Property Law Documents

Property Taxes

Instructions for IRS Form 709 Gift Tax Return 2023

This file provides essential instructions for completing IRS Form 709, the United States Gift Tax Return. It outlines who must file, the filing process, and important updates for 2023, ensuring accurate reporting of gifts. Follow these guidelines to ensure compliance with tax regulations related to gift and generation-skipping transfer taxes.

Real Estate

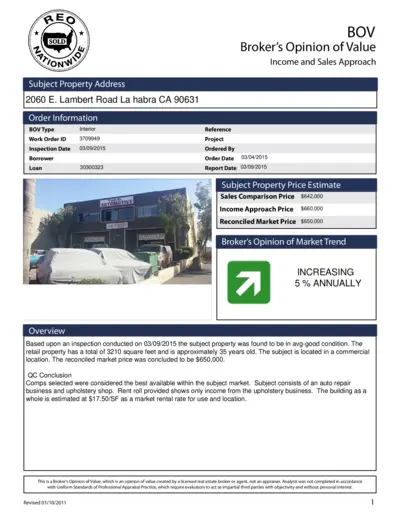

Broker's Opinion of Value for 2060 E. Lambert Rd.

This file contains a Broker's Opinion of Value for the property located at 2060 E. Lambert Road, La Habra, CA. It provides detailed insights into the property's value, its condition, and market trends. Ideal for potential investors and real estate professionals.

Property Taxes

Instructions for Schedule B Form 941

This file provides instructions for completing Schedule B of Form 941. It outlines tax liability for semiweekly schedule depositors. Users will find essential guidance for filing their quarterly federal tax return.

Property Taxes

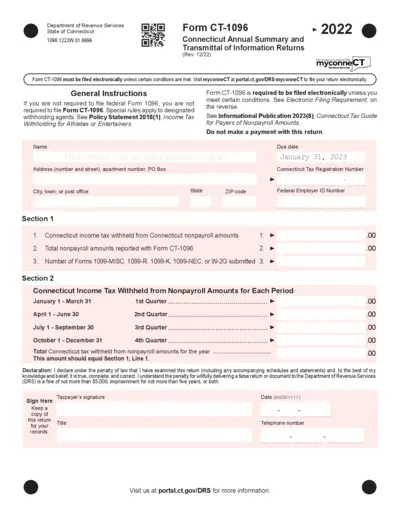

Connecticut Form CT-1096 Annual Summary Instructions

Form CT-1096 is essential for reporting nonpayroll amounts in Connecticut. It must be filed electronically via myconneCT. Ensure accurate filing to avoid penalties and ensure compliance.

Real Estate

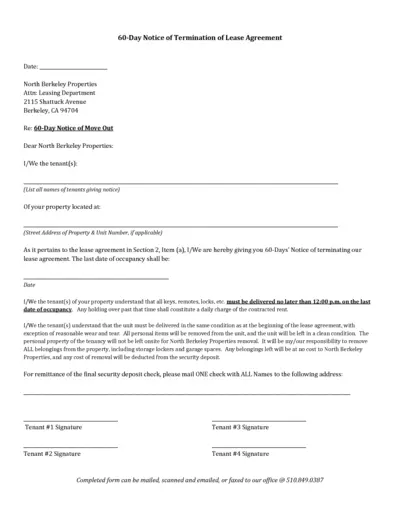

60-Day Notice to Terminate Lease Agreement

This document serves as a formal 60-day notice for tenants planning to terminate their lease agreement. It guides the tenant in providing necessary details to the property management. Properly filling out this form ensures a smooth transition during the move-out process.

Property Taxes

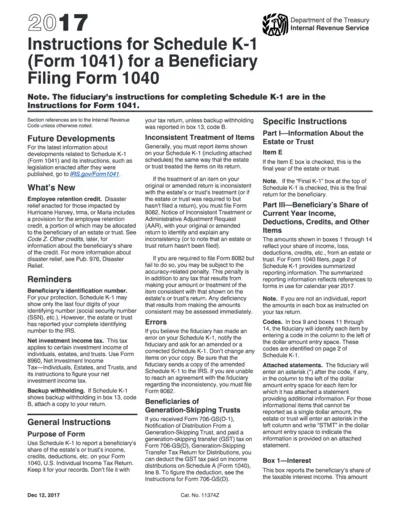

2017 Instructions for Schedule K-1 (Form 1041)

This document provides comprehensive instructions on how to fill out Schedule K-1 (Form 1041) for beneficiaries. It outlines important tax information and lists the necessary forms needed for proper filing. Ideal for estate or trust beneficiaries who need clarity on reporting income and deductions.

Property Taxes

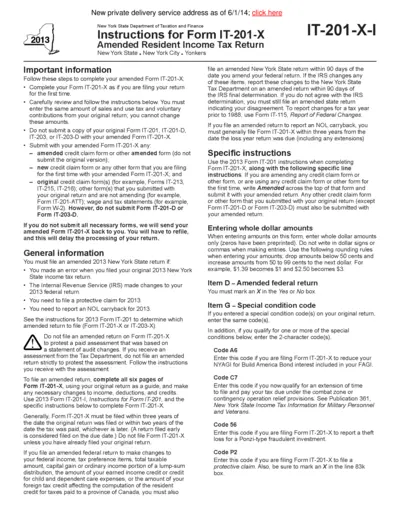

New York State IT-201-X Amended Tax Return Instructions

This file provides detailed instructions for filing Form IT-201-X, which is the amended resident income tax return for New York State. It includes important steps, requirements, and tips for successful submission. Understanding these guidelines ensures compliance and minimizes delays in processing your amended return.

