Property Law Documents

Property Taxes

New Jersey Sales and Use Tax Quarterly Return

This ST-50 worksheet is for online filing of the New Jersey Sales and Use Tax quarterly return. It helps you calculate sales tax due and provides payment instructions. Use this form for accurate reporting of tax obligations.

Property Taxes

IRS Publication 1220 Specifications for Electronic Filing

This document provides comprehensive specifications for the electronic filing of forms like 1099 and W-2G for tax year 2023. It outlines the requirements for both first-time and seasoned filers. Understanding these guidelines is essential for compliance and accuracy in your electronic submissions.

Real Estate

Quitclaim Deed Form for Clark County Nevada

This file contains a quitclaim deed form used for transferring property ownership in Clark County, Nevada. It's essential for anyone looking to execute a property transfer or adjustment of ownership. Ensure you understand the requirements and instructions when filling out this form.

Real Estate

FAR/BAR AS IS Residential Contract Overview

This document provides essential details on the FAR/BAR 'As Is' Residential Contract for Sale and Purchase. It outlines important considerations and guidelines for both buyers and sellers. Ideal for real estate professionals and homeowners navigating Florida property transactions.

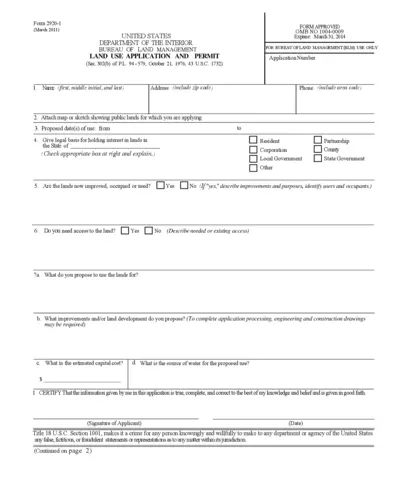

Land Use

Land Use Application and Permit Form 2920-1

This form is an application for land use and permits issued by the Bureau of Land Management. It is required for individuals and organizations seeking to utilize public lands. Ensure accurate information is provided to avoid delays.

Property Taxes

California LLC Nonresident Members' Consent Form FTB 3832

The California LLC Nonresident Members' Consent Form FTB 3832 is essential for limited liability companies with nonresident members. This form allows nonresident members to consent to California jurisdiction for tax purposes. Ensure all relevant nonresident members sign for accurate tax compliance.

Property Taxes

IRS 2023 Form 1041-V Payment Voucher for Estates

This document is the IRS 2023 Form 1041-V, used for submitting payments related to estate and trust tax filings. It provides instructions for filling out the payment voucher and details on sending payments. Get guidance on using this form accurately to ensure compliance.

Property Taxes

2023 Instructions for Form 990 Tax Exempt Organizations

This file contains the essential instructions for Form 990, which organizations must use to report their financial information to the IRS. It provides guidance on filing requirements, penalties for non-compliance, and public inspection details. Nonprofits and tax-exempt organizations will find this resource invaluable for maintaining compliance with tax regulations.

Property Taxes

Property Transfer Tax Return Instructions PTT-172

This document provides instructions for completing the Property Transfer Tax Return Form PTT-172 in Vermont. It outlines who needs to file, when it is required, and what documents are necessary. Ensure compliance by following these guidelines carefully.

Property Taxes

Election by a Small Business Corporation Form 2553

Form 2553 allows small business corporations to elect S corporation status for tax purposes. This form must be filed with the IRS to ensure proper tax treatment. Follow the instructions carefully to ensure eligibility for the S corporation election.

Property Taxes

Instructions to Respond to IRS Missing Form 8962

This document provides detailed instructions on how to respond to the IRS regarding a missing Form 8962. Follow the step-by-step guide to ensure a proper submission. It caters to taxpayers who need assistance in handling IRS notices effectively.

Property Taxes

Election To Treat a Qualified Revocable Trust

Form 8855 allows qualified revocable trusts to be treated as part of an related estate. This form is essential for tax purposes in estate management. Executors and trustees must ensure they understand the filing requirements associated with this election.