Property Law Documents

Property Taxes

Form 8283 for Noncash Charitable Contributions

Form 8283 is used to report noncash charitable contributions. This form must be attached to your tax return if you claim a deduction over $500. Detailed instructions are available for completing this form.

Real Estate

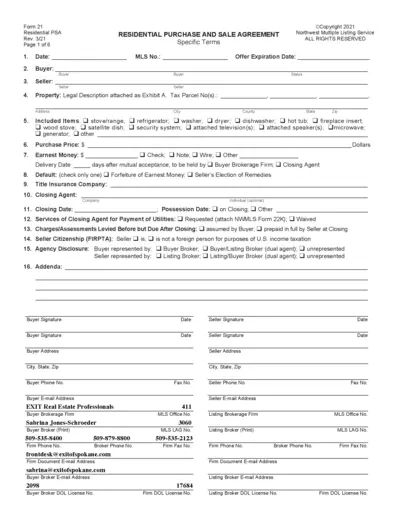

Residential Purchase and Sale Agreement Form 21

This file contains the Residential Purchase and Sale Agreement, outlining the terms and conditions of a property sale. It provides essential information for buyers and sellers, ensuring a clear understanding of the transaction. Completing this form accurately is crucial for a smooth and legally binding sale.

Property Taxes

Georgia Individual Income Tax Return Form 500

This file is the Georgia Individual Income Tax Return Form 500 for 2018. It is used by residents and non-residents to file their state income tax. Please ensure all information is accurately filled out to avoid processing issues.

Real Estate

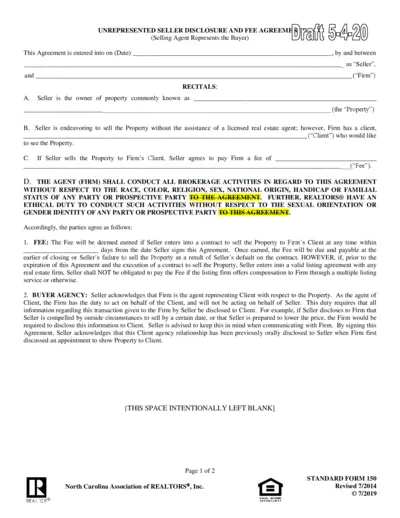

Unrepresented Seller Disclosure and Fee Agreement

This agreement outlines the terms between the seller and the firm for selling a property without a licensed agent. It includes details about fees and agency representation. Ideal for sellers wanting to navigate real estate transactions independently.

Real Estate

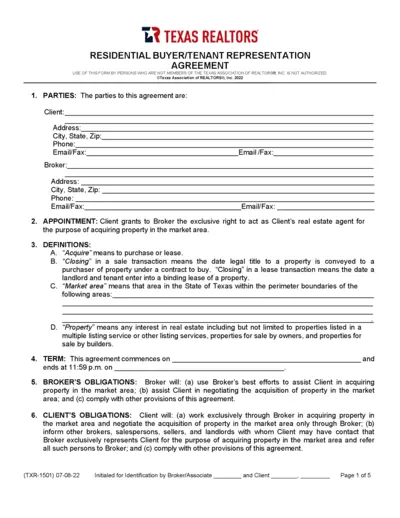

Texas Realtors Buyer Tenant Representation Agreement

This file serves as a template for the Buyer/Tenant Representation Agreement, outlining the responsibilities and agreements between the client and broker. It includes various terms and conditions, commitments from both parties, and important definitions pertaining to real estate transactions in Texas. Ideal for buyers or tenants seeking representation in real estate deals.

Property Taxes

Connecticut Form CT-2210 Underpayment Instructions

Form CT-2210 from the Connecticut Department of Revenue Services guides residents and trusts on how to address underpayment of income tax. It provides necessary details for completing your tax return accurately. Ensure to follow the outlined instructions to avoid interest penalties.

Property Taxes

2022 Mississippi Fiduciary Income Tax Return Instructions

This document provides instructions for filing the Fiduciary Income Tax Return for estates and trusts in Mississippi for the tax year 2022. Users will find essential guidelines to ensure proper submission of their returns. Accurate completion of this form is crucial for compliance with state tax regulations.

Property Taxes

IRS CP277 Notice Instructions for Form 8832

This file contains important information regarding the IRS CP277 notice. Users will find detailed instructions and guidance for Form 8832, which pertains to entity classification elections. It's essential for domestic eligible entities seeking to understand their tax classification.

Property Taxes

Florida Annual Resale Certificate for Sales Tax

The 2022 Florida Annual Resale Certificate for Sales Tax allows businesses to make tax-exempt purchases and rentals of taxable property. It is essential for those who sell tangible personal property or services. Make sure to follow the guidelines to avoid penalties.

Real Estate

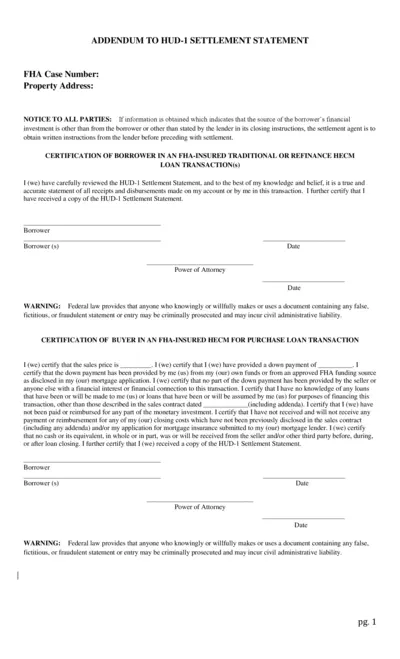

HUD-1 Settlement Statement Certification Form

This file contains important certifications for borrowers and sellers involved in FHA-insured transactions. It includes guidance for filling out the HUD-1 Settlement Statement and necessary legal warnings. Use this form to ensure compliance during your real estate transactions.

Property Taxes

Instructions for Form 8960 Net Investment Income Tax

This document provides detailed instructions for completing Form 8960 related to Net Investment Income Tax for individuals, estates, and trusts. It includes essential definitions, eligibility criteria, and record-keeping guidelines. Suitable for taxpayers looking to navigate the complexities of tax obligations.

Property Taxes

Maryland MW507 Income Tax Withholding Form

The Maryland Form MW507 is used for calculating income tax withholding. It helps employers withhold the correct tax amounts from employee pay. Complete this form annually or when personal circumstances change.