Property Law Documents

Property Taxes

North Carolina Partnership Income Tax Return Instructions

This file contains essential instructions for filing the North Carolina Partnership Income Tax Return for the year 2022. It outlines important updates, steps for completing the return, and key information needed by partnerships. Users can find specifics on tax rates and filing requirements to ensure compliance.

Property Taxes

Michigan Sales and Use Tax Certificate of Exemption

This file serves as a Michigan Sales and Use Tax Certificate of Exemption. It helps purchasers claim exemption from sales tax for qualified transactions. Ensure all fields are completed accurately to avoid any tax implications.

Real Estate

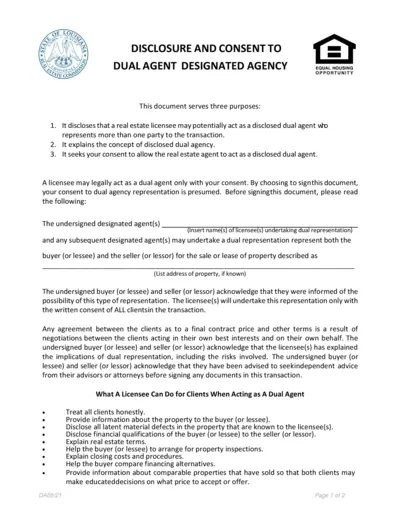

Disclosed Dual Agency Consent Form

This document outlines the roles and responsibilities of a real estate dual agent. It details the consent required for dual agency representation. Understanding this form is crucial for buyers and sellers engaged in real estate transactions.

Property Taxes

Form 1120X Amended US Corporation Income Tax Return

This PDF contains Form 1120X, the Amended U.S. Corporation Income Tax Return. Users can utilize this form to correct previously filed tax returns. Detailed instructions and fields are provided within the document for accurate completion.

Property Taxes

IRS Form 1042 Electronic Filing Instructions

This document outlines the new IRS requirements for electronically filing Form 1042 for tax year 2023. It includes details on who needs to file and the challenges involved. Essential for businesses paying foreign entities.

Property Taxes

Schedule K-1 Form 1120-S 2021 Tax Information

The Schedule K-1 (Form 1120-S) provides information about a corporation's income, deductions, and credits. Shareholders use this form to report their share of the corporation's income on their tax returns. It's essential for tax compliance and ensuring accurate reporting.

Property Taxes

NY State Instructions for Form IT-255 Solar Credit

This document provides detailed instructions for Form IT-255, which is used to claim the Solar Energy System Equipment Credit in New York State. It outlines eligibility, credit amounts, and filing information. Homeowners looking to benefit from solar energy system credits in NY will find essential guidance here.

Property Taxes

California Resident Income Tax Return 2022

The 2022 California Resident Income Tax Return (Form 540 2EZ) is designed for residents to report their annual income accurately. This user-friendly form simplifies tax filing for eligible individuals, allowing for streamlined processes and clear guidelines. Use this form to ensure compliance with California tax regulations.

Property Taxes

Maine Form 1040ME - Schedule A Instructions 2023

This file provides detailed instructions for filling out Maine's Form 1040ME Schedule A. It includes information on refundable and nonrefundable credits. Understanding these instructions is essential for accurate tax filing.

Real Estate

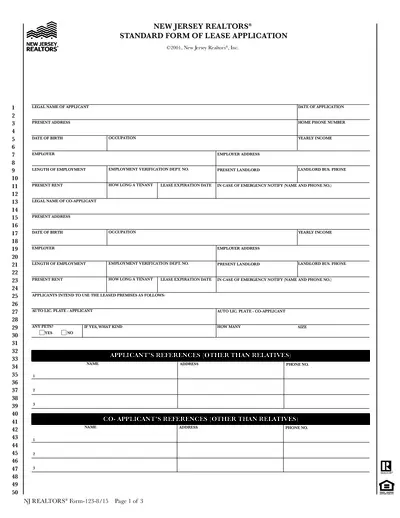

New Jersey Realtors Standard Lease Application Form

The New Jersey Realtors Standard Lease Application Form is designed for individuals seeking to apply for rental properties. This form collects essential information including personal and financial details, rental history, and references. Utilize this comprehensive document to streamline your rental application process.

Property Taxes

2021 IRS Form 1099 Guide for Tax Reporting

This guide provides detailed instructions for filing your 2021 federal income tax return using the Consolidated IRS Form 1099. It includes essential information on the types of reportable income and the necessary steps for accurate reporting. Utilize this comprehensive reference to ensure compliance and avoid potential errors in your tax return.

Property Taxes

2024 Personal Tax Credits Return Form

The 2024 Personal Tax Credits Return (TD1) form assists Canadian residents in calculating their personal tax credits. Employers use this form to determine tax deductions based on personal circumstances. Completing the form accurately ensures proper tax withholding and compliance.