Property Law Documents

Property Taxes

Connecticut Sales and Use Tax Return Instructions

This document provides detailed instructions for completing the Connecticut Sales and Use Tax Return, Form OS-114. It outlines filing requirements, payment methods, and guidelines for accurate tax reporting. Ideal for businesses reporting sales activity in Connecticut.

Real Estate

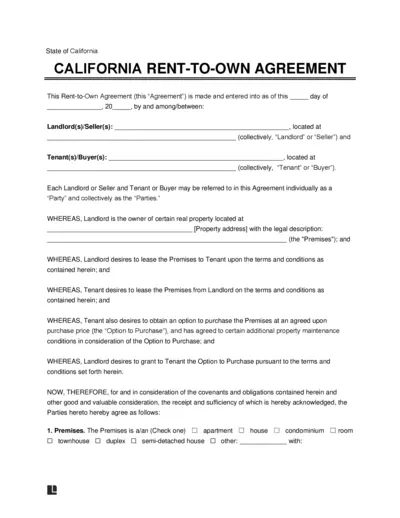

California Rent-to-Own Agreement

The California Rent-to-Own Agreement provides a structured path for tenants who wish to rent with an option to buy. This legally binding document outlines the rights and responsibilities of both landlords and tenants. It includes terms for lease duration, rental amounts, and conditions for purchasing the property.

Real Estate

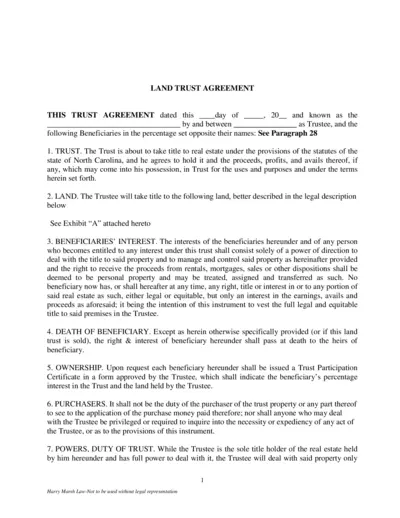

Land Trust Agreement Guide for North Carolina Users

This Land Trust Agreement provides critical guidelines for real estate management in North Carolina. It outlines the roles of trustees and beneficiaries in a trust structure. Users can leverage this agreement for effective property management and legal compliance.

Property Taxes

2022 Automatic Filing Extension for Colorado Tax Return

This file provides instructions and forms for the 2022 Automatic Filing Extension for Composite Nonresident Income Tax Return in Colorado. Users can find important deadlines and guidelines for filing their tax returns. The file also details how to make additional payments and the process to claim the extension.

Property Taxes

Maryland Form 502INJ Injured Spouse Claim Form 2023

The Maryland Form 502INJ is used by injured spouses to claim their portion of a joint tax refund. It provides the necessary information required to allocate income and deductions accurately between spouses. Completing this form is essential for ensuring the rightful receipt of tax refunds.

Property Taxes

Step-by-Step Guide on Filing Auto-Populated VAT Return

This comprehensive guide provides detailed instructions on how to fill out the auto-populated VAT return in iTax. Tailored for taxpayers in Kenya, it simplifies the filing process, enhancing compliance and transparency. It also addresses common concerns and outlines important dates for submission.

Property Taxes

Michigan Department of Treasury Installment Agreement

This file contains the Michigan Department of Treasury's Installment Agreement form for individuals and businesses seeking to establish a payment plan. It outlines the necessary instructions for completing the form and essential guidelines for submission. Proper completion of this form is crucial for managing outstanding debts with the Michigan Department of Treasury.

Property Taxes

Form 720 Instructions Quarterly Federal Excise Tax

This document provides comprehensive instructions for filling out Form 720, the Quarterly Federal Excise Tax Return. It includes essential updates, procedural guidance, and tax rate changes for 2009. Users will find important filing deadlines and general information regarding the form's purpose.

Real Estate

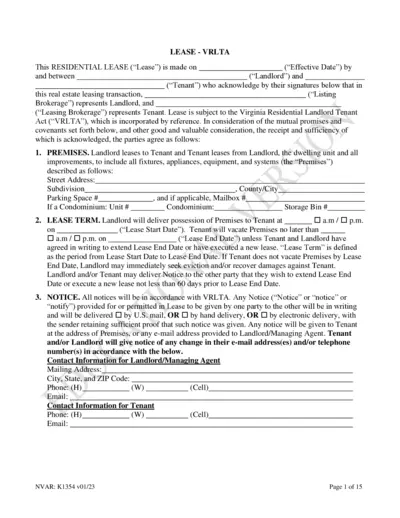

Residential Lease Agreement - Virginia VRLTA

This file is a comprehensive Residential Lease Agreement that complies with the Virginia Residential Landlord Tenant Act (VRLTA). It outlines the terms, conditions, and expectations for both landlords and tenants in a leasing relationship. This document serves as a legal framework ensuring clarity and protection for all parties involved.

Real Estate

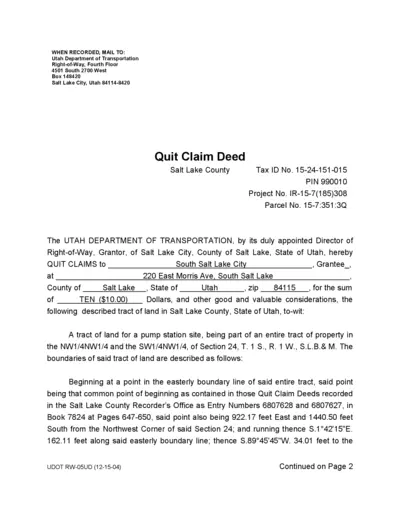

Quit Claim Deed Salt Lake County Utah

This Quit Claim Deed outlines the transfer of property rights for a tract of land in Salt Lake County, Utah. It includes information about the land boundaries and usage restrictions. This document is essential for those involved in property transactions and land use in Utah.

Real Estate

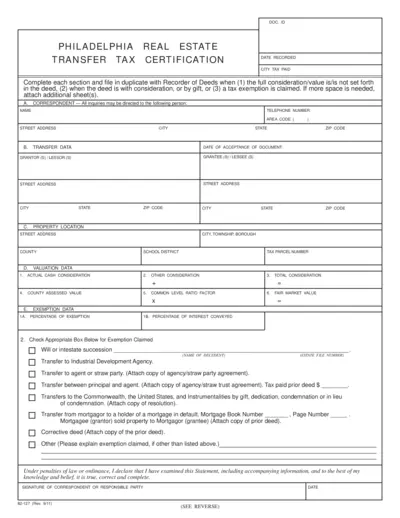

Philadelphia Real Estate Transfer Tax Certification

This file provides essential information about the Philadelphia Real Estate Transfer Tax Certification. It is necessary for anyone involved in real estate transactions in Philadelphia to ensure compliance with local tax regulations. Users can refer to this document for guidance on filling out the certification accurately and efficiently.

Property Taxes

Georgia Depreciation and Amortization Instructions

This document provides essential guidelines for filling out Form 4562 related to Georgia's depreciation and amortization rules. It covers specific tax years and relevant deductions, including the Section 179 deduction. Understanding these instructions is crucial for accurate tax reporting and compliance.