Real Estate

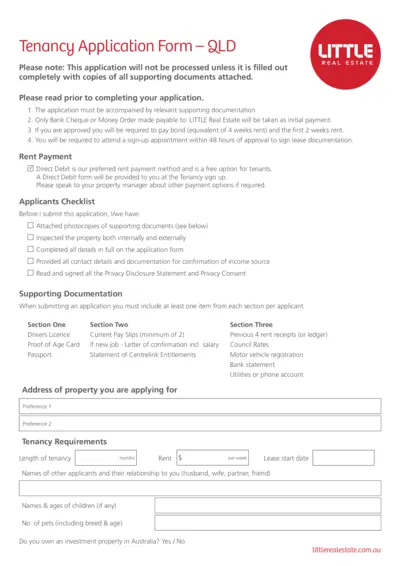

Tenancy Application Form - QLD

This Tenancy Application Form is essential for individuals seeking rental properties in Queensland. It provides detailed instructions and requirements for submission. Make sure to attach all necessary supporting documents for a successful application.

Property Taxes

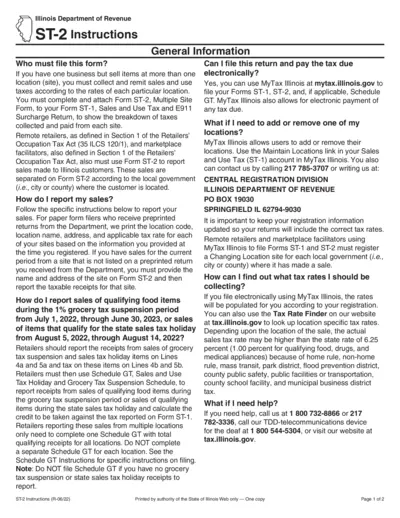

Illinois Department of Revenue ST-2 Instructions

The Illinois ST-2 form provides essential instructions for reporting sales and use taxes in Illinois. It details the requirements for remote retailers and multiple site sellers. This guide ensures compliance with state tax regulations for businesses operating in Illinois.

Real Estate

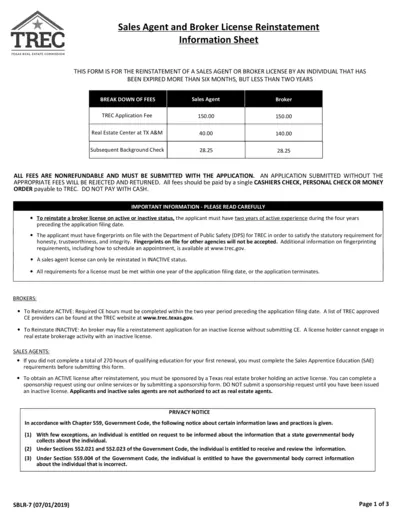

Texas Real Estate Commission License Reinstatement

This information sheet provides details on how to reinstate a sales agent or broker license that has been expired for more than six months. Important instructions regarding fees and eligibility requirements are included. This document is essential for individuals seeking to reactivate their real estate licenses in Texas.

Real Estate

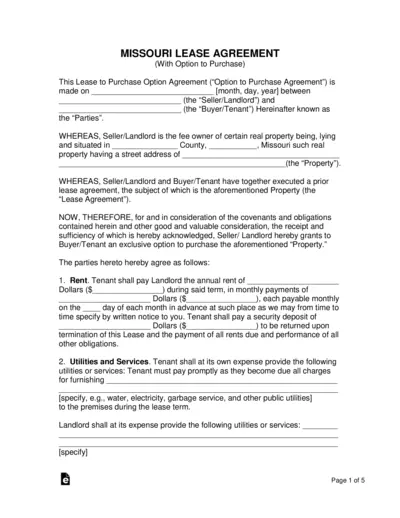

Missouri Lease Agreement with Purchase Option

This Missouri Lease Agreement includes a purchase option for tenants. It outlines the terms, conditions, and obligations for both landlords and tenants. Ideal for those looking to secure property with leasing flexibility.

Real Estate

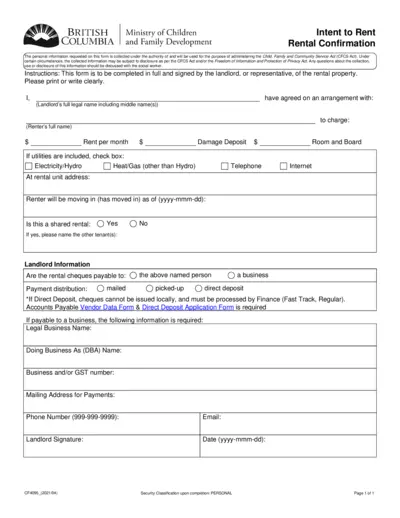

Intent to Rent Confirmation in British Columbia

This document is crucial for landlords and renters in British Columbia. It provides a standard format for confirming rental agreements. The form includes necessary information for processing the rental confirmation.