Property Law Documents

Property Taxes

IRS Tax Year 2022 1040 and 1040-SR Instructions

This file provides essential tax tables and guidelines for completing IRS Form 1040 and 1040-SR. It includes important tax credits and detailed instructions on how to calculate tax owed. Ideal for individuals filing their tax returns.

Real Estate

Texas Commercial Real Estate Purchase Agreement

This Texas Commercial Real Estate Purchase Agreement is a comprehensive legal document necessary for the purchase of commercial property. It outlines the responsibilities, terms, and conditions agreed upon by the buyer and seller. Ideal for individuals and businesses looking to secure real estate transactions in Texas.

Zoning Regulations

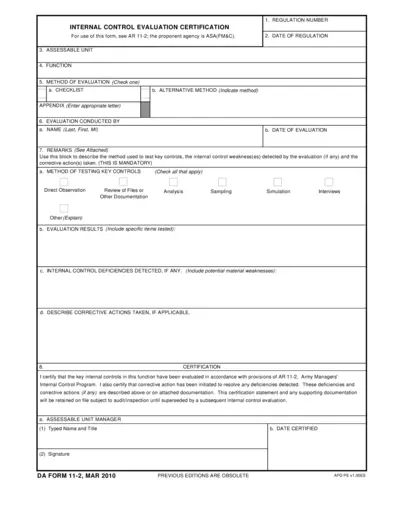

Internal Control Evaluation Certification Form

The Internal Control Evaluation Certification form is essential for evaluating internal controls within various assessable units. This form ensures that key controls are tested and any deficiencies are addressed accordingly. Use this certification to maintain compliance and improve your internal management processes.

Property Taxes

ICESA Format Wage Reporting Program Guidelines

This document outlines the ICESA format for wage reporting. It provides essential information for employers submitting wage data to the Texas Workforce Commission. Ensure compliance by following the detailed instructions within the document.

Property Taxes

Form 1125-E Instructions for Officer Compensation

This document provides comprehensive instructions for completing Form 1125-E for officer compensation reporting. It outlines requirements, definitions, and steps involved in the filing process. Understanding these guidelines is crucial for compliance with IRS regulations.

Property Taxes

Maryland Estate Tax Return Instructions Form MET 1

The Maryland Estate Tax Return Form MET 1 is essential for reporting estate taxes for decedents dying after December 31, 2018. It requires detailed information about the decedent and the estate's value, which must include a federal estate tax return. Proper completion can minimize liabilities and ensure compliance with state regulations.

Property Taxes

Form 706 Estate Tax Return and Instructions

This file provides a detailed examination of Form 706, including schedules and instructions. It helps users understand how to file estate tax returns and what precautions to take. Ideal for tax professionals and individuals handling estate planning.

Property Taxes

Minnesota Individual Income Tax Forms and Instructions

This file contains the forms and instructions for filing individual income tax in Minnesota. It includes Form M1 and various schedules for specific tax credits and deductions. The document provides essential information for taxpayers in Minnesota to ensure compliance with tax laws.

Property Taxes

Arizona Transaction Privilege Use and Severance Tax Return

The Transaction Privilege, Use, and Severance Tax Return (TPT-EZ) is a crucial document for Arizona businesses. This form allows taxpayers to report and remit their tax liabilities effectively. It simplifies the process of submitting tax information for those engaging in applicable transactions.

Property Taxes

Form 8949 Instructions for Capital Asset Transactions

Form 8949 is used to report sales and dispositions of capital assets. It allows taxpayers to summarize their short-term and long-term transactions. This form is essential for accurately calculating gains and losses on your tax return.

Real Estate

Missouri General Warranty Deed Document

This document is a Missouri General Warranty Deed used for transferring real property ownership in Missouri. It outlines the rights, guarantees, and obligations of the grantor and grantee. Essential for property transactions, it ensures legal protection for the buyer.

Property Taxes

IRS Form 1065 Instructions for Partnerships

This document provides detailed instructions for filing IRS Form 1065 for partnerships. Learn how to amend returns under the CARES Act and ensure compliance. It includes necessary schedules and required information for accurate submission.