Tax Documents

Tax Exemptions

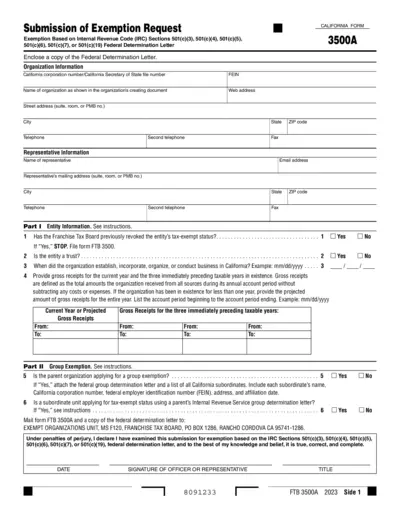

California Form 3500A Tax Exemption Request

California Form 3500A is used for submitting exemption requests based on Internal Revenue Code sections. This form is essential for organizations seeking tax-exempt status in California. It includes required organizational information and instructions for compliance.

Cross-Border Taxation

Instructions for Form 5472 Information Return

This document provides the necessary instructions for filing Form 5472, specifically for 25% foreign-owned U.S. corporations and foreign corporations engaged in a U.S. trade or business. It outlines the requirements and procedures for compliance with IRS regulations and provides essential definitions and guidelines for reportable transactions.

Cross-Border Taxation

Wisconsin Homestead Credit Instructions for 2022

This document provides detailed instructions for claiming the Wisconsin Homestead Credit for the year 2022. It includes eligibility requirements, filing tips, and the process to follow for a successful application. Ensure you understand the steps to maximize your benefit and avoid common pitfalls.

Cross-Border Taxation

2023 New Jersey Partnership Return Instructions

This document provides comprehensive instructions for New Jersey's NJ-1065 Partnership Return, ensuring accurate tax reporting. It outlines essential filing requirements for partnerships, income allocation, and pertinent deadlines. Ideal for both resident and non-resident partners in New Jersey.

Cross-Border Taxation

Instructions for Form 8975 Country-By-Country Report

This file contains detailed instructions for completing Form 8975 and its Schedule A. It provides essential guidance on filing requirements for U.S. multinational enterprises. Users can find necessary definitions, procedures, and forms to ensure proper reporting.

Cross-Border Taxation

Instructions for Form CT-6 NY S Corporation Election

This document provides detailed instructions for filing Form CT-6. It is essential for federal S corporations electing to be treated as New York S corporations. Ensure compliance with New York State Tax Law while following this guide.

Cross-Border Taxation

Oregon Pass-Through Entity Withholding Form OR-19

The Form OR-19 is used by pass-through entities in Oregon to withhold taxes for nonresident owners. This ensures compliance with state tax obligations on Oregon-source distributive income. Proper usage helps avoid tax penalties and supports accurate reporting.

Tax Returns

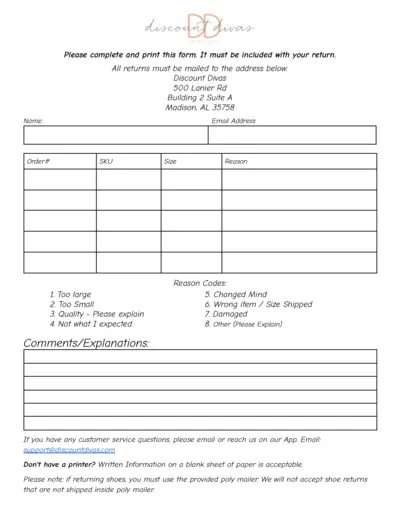

Discount Divas Return Form Instructions and Details

This document contains the return form and instructions for Discount Divas products. Users can fill out the form to streamline the return process efficiently. Ensure that the completed form is included with your return shipment.

Tax Returns

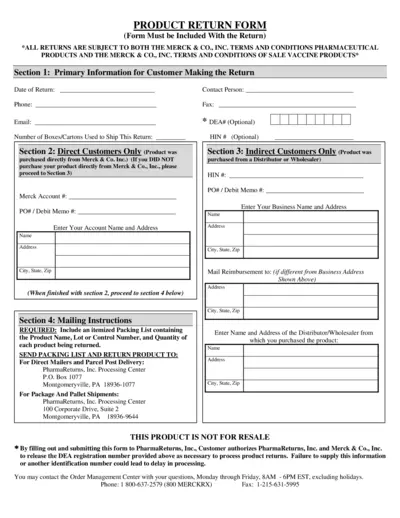

Product Return Form for Merck Pharmaceutical Returns

This Product Return Form is essential for customers returning pharmaceutical products to Merck & Co., Inc. It includes detailed instructions on completing the return process. Ensure you fill out all required fields to avoid processing delays.

Tax Returns

Lands' End Easy Return Instructions and Guidelines

This document provides clear instructions for returning products to Lands' End. It details three easy return methods including in-store, Happy Returns, and mail returns. Ensure a hassle-free return process with helpful tips and guidelines.

Cross-Border Taxation

Instructions for Form 8996 Qualified Opportunity Funds

Form 8996 is essential for corporations and partnerships investing in Qualified Opportunity Zones (QOZs). It certifies the organization as a Qualified Opportunity Fund (QOF) and ensures compliance with investment standards. Accurate completion assists in gaining tax benefits associated with investments in QOZs.

Cross-Border Taxation

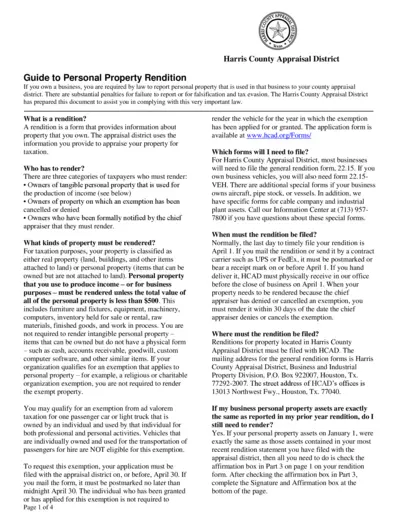

Harris County Appraisal District Personal Property Guide

This document serves as a comprehensive guide for businesses on reporting personal property for taxation in Harris County, Texas. It outlines the process, required forms, and deadlines for submission. Understanding this guide is crucial for compliance and avoiding penalties.