Financial Services Documents

Retirement Planning

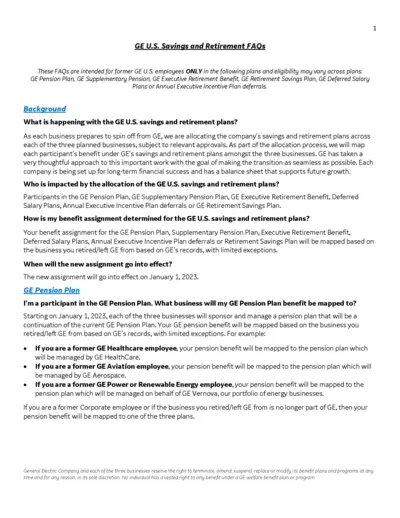

GE U.S. Savings and Retirement FAQs

This document contains essential FAQs about GE U.S. savings and retirement plans, tailored for former GE employees. It provides critical information regarding benefit assignments, pension plan mappings, and upcoming changes affecting retirement resources.

Tax Filing

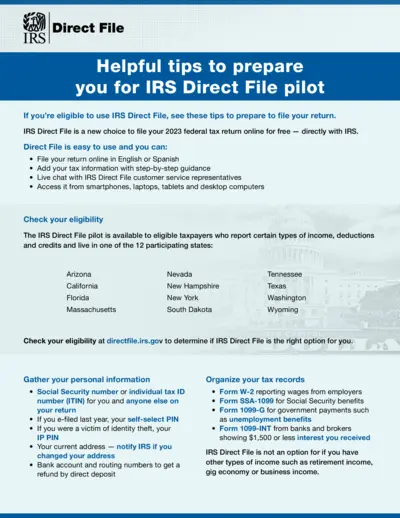

IRS Direct File: Simplified 2023 Federal Tax Filing

IRS Direct File allows eligible taxpayers to file their 2023 federal tax return online for free. This service provides step-by-step guidance and live customer support. Access it easily from any device to file in English or Spanish.

Tax Preparation

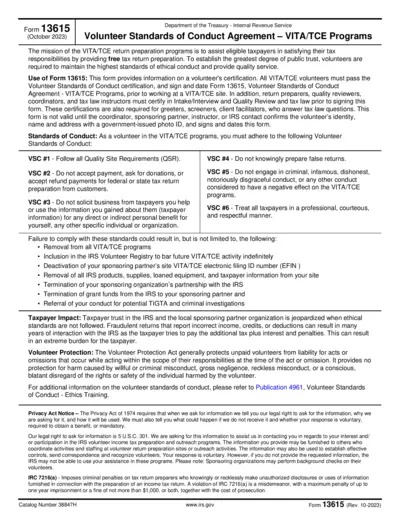

Volunteer Standards of Conduct Agreement Form 13615

The Form 13615 outlines ethical conduct standards for volunteers in VITA/TCE programs. It ensures volunteers are trained and certified to provide quality tax assistance. Complete this form prior to participating in VITA/TCE services.

Tax Consulting

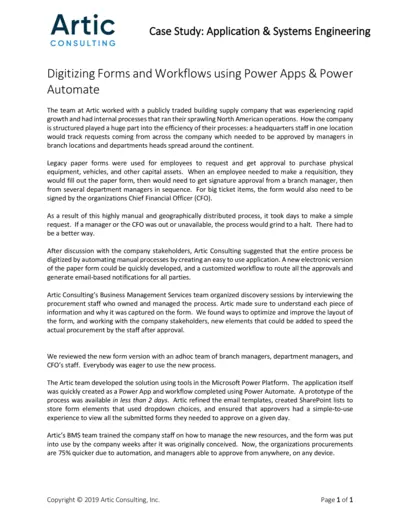

Digitizing Forms and Workflows with Power Apps

This file provides a case study on how Artic Consulting helped a building supply company optimize its procurement process through automation. It details the challenges faced by the company with manual paper forms and how a digital solution was implemented. The case study illustrates the steps taken by Artic Consulting to streamline workflows using Microsoft Power Apps and Power Automate.

Financial Planning

CFP Certification Application Form Guide

This document provides essential information and instructions for completing the CFP Certification Application Form. It ensures applicants have all necessary details to submit their applications effectively. This guide aims to streamline the certification process for financial planners.

Tax Consulting

Client Information and Coaching Forms

This document includes essential forms for coaching services, such as the Client Information Form, Financial Information Form, and Consent Forms. It ensures that clients provide necessary details for effective service delivery while maintaining confidentiality. Completing these forms accurately helps facilitate the coaching process.

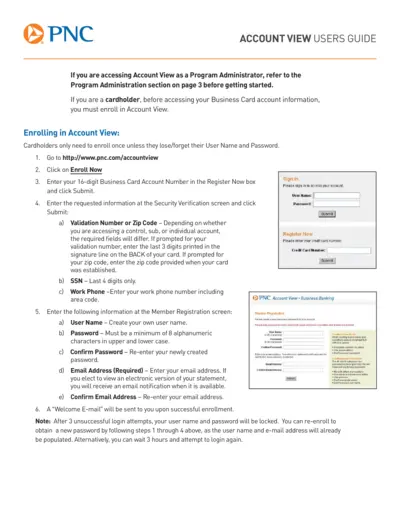

Business Banking

PNC Account View Users Guide

This guide provides detailed instructions on accessing and managing your PNC Account View. It is essential for cardholders and program administrators for easy navigation. Follow the steps provided to enroll, sign in, and manage your statements and payments.

Tax Preparation

HowardSoft Tax Preparer User's Guide 2015

This user's guide contains essential information and instructions for using the HowardSoft Tax Preparer software. It outlines system requirements and offers assistance for both installation and software updates. Ideal for new users as well as those upgrading from previous versions.

Tax Consulting

Scentsy Policies and Procedures for Consultants

This document outlines the Scentsy Policies and Procedures for Independent Consultants. It provides essential information regarding agreements, compliance, and business conduct. Understanding these policies is crucial for anyone looking to succeed as a Scentsy Consultant.

Tax Filing

Understanding Form W-2 Box 12 Tax Reporting Codes

This file provides detailed information about IRS Form W-2 and Box 12 reporting codes. It's essential for employees and employers to report taxable amounts accurately. Learn about how to fill out W-2 forms effectively.