Finance Documents

Banking

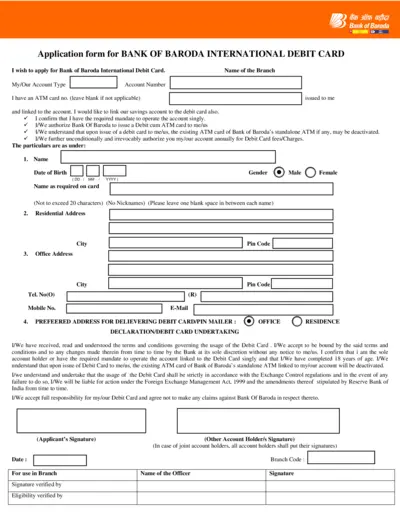

Bank of Baroda International Debit Card Application

This document is the application form for the Bank of Baroda International Debit Card. It includes personal details and terms for card issuance. Users must complete the form to obtain a debit card linked to their account.

Tax Forms

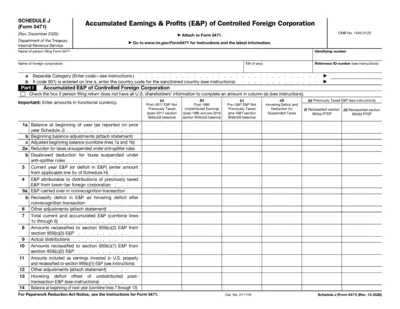

Form 5471 Schedule J Instructions and Details

This file provides the instructions for filling out Schedule J of Form 5471. It outlines the accumulated earnings and profits of controlled foreign corporations. Users must reference these instructions to ensure accurate reporting and compliance with tax regulations.

Banking

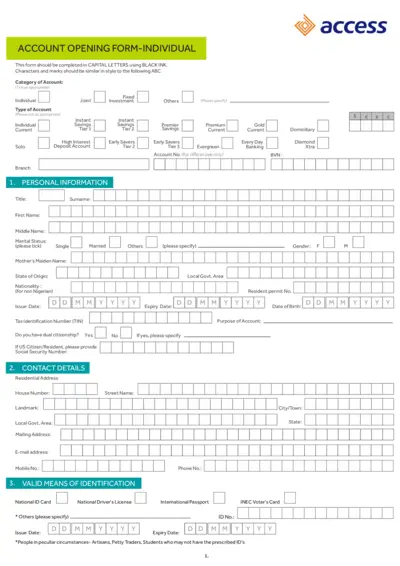

Access Bank Individual Account Opening Form

This form is essential for individuals looking to open a bank account with Access Bank. It requires personal, contact, and identification information. Filling it out correctly ensures a smooth account opening process.

Banking

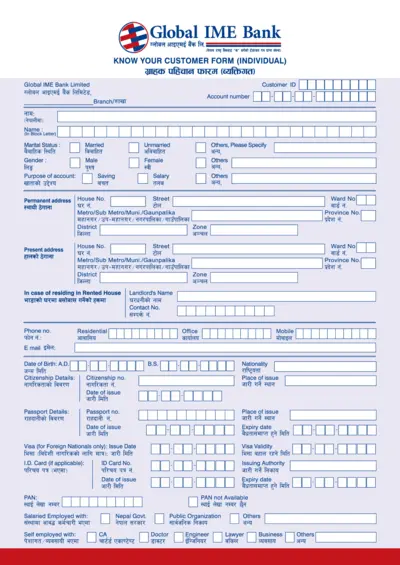

Global IME Bank Know Your Customer Form for Individuals

This form is essential for individual customers of Global IME Bank to establish their identity. It collects important personal details such as marital status, citizenship information, and residential addresses. Properly filling out this form helps ensure compliance with regulatory requirements.

Tax Forms

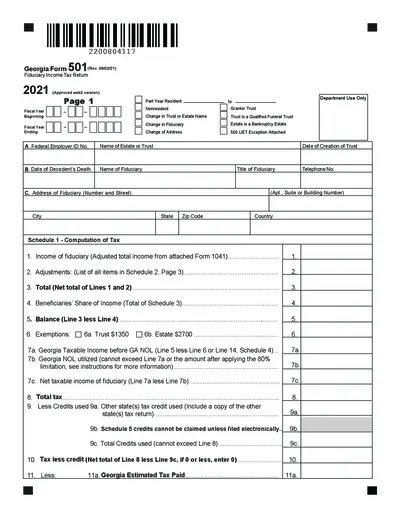

Georgia Fiduciary Income Tax Return Form 501

The Georgia Fiduciary Income Tax Return Form 501 is essential for fiduciaries of estates and trusts to report income. It provides a structured format for calculating taxable income and credits. Accurate completion is necessary to ensure compliance with state tax regulations.

