Property Law Documents

Property Taxes

Georgia Individual Income Tax Return Form 500

This is the official Georgia Form 500 for Individual Income Tax Return. It is essential for residents, part-year residents, and non-residents filing taxes in Georgia. Completing and submitting this form ensures compliance with state income tax regulations.

Property Taxes

PA Corporate Net Income Tax REV-1200 Instructions 2022

This file provides detailed instructions for the Pennsylvania Corporate Net Income Tax for the tax year 2022. It includes information on filing requirements, important tax rate changes, and relevant updates for tax forms. Corporations and business entities can ensure compliance by reviewing this comprehensive guidance.

Property Taxes

Instructions for Form 8697 Interest Computation

Form 8697 provides guidance on calculating interest using the look-back method for long-term contracts. This form assists individuals and corporations in determining what interest they owe or may be refunded. It's essential for accurate income tax filing related to completed long-term contracts.

Property Taxes

Wisconsin Form 3 Instruction Guide for 2022

The 2022 Wisconsin Form 3 instructions provide essential guidelines for partnerships and LLCs to file their tax returns accurately. This document outlines who must file, what information is needed, and the consequences of failing to file. It's a vital resource for Wisconsin business owners navigating their tax obligations.

Property Taxes

Schedule K-1 Form 1065 2022 Instructions

This document contains the Schedule K-1 (Form 1065) for the tax year 2022. It details the partner's share of income, deductions, and credits. This form is essential for partnerships to report income distribution among partners.

Real Estate

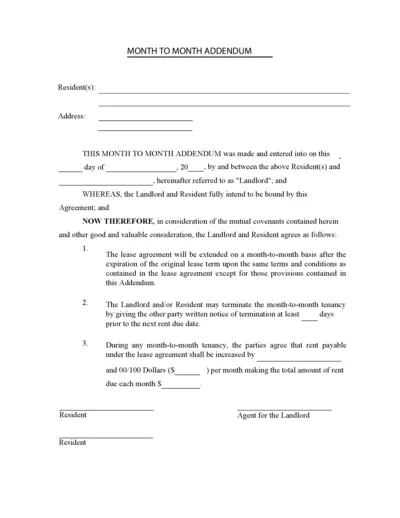

Month to Month Lease Addendum for Residents

This Month to Month Addendum is crucial for residents who wish to continue their tenancy beyond the original lease term. It outlines the agreement terms between the landlord and resident, including rent adjustments and termination procedures. Ensure you understand the extension details for a seamless transition in your rental arrangement.

Property Taxes

Claim for Sales and Use Tax Exemption in New York

This file contains the Claim for Sales and Use Tax Exemption form for motor vehicles, trailers, ATVs, vessels, and snowmobiles in New York. It provides detailed instructions on how to claim exemptions from sales and use tax for eligible purchases. Fill out the form accurately to avoid penalties and ensure a smooth processing of your exemption claim.

Property Taxes

Consent to Disclosure of Tax Return Information

This file provides essential consent forms for the disclosure of tax return information. It is crucial for tax preparation services and compliance with federal regulations. Users must complete the forms to authorize the sharing of their tax return details with specified third parties.

Property Taxes

1041-ES Estimated Income Tax Form Instructions

The 1041-ES form helps estates and trusts calculate and pay estimated income taxes. It's essential for fiduciaries managing tax obligations. This document provides detailed information necessary for the smooth preparation and submission of the form.

Property Taxes

Form 8824 Like-Kind Exchanges Instructions

Form 8824 is a crucial document used to report Like-Kind Exchanges to the IRS. It includes necessary information and guidance on how to accurately fill it out. This file is essential for taxpayers who have engaged in property exchanges.

Property Taxes

Quarterly Income Tax Withholding Return Form NC-5Q

Form NC-5Q is essential for semi-weekly withholding filers in North Carolina. It ensures accurate reporting of quarterly income tax withholdings. Utilize this form to comply with the North Carolina Department of Revenue's regulations.

Real Estate

Rental Agreement Lease - San Francisco Guidelines

This file provides a comprehensive rental agreement specifically tailored for landlords and tenants in San Francisco. It includes terms and conditions related to rent, security deposits, and tenant responsibilities. Users can effectively navigate through the document to ensure compliance with local regulations.