Property Taxes Documents

Property Taxes

2023 Virginia Form 760C Estimated Tax Underpayment

Form 760C is essential for individuals, estates, and trusts in Virginia to report and compute underpayment of estimated tax. Timely completion is critical to avoid additional tax penalties. This guide ensures users understand their obligations and can manage their payments accurately.

Property Taxes

Instructions for Schedule R Form 941 Rev March 2024

This file provides detailed instructions for completing Schedule R, Form 941, for the year 2024. It explains eligibility for filing, how to fill out various sections, and the purpose of Schedule R in context with the IRS. Users will find guidance on necessary information and requirements for aggregate Form 941 filers.

Property Taxes

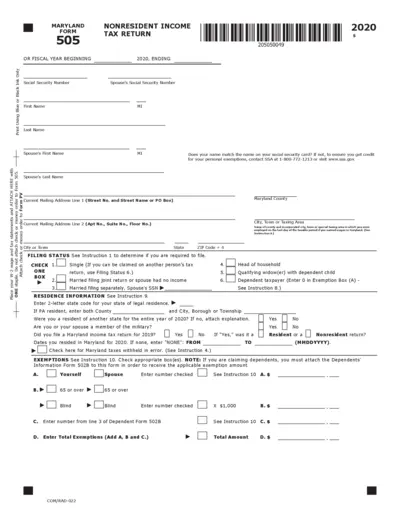

Maryland Nonresident Income Tax Return 2020

The Maryland Form 505 is designed for nonresidents to report their income tax for the year 2020. This form includes information about income, exemptions, and tax calculations. It is essential for nonresidents who earned income in Maryland to ensure accurate tax reporting.

Property Taxes

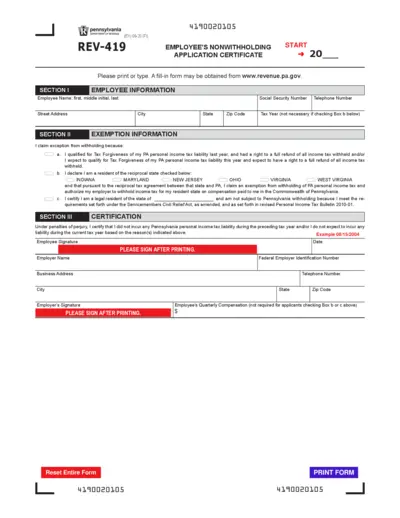

Employee's Nonwithholding Certificate Form REV-419

The REV-419 form allows employees to apply for nonwithholding of Pennsylvania personal income tax. This certificate is essential for individuals expecting no tax liability. Ensure accurate completion to facilitate proper tax management.

Property Taxes

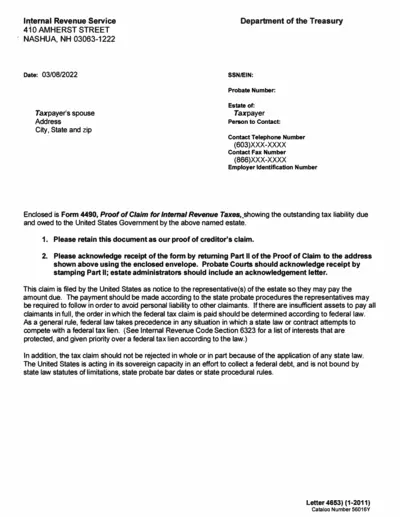

Proof of Claim for Internal Revenue Taxes Form 4490

This file contains the Proof of Claim for Internal Revenue Taxes, outlining tax liabilities due by an estate to the IRS. It includes detailed instructions for submission and important legal information regarding the filing. Ideal for those needing to address federal tax claims associated with an estate.

Property Taxes

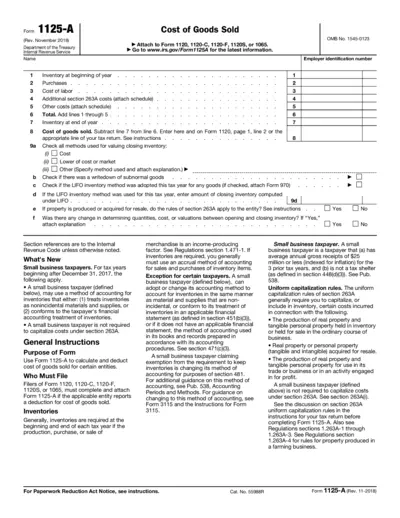

Form 1125-A Instructions for Cost of Goods Sold

Form 1125-A is used to calculate and report the cost of goods sold for various tax returns. This form is essential for businesses to accurately compute their taxable income. Make sure to follow the instructions carefully to ensure compliance with IRS regulations.

