Property Taxes Documents

Property Taxes

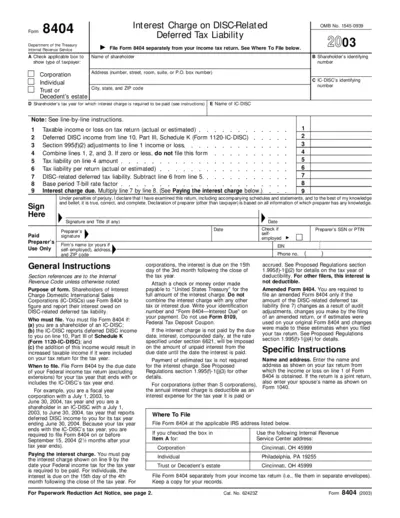

Form 8404 - Interest Charge on DISC-Related Deferred Tax Liability

Form 8404 is used by shareholders of Interest Charge Domestic International Sales Corporations (IC-DISCs) to calculate and report interest owed on DISC-related deferred tax liability. Instructions include who must file, when to file, paying the interest charge, and other computation rules. It also explains how to enter necessary information such as taxpayer details and identifying numbers.

Property Taxes

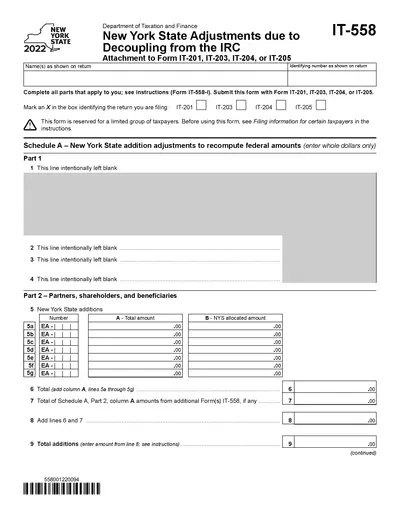

New York State 2022 Adjustments Due to Decoupling from the IRC

This file contains the New York State Adjustments due to Decoupling from the IRC for the year 2022. It is used as an attachment to Form IT-201, IT-203, IT-204, or IT-205. Complete all relevant parts and submit it with the appropriate form.

Property Taxes

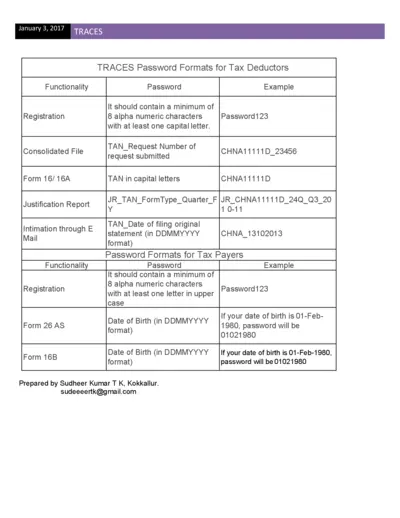

TRACES Password Formats and Functionality Guide for Tax Deductors and Tax Payers

This document provides guidance on TRACES password formats for tax deductors and tax payers. It includes detailed examples and instructions for various forms such as Form 16/16A and Form 26AS. Users will find step-by-step guidance on how to register and create passwords.

Property Taxes

Indiana W-2G and 1099 Filing Requirements Guide

This file provides detailed instructions and requirements for filing W-2G and 1099 forms in Indiana. It includes guidelines for electronic filing, sequence of records, and specific IRS format. The document also covers administrative highlights and important information for taxpayers.

Property Taxes

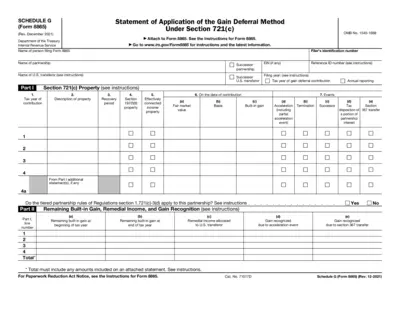

Schedule G (Form 8865) Instructions and Details

Schedule G (Form 8865) is used for the Statement of Application of the Gain Deferral Method under Section 721(c). It must be attached to Form 8865. This document provides instructions and required details for filing Schedule G.

