse's military service.

- 7. Acknowledgements and Agreements: Signatures and agreements required for the application.

What happens if I fail to submit this form?

If you fail to submit this form, your loan application will not be processed, leading to delays or denial of the loan.

- Delay in Loan Processing: Your loan application will be delayed, making it difficult to secure funding on time.

- Denial of Loan: Your loan application may be denied due to incomplete documentation.

How do I know when to use this form?

- 1. Joint Credit Application: When you and another borrower are applying for joint credit.

- 2. Detailed Financial Information: When the lender requires detailed financial information from all borrowers involved.

Frequently Asked Questions

How do I fill out this form?

Gather all necessary personal and financial information, complete each section as directed, and review the form before submitting it to your lender.

Can I edit this form online?

Yes, you can edit this form online using PrintFriendly's PDF editor. Simply open the PDF file and click on the text fields to start typing.

How do I sign this form?

You can sign this form digitally using PrintFriendly's signature tool. Click on the signature field and use the digital signature tool to sign the document.

Can I share this form?

Yes, you can share this form using PrintFriendly. Click on the share icon and choose your preferred sharing method, such as email or direct link.

Do I need to provide all my financial information?

Yes, you need to provide detailed financial information as requested in the form to complete the loan application process.

What if I have multiple sources of income?

Include all sources of income in the relevant section of the form, providing accurate details for each income source.

Can I save my progress while filling out the form?

Yes, you can save your progress using PrintFriendly's PDF editor, allowing you to complete the form at your own pace.

How do I submit the completed form?

Submit the completed form to your lender following their submission instructions, which may include email, fax, or online submission.

What if I need to make changes after submitting the form?

Contact your lender to request any necessary changes to the submitted form, following their specific guidelines.

Is there a deadline for submitting this form?

Yes, follow your lender's deadlines for submitting the completed form to ensure your loan application is processed in a timely manner.

Related Documents - Loan Application - Add. Borrower

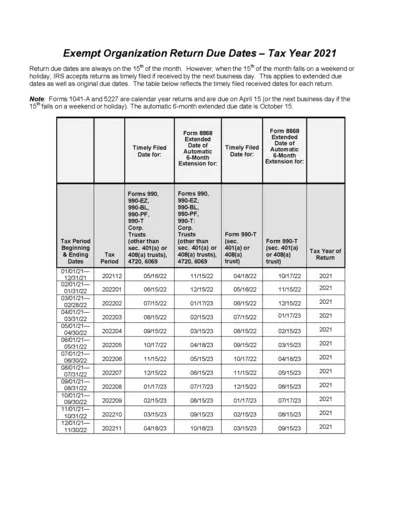

Exempt Organization Return Due Dates - Tax Year 2021

This file provides detailed information on return due dates for exempt organizations for the tax year 2021. It includes original and extended due dates, along with specific forms and filing periods. Use this guide to ensure timely submission of your tax returns.

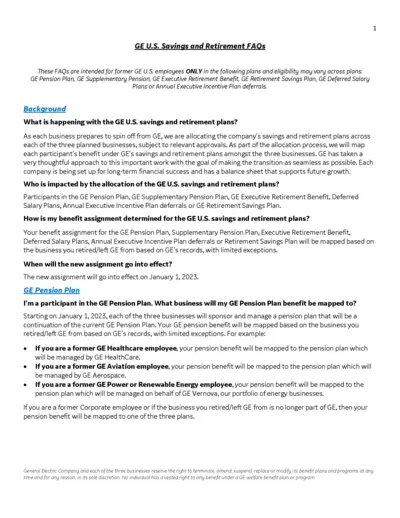

GE U.S. Savings and Retirement FAQs

This document contains essential FAQs about GE U.S. savings and retirement plans, tailored for former GE employees. It provides critical information regarding benefit assignments, pension plan mappings, and upcoming changes affecting retirement resources.

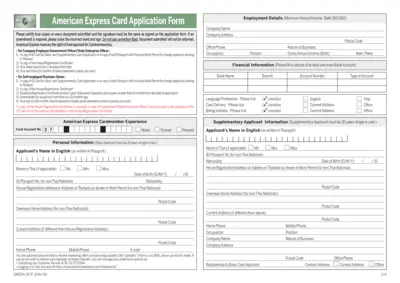

American Express Card Application Form Instructions

This file contains essential information on how to apply for an American Express Card. It includes required documents and guidelines for successful submission. Ensure you provide accurate details to avoid delays in processing.

NatWest Bereavement Services Account Closure Guide

This document provides comprehensive details on how to close an account following a bereavement. It outlines the necessary steps and required documents for beneficiaries. Stay informed on the process to ensure a smooth account closure.

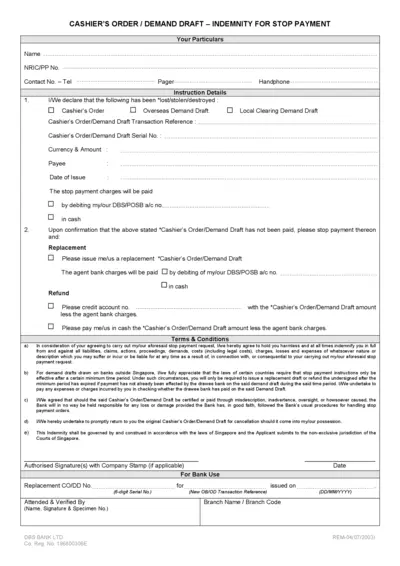

Cashier Order Demand Draft Indemnity Form

This document serves as an indemnity form for stop payment requests on cashier's orders or demand drafts. Ensure that you provide all required details accurately to facilitate the request. This form is essential for those who have lost or need to replace their cashier's order or demand draft.

