Tax Documents

Cross-Border Taxation

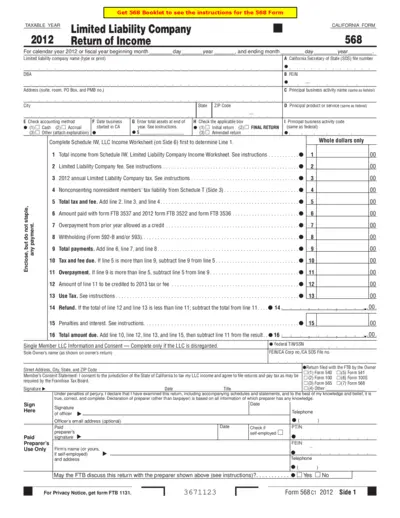

California Form 568 Limited Liability Company Income

The California Form 568 is a return of income for Limited Liability Companies. It provides detailed instructions on reporting income and taxes for LLCs in the state. This form is essential for compliance with California tax regulations.

Payroll Tax

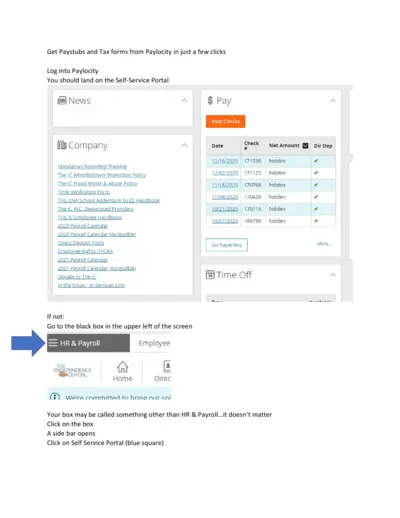

Retrieve Paystubs and Tax Forms from Paylocity Easily

This file provides a comprehensive guide on accessing paystubs and tax forms through Paylocity. Users can quickly navigate the Self-Service Portal and download necessary documents with simple instructions. Ideal for employees looking to manage their payroll information efficiently.

Cross-Border Taxation

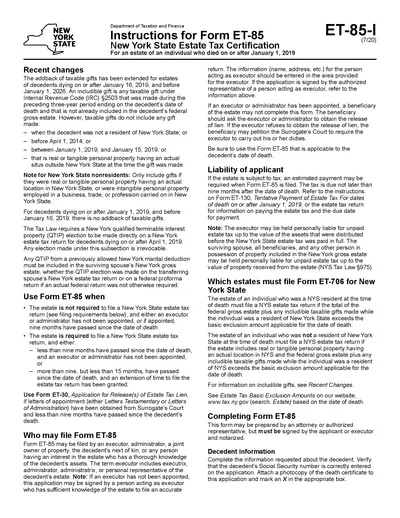

New York State Estate Tax Certification Instructions

This file contains important instructions for filling out Form ET-85 for New York State Estate Tax Certification. It explains the eligibility requirements, filing process, and details necessary for estate executors and beneficiaries. By following these instructions, users can ensure compliance with New York state estate tax laws.

Cross-Border Taxation

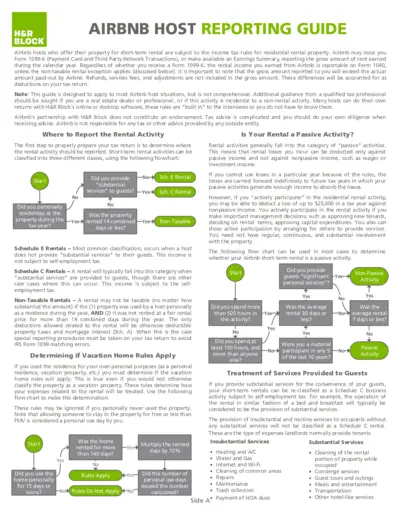

Airbnb Host Reporting Guide by H&R Block

This guide provides essential information for Airbnb hosts regarding income tax obligations. It outlines how to report rental income and expenses. Perfect for short-term rental owners navigating tax requirements.

Cross-Border Taxation

IRS Form 5329 Instructions for Additional Tax

IRS Form 5329 provides instructions for reporting additional taxes on qualified plans and other tax-favored accounts. It is essential for anyone who has taken early distributions from their retirement accounts. Understanding the details of Form 5329 helps taxpayers comply with IRS requirements.

