Property Law Documents

Real Estate

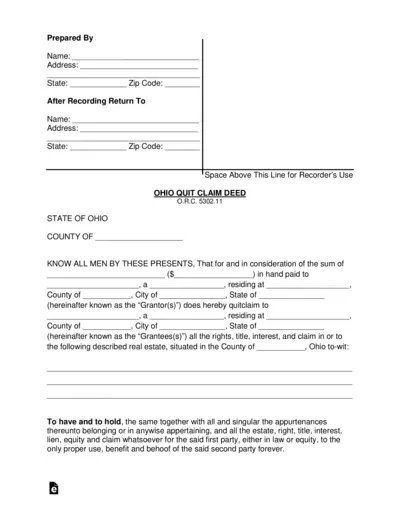

Ohio Quit Claim Deed Form for Property Transfer

This Ohio Quit Claim Deed form is essential for transferring property ownership. It allows the Grantor to quitclaim their rights to the Grantee without warranties. Complete this form to ensure a smooth property transition in Ohio.

Real Estate

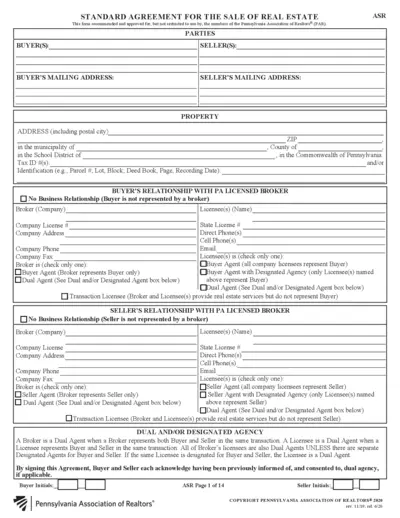

Standard Real Estate Sale Agreement Pennsylvania

This file contains the standard agreement for the sale of real estate in Pennsylvania, approved by the Pennsylvania Association of Realtors. It outlines the necessary terms and conditions required for a valid and legal real estate transaction. Users can refer to this document for guidance on buying or selling property within the state.

Property Taxes

Rhode Island Sales and Use Tax Return Form

This document is the Rhode Island Sales and Use Tax Return form, used for reporting taxable sales and services. It's essential for businesses operating in Rhode Island to ensure compliance with state tax laws. Accurate completion of this form helps avoid penalties and ensures the correct amount of tax is remitted.

Real Estate

Quitclaim Deed for Weber County Utah

This document is a quitclaim deed executed by Brian and Valerie Triplett to Weber County. It includes information about the described tract of land, relevant easements, and grantor details. This file is essential for anyone dealing with property rights and ownership transfers in Weber County.

Property Taxes

IRS Schedule SE Instructions for Self-Employment Tax

The 2022 Instructions for Schedule SE guide self-employed individuals on calculating and paying their self-employment tax. This guide, published by the IRS, is essential for understanding your tax obligations and maximizing your benefits under the social security program. Make sure to refer to these instructions to ensure compliant and accurate filing.

Property Taxes

Instructions for Form 7203 S Corporation Shareholder

Form 7203 provides guidelines for S corporation shareholders to determine stock and debt basis limitations for tax deductions. Users can utilize this form to report stock losses and analyze their eligibility for deductions. This document is essential for accurately filing taxes related to S corporations.

Property Taxes

Wisconsin Homestead Credit Application - Form H-EZ 2022

This file contains the Wisconsin Homestead Credit application form H-EZ for 2022. It provides detailed instructions for residents of Wisconsin seeking homestead credit benefits. Ensure to fill in your details accurately to qualify for potential tax relief.

Property Taxes

Texas Franchise Tax EZ Computation Report

The Texas Franchise Tax EZ Computation Report is a form used by entities to report annualized total revenue of $20,000,000 or less. This form is essential for taxpayers who need to file their franchise taxes correctly. Ensure to follow the provided instructions for accurate submission.

Property Taxes

IRS Instructions for Form 7206 Self-Employed Health Insurance Deduction

This file contains the IRS instructions for Form 7206, which deals with the self-employed health insurance deduction. It provides essential guidelines for eligible individuals on how to utilize the form effectively. Use this file to ensure compliance with IRS regulations concerning health insurance deductions.

Real Estate

Contrato de Opción de Compraventa en Puerto Rico

This document outlines the terms for a purchase option agreement between a seller and a buyer in Puerto Rico. It includes conditions for payment, responsibilities, and property details. This form is essential for those looking to formalize a property transaction.

Real Estate

Non-Refundable Holding Deposit Agreement

This document serves as a non-refundable holding deposit for an apartment rental. It outlines the terms and conditions of the deposit and its applicability towards the security deposit upon move-in.

Real Estate

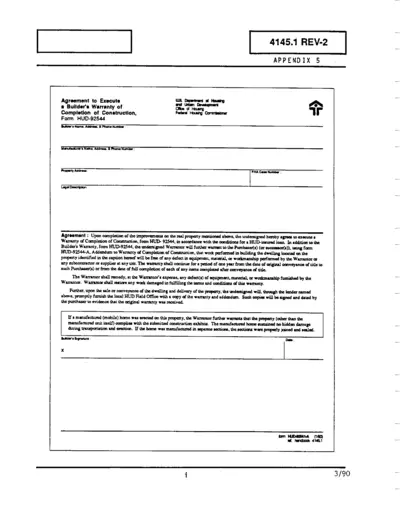

HUD 92544 Builder's Warranty Agreement Form

This file contains the HUD 92544 Builder's Warranty Agreement Form, required for warranty of completion of construction. It outlines the builder's responsibilities to ensure that the construction work is defect-free for one year. Homeowners and builders alike must complete this document to comply with HUD-insured loan requirements.