Property Taxes

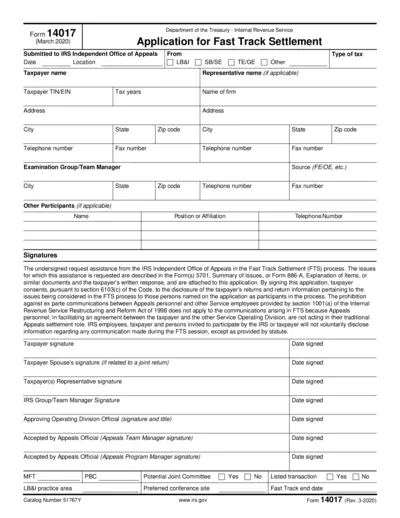

IRS Form 14017 Application for Fast Track Settlement

Form 14017 allows taxpayers to request Fast Track Settlement with the IRS. This process helps resolve disputes quickly and effectively. Use this form if you need assistance with the IRS Independent Office of Appeals.

Property Taxes

Employee Tax Certificate Guide for 2024-2025

This guide explains the employee tax certificate process for the filing season. It provides essential information regarding the IRP5 and IT3(a) forms. Follow this guide to understand how to complete your tax return efficiently.

Property Taxes

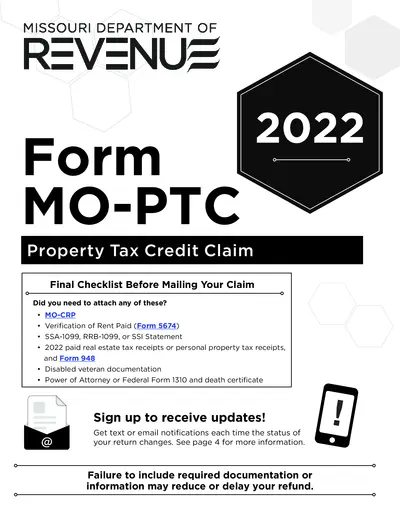

Missouri Property Tax Credit Claim Form 2022

The Missouri Property Tax Credit Claim Form is essential for Missouri residents seeking tax credits for property taxes paid in 2022. This comprehensive form includes eligibility requirements and detailed instructions on how to fill it out. Ensure to attach necessary documentation to avoid delays in your refund.

Property Taxes

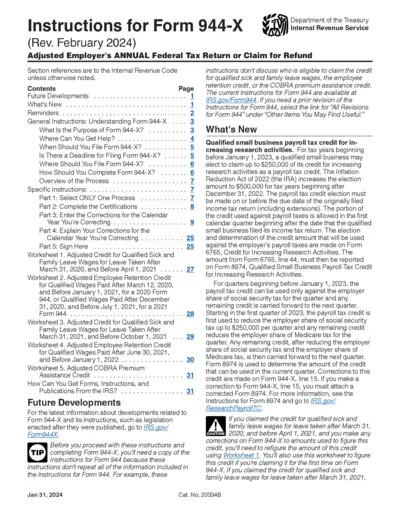

Instructions for Form 944-X Adjusted Tax Return

This file provides comprehensive instructions for completing Form 944-X, including error corrections and submission details. It's essential for employers who need to adjust their annual federal tax return or claim a refund. Stay informed with updates and worksheets included.

Property Taxes

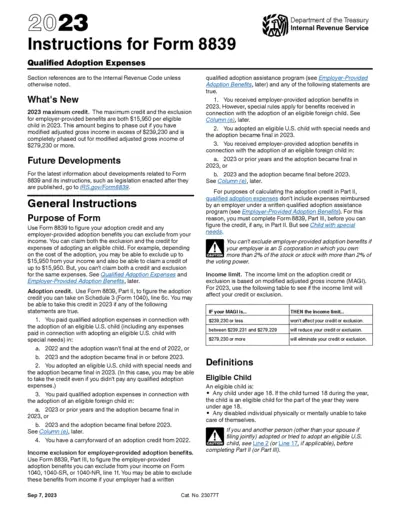

Instructions for Form 8839 on Qualified Adoption Expenses

This document provides comprehensive instructions for Form 8839, which is used to claim adoption credits and benefits. It outlines eligible expenses and income exclusion criteria, ensuring users understand the requirements for claiming credits. A crucial resource for individuals adopting an eligible child in 2023.

Property Taxes

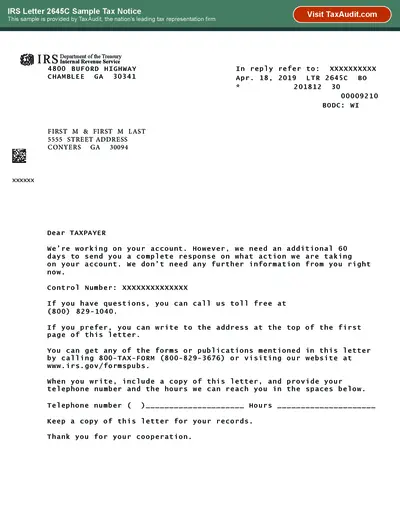

IRS Letter 2645C Sample Tax Notice for Tax Audit

This file contains a sample IRS Letter 2645C tax notice. It serves as a reference for individuals receiving similar notices from the IRS. The document includes important instructions and contact information relevant to tax inquiries.