Cross-Border Taxation Documents

Cross-Border Taxation

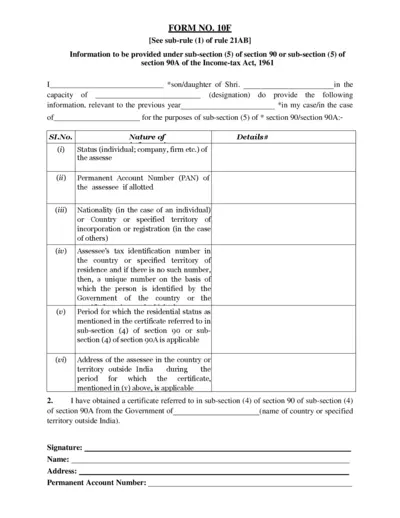

Form No. 10F: Income Tax Information Submission

Form No. 10F is required for providing tax information under sections 90 and 90A. Use this form to ensure compliance with tax regulations. Accurately filled forms help facilitate seamless processing of your tax-related matters.

Cross-Border Taxation

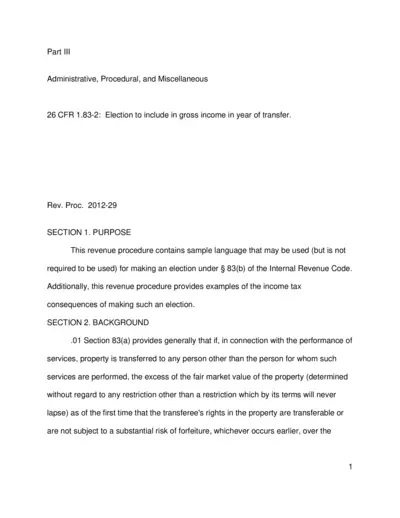

Election to Include in Gross Income under 83(b)

This document outlines the process of making an election under Section 83(b) of the Internal Revenue Code. It provides guidelines on the tax consequences and filing procedures necessary for individuals transferring property. Understanding these details is crucial for compliant tax reporting.

Cross-Border Taxation

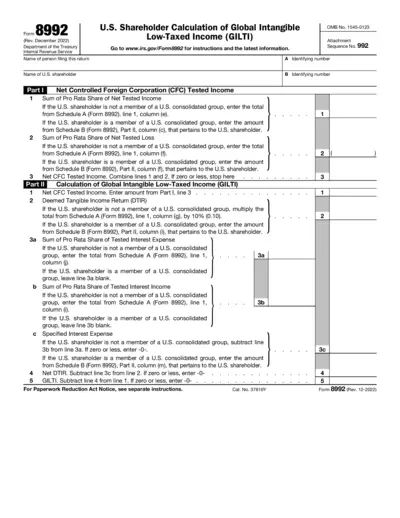

Global Intangible Low-Taxed Income (GILTI) Form 8992

Form 8992 is a crucial document for U.S. shareholders calculating their Global Intangible Low-Taxed Income (GILTI). It assists in reporting income from controlled foreign corporations. Understanding this form is vital for compliance with U.S. tax regulations.

Cross-Border Taxation

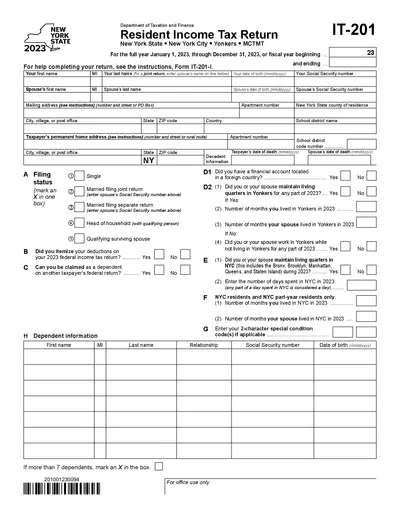

New York State Resident Income Tax Return 2023

This document is the New York State Resident Income Tax Return form for 2023. It is essential for individuals filing their state income taxes. This form includes detailed instructions and sections for reporting income and deductions.

Cross-Border Taxation

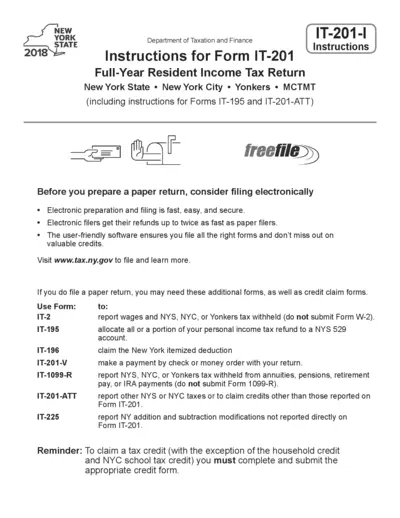

New York State 2018 IT-201-I Tax Filing Instructions

This document provides detailed instructions for filing the 2018 New York IT-201-I tax form. It includes essential information about credits and forms required for full-year resident taxpayers. Ideal for individuals seeking guidance on electronically or paper filing their tax returns.

