Property Taxes Documents

Property Taxes

Instructions for Form 8960 Net Investment Income Tax

This file provides comprehensive instructions for Form 8960, detailing how to calculate the Net Investment Income Tax. It is essential for individuals, estates, and trusts to ensure accurate tax compliance. Users will find definitions, who must file, and guidance on completing the form.

Property Taxes

BIR Form 2303 Registration Certificate Instructions

BIR Form 2303 is a detailed certificate of registration for taxpayers including their TIN, address, and tax types applicable. It provides essential information for compliance with tax regulations in the Philippines. Understanding and filling this form correctly is crucial for businesses and individuals alike.

Property Taxes

Oregon Quarterly Tax Report Form OQ Instructions

The Oregon Quarterly Tax Report (Form OQ) provides essential line-by-line instructions for filing state unemployment taxes accurately. Designed for employers, this form ensures compliance with Oregon tax laws. This guide directs users in completing the form effectively.

Property Taxes

Texas Sales and Use Tax Return Instructions

This file contains detailed instructions for completing the Texas Sales and Use Tax Return form. It is essential for taxpayers to understand their filing requirements and procedures. Proper adherence to these guidelines ensures compliance with Texas tax regulations.

Property Taxes

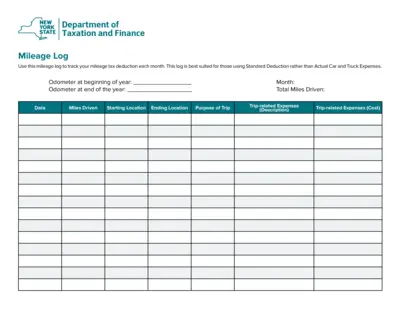

New York State Mileage Log for Tax Deductions

This Mileage Log helps users track their monthly mileage for tax purposes. It is designed for individuals utilizing Standard Deduction. Efficiently record your trips to maximize tax deductions.

Property Taxes

United States Gift Tax Return Form 709 2023

The United States Gift Tax Return Form 709 allows donors to report gifts given during the calendar year. This file contains instructions and information necessary for properly completing the form. It is essential for ensuring compliance with IRS regulations regarding gift taxes.

Property Taxes

Maryland Tax Connect User Guide for Filing Forms

This guide provides detailed steps for filing Maryland state tax forms through Maryland Tax Connect. It covers filing for different tax types and includes essential information for users. Ideal for both consumers and business users wishing to navigate their tax obligations.

Property Taxes

IRS Schedule D Form 1040 Capital Gains and Losses

This file contains the IRS Schedule D Form 1040 used for reporting capital gains and losses for tax purposes. It provides detailed instructions and forms necessary for accurate tax reporting. Ensure you follow the guidelines closely for successful submission.

Property Taxes

VAT Refund Request Instructions for IKEA

This VAT refund request form for IKEA helps individuals and businesses reclaim VAT. Proper completion and submission are essential for successful refunds. Follow the instructions carefully to ensure your application is processed promptly.

Property Taxes

IRS Form 4810 Request for Prompt Tax Assessment

IRS Form 4810 is used to request a prompt assessment of tax under Section 6501(d). It must be accompanied by specific documentation. Make sure to fill this form accurately to avoid delays.

Property Taxes

2023 Instructions for Schedule I Form 1041 - AMT Tax

This file provides detailed instructions for completing Schedule I of Form 1041, used to calculate Alternative Minimum Tax for estates and trusts. It covers who needs to file this form, records required, and special notes for the 2023 tax year. This guide is essential for CPAs, tax preparers, and fiduciaries handling estates or trusts.

Property Taxes

North Carolina Individual Income Tax Form D-400 Instructions

This document provides essential instructions for filing North Carolina's Individual Income Tax Form D-400. It includes updates for 2011, details on e-filing, and critical filing information. Users will find valuable tips on deductions, tax credits, and electronic filing options.