Cross-Border Taxation

Heavy Highway Vehicle Use Tax Return Form 2290

The IRS Form 2290 is used to report and pay the Heavy Highway Vehicle Use Tax. This tax applies to vehicles that are driven on public highways with a gross weight of 55,000 pounds or more. It is essential for businesses and individuals operating heavy vehicles to complete this form accurately.

Cross-Border Taxation

Instructions for Form IT-2658 on Estimated Tax

This file provides essential guidance for completing Form IT-2658, which is used for estimated tax payments for nonresident individual partners and shareholders in New York. It includes detailed information about filing requirements, deadlines, and compliance with tax laws. Understanding this document is crucial for any entity involved in partnerships or S corporations operating in New York.

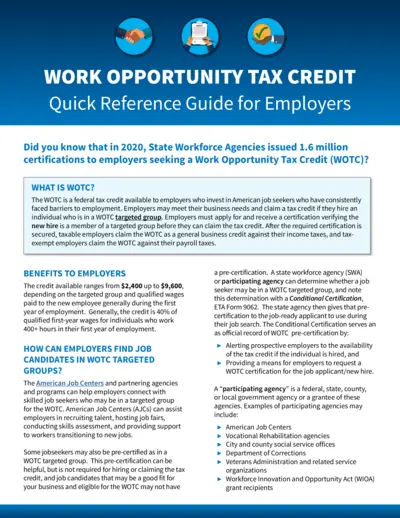

Tax Credits

Work Opportunity Tax Credit Quick Reference Guide

This guide provides essential information about the Work Opportunity Tax Credit (WOTC) available to employers. It outlines the benefits, application process, and resources for finding eligible job candidates. Enhance your hiring practices and learn how to maximize your tax credits with WOTC.

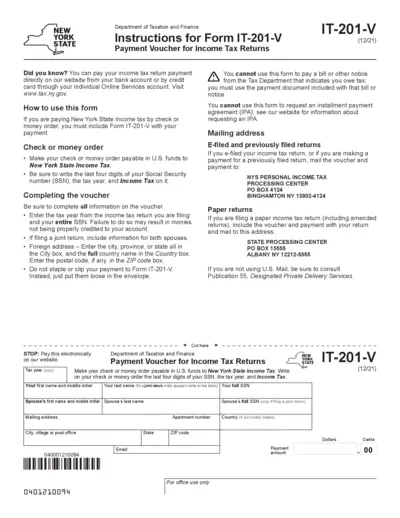

Cross-Border Taxation

Instructions for Form IT-201-V Payment Voucher

This document provides clear instructions for completing Form IT-201-V, the New York State Payment Voucher for Income Tax Returns. Ensure proper submission to avoid processing delays. Follow the guidelines and utilize online services for convenience.

Cross-Border Taxation

W-8IMY Instructions for Foreign Entities Tax Compliance

This file provides comprehensive instructions for Form W-8IMY. It is essential for foreign intermediaries, entities, and certain U.S. branches regarding U.S. tax withholding and reporting. Users will find guidance on completing the form to ensure compliance with IRS regulations.

Cross-Border Taxation

Missouri Use Tax Return Instructions and Form

This document provides detailed instructions for filing the Missouri Use Tax Return. It includes necessary fields, rates, and guidelines for accurate submissions. Ensure compliance with state laws by following the outlined procedures.

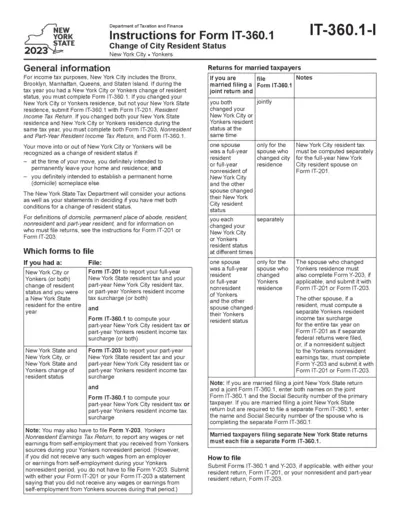

Cross-Border Taxation

NYC and Yonkers Change of Resident Status Instructions

This file provides step-by-step instructions for completing Form IT-360.1 for New York City and Yonkers change of resident status for tax purposes. It includes essential guidance on necessary forms, eligibility, and filing procedures. Ideal for taxpayers navigating residency status changes in NYC or Yonkers.