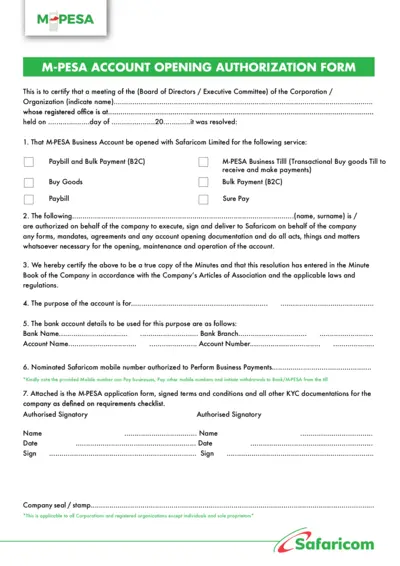

M-PESA Account Opening Authorization Form

This M-PESA Account Opening Authorization Form is essential for corporations or organizations looking to open a business account with Safaricom. It includes required authorizations and details necessary for account setup. Utilize this form to ensure compliance with Safaricom’s requirements for business transactions.

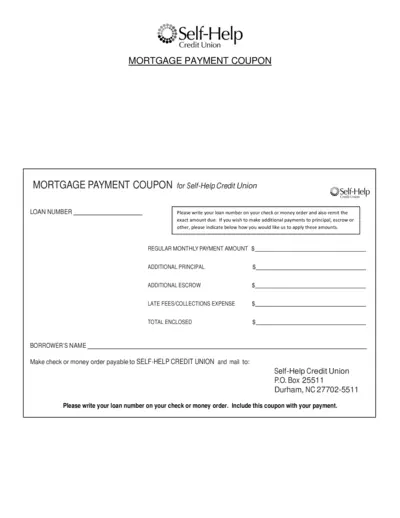

Mortgage Payment Coupon for Self-Help Credit Union

This Mortgage Payment Coupon is essential for members of Self-Help Credit Union. It allows you to make your mortgage payments easily and conveniently. Follow the instructions for accurate submission.

Distributor Services Manual - KFintech

The Distributor Services Manual offers comprehensive guidance for using distributor services on the KFintech platform. It covers essential client and transaction information to enhance your distribution experience. Unlock the potential for customized reporting and informed business decision-making.

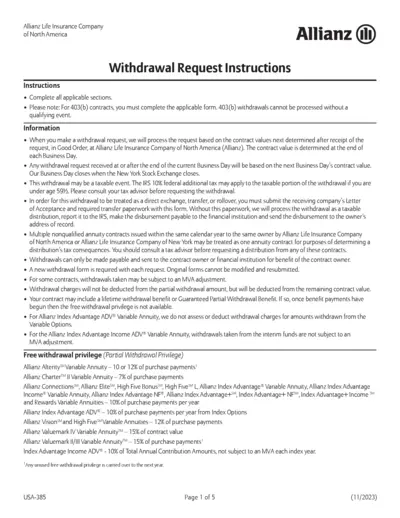

Allianz Life Insurance Withdrawal Request Instructions

This file contains detailed instructions for completing the Allianz Life Insurance Withdrawal Request. It guides users through the withdrawal process for their annuity contracts. Ensure to follow the instructions carefully for smooth processing.

IRS Direct File: Simplified 2023 Federal Tax Filing

IRS Direct File allows eligible taxpayers to file their 2023 federal tax return online for free. This service provides step-by-step guidance and live customer support. Access it easily from any device to file in English or Spanish.

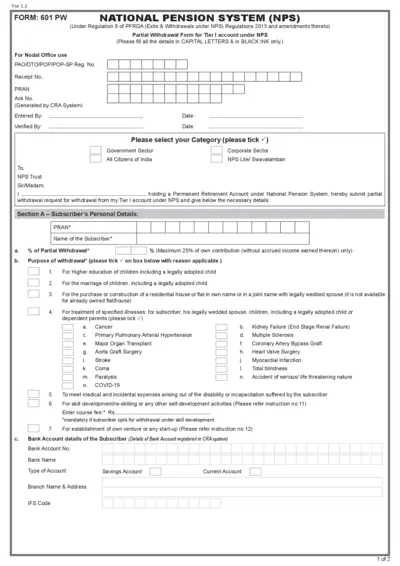

Partial Withdrawal Form for NPS Tier I Account

This form is essential for subscribers of the National Pension System (NPS) to request a partial withdrawal from their Tier I account. It includes detailed personal information, reasons for withdrawal, and bank account details. Ensure all mandatory fields are filled out accurately for successful processing.

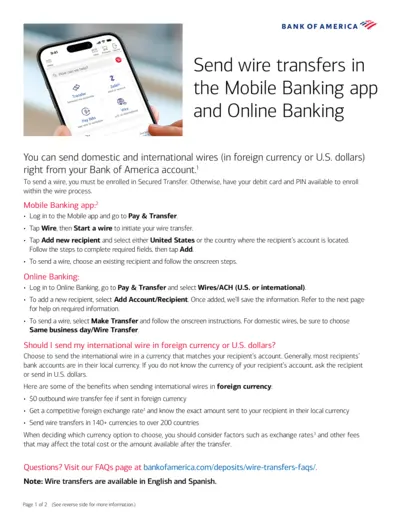

Guide to Bank of America Wire Transfers Online

This document provides comprehensive guidance on how to send and receive wire transfers through Bank of America. It covers necessary information, cut-off times, and tips on currency selection. Ideal for personal and business users looking to utilize wire transfer services efficiently.