Property Taxes

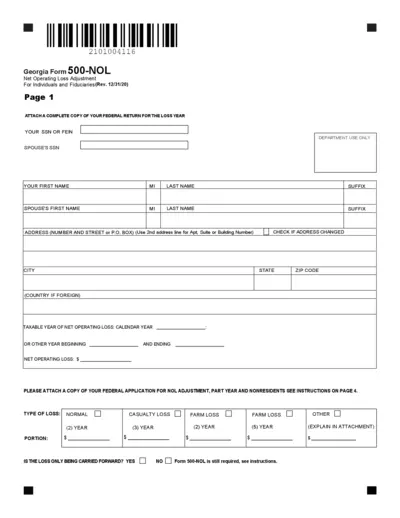

Georgia Form 500-NOL: Net Operating Loss Adjustment

This document is the Georgia Form 500-NOL, used for adjusting net operating losses for individuals and fiduciaries. It includes fields for personal information, loss types, and detailed income adjustments. The form must be filled out accurately and a complete copy of your federal return is required.

Property Taxes

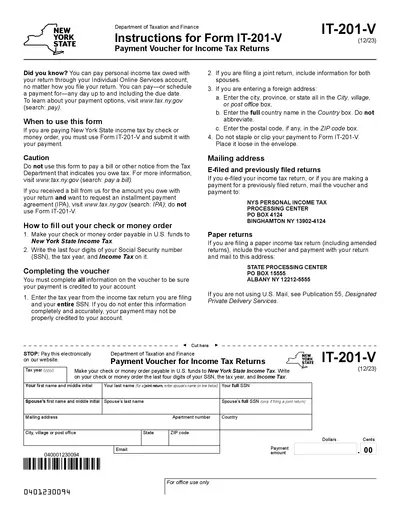

Instructions for Form IT-201-V Payment Voucher

This document provides instructions for filling out Form IT-201-V, which is used to submit payments for New York State income taxes by check or money order. It details when to use the form, how to complete it accurately, and where to mail it. The file also includes important contact information and privacy notices.

Property Taxes

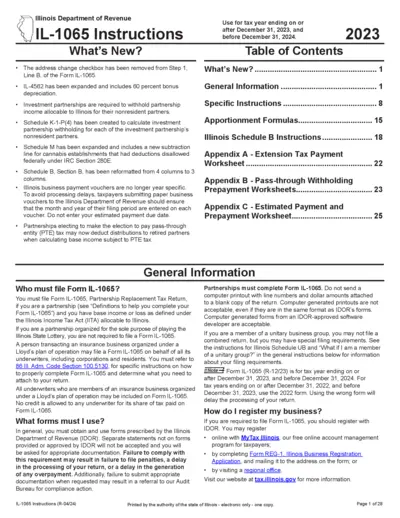

Illinois Department of Revenue IL-1065 Instructions 2023-2024

This document provides instructions for completing the IL-1065 form for the Illinois Department of Revenue. It includes new updates, general information, and specific instructions for the 2023-2024 tax year. Ensure accuracy by following the detailed guidelines.

Property Taxes

Filing Taxes for Employee Stock Purchase Plan (Qualified)

This guide provides information on filing taxes for a qualified Employee Stock Purchase Plan (ESPP), including necessary documents, tax treatment, and reporting guidelines. It helps you understand the tax implications of ESPP stock sales and how to report ordinary income and capital gains/losses. Ensure you're enrolled in a qualified ESPP and use this guide to accurately file your taxes.

Property Taxes

2023 Oklahoma Resident Individual Income Tax Forms & Instructions

This file contains the 2023 Oklahoma Resident Individual Income Tax Return Form 511, instructions, and supporting schedules. It includes information about residence status, due dates, extensions, refunds, and amended returns. Also provides helpful hints and new tax credits for the year.

Property Taxes

New York State Department of Taxation and Finance - Other Tax Credits and Taxes Form 2023

This document is a form issued by the New York State Department of Taxation and Finance for reporting other tax credits and taxes. It functions as an attachment to Form IT-201 and details nonrefundable and refundable credits, as well as additional New York City and Yonkers taxes. Users must submit this form alongside Form IT-201.

Property Taxes

Instructions for Form NYC-210, New York City School Tax Credit

This file provides detailed instructions on how to fill out Form NYC-210 to claim the New York City School Tax Credit for the year 2014. It includes eligibility criteria, instructions for filling out the form, and submission details. The file is essential for individuals seeking to claim this tax credit.