Cross-Border Taxation

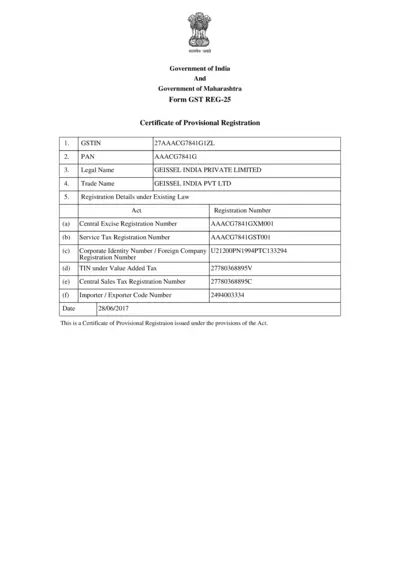

Certificate of Provisional Registration GST REG-25

This file is a certificate for provisional registration under GST. It includes essential details such as GSTIN and PAN. Businesses applying for GST registration must use this file.

Cross-Border Taxation

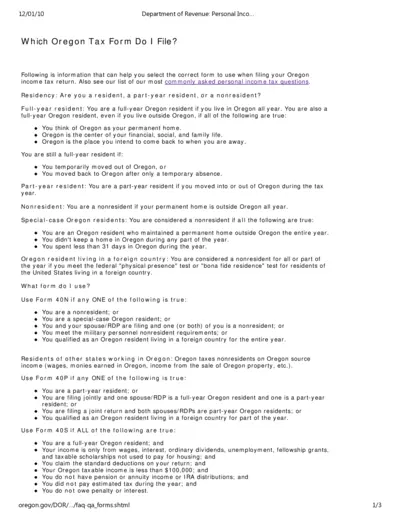

Oregon Department of Revenue Personal Income Tax Forms

This document provides essential information for filing personal income tax forms in Oregon. It includes guidelines for residents and nonresidents, along with important form selection criteria. Understanding your residency status and the appropriate forms is crucial for accurate tax filing.

Cross-Border Taxation

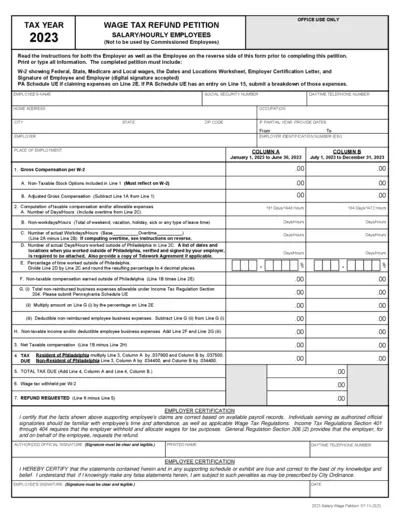

2023 Wage Tax Refund Petition Instructions

This document provides essential instructions for filling out the 2023 Wage Tax Refund Petition. It is designed for salary and hourly employees who are seeking a refund of over-withheld wage taxes. Follow the detailed guidelines to ensure your petition is completed correctly.

Cross-Border Taxation

Instructions for Form 8960 Net Investment Income Tax

This document provides essential instructions for completing Form 8960, which calculates the Net Investment Income Tax. It is useful for individuals, estates, and trusts subject to this tax. Familiarize yourself with the guidelines to ensure accurate filing.

Cross-Border Taxation

DC Withholding Tax Reporting Instructions for 2023

This file contains the employer/payor withholding tax reporting instructions for the year 2023. It includes essential details on filing the FR-900Q form each quarter. Employers should refer to this file for guidelines to ensure compliance with DC tax laws.

Cross-Border Taxation

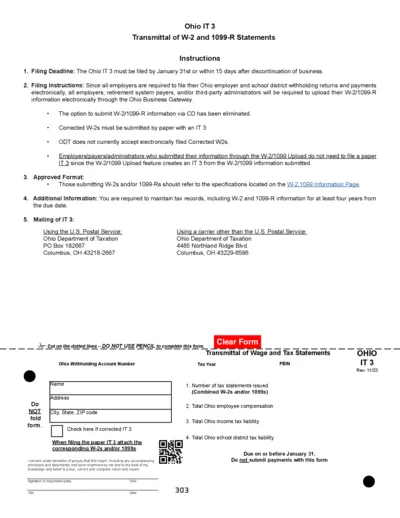

Ohio IT 3 W-2 and 1099-R Filing Instructions and Details

This document provides comprehensive instructions for filing the Ohio IT 3 form, including W-2 and 1099-R statements. It outlines filing deadlines, electronic submission processes, and additional information for employers. Ensure compliance with Ohio tax regulations using this essential guide.

Cross-Border Taxation

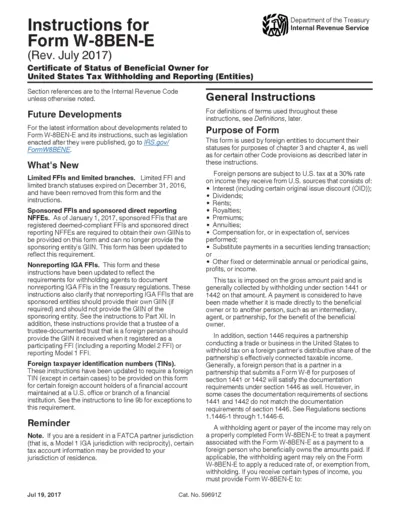

W-8BEN-E Form Instructions for Tax Compliance

This document provides comprehensive instructions for completing Form W-8BEN-E, which certifies the status of beneficial owners for tax reporting. It includes information on applicable rules and regulations for foreign entities. Ensure compliance with U.S. withholding tax requirements by following the guidelines provided.