Banking

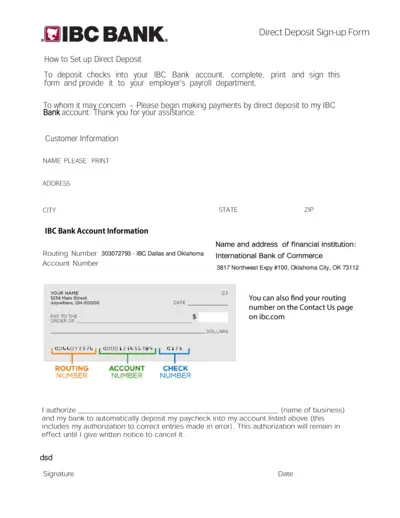

IBC Bank Direct Deposit Sign-up Form Instructions

This file contains detailed information on how to complete the IBC Bank Direct Deposit Sign-up Form. It is essential for depositing checks directly into your bank account. Follow the simple instructions provided to set up your direct deposit seamlessly.

Tax Forms

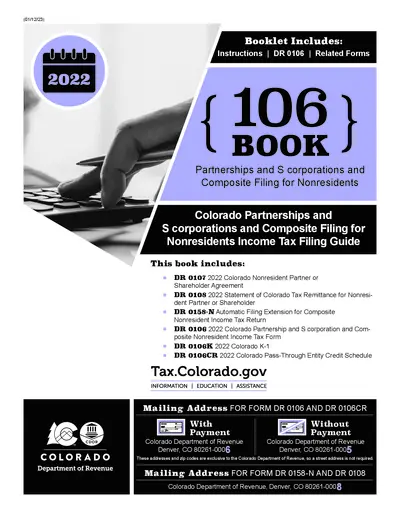

Colorado Nonresident Partner Tax Filing Guide

This guide provides essential instructions for filing the Colorado Nonresident Partner or Shareholder Agreement. It assists users in understanding the necessary requirements and forms needed for compliance. Use this resource to navigate nonresident income tax filing efficiently.

Tax Forms

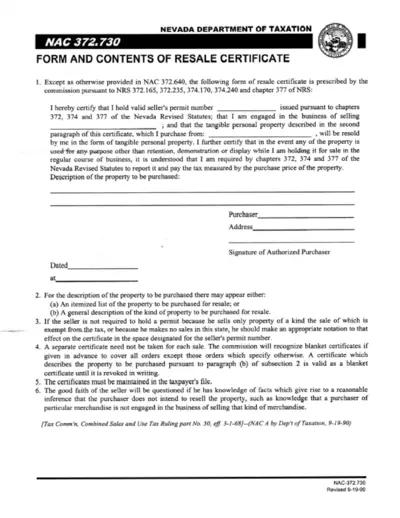

Nevada Resale Certificate Instructions and Details

This file provides guidelines on how to properly fill out the Nevada resale certificate. It ensures compliance with Nevada tax laws when purchasing goods for resale. Use this document to understand the forms and requirements needed for tax exemption.

Tax Forms

IRS Form 8825: Rental Real Estate Income & Expenses

Form 8825 is utilized for reporting rental real estate income and expenses for partnerships or S corporations. It serves as an essential resource for accurate tax reporting. Ensure to follow the instructions carefully to avoid errors.

Tax Forms

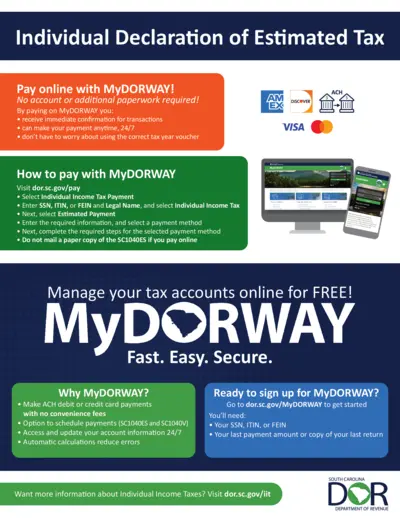

Individual Declaration of Estimated Tax Form SC1040ES

The Individual Declaration of Estimated Tax form is essential for individuals in South Carolina to report their estimated taxes. This form allows users to pay their taxes online easily. Completing this form accurately ensures compliance with tax regulations in South Carolina.

Banking

Truist Bank Services Agreement and Details

This document contains the comprehensive Truist Bank services agreement outlining various account types and rules. It provides essential information about money management and electronic fund transfers. Users will find valuable instructions for account opening, management, and electronic transactions.

Tax Forms

Instructions for Form 8621 Passive Foreign Investment

This file provides comprehensive instructions for filling out Form 8621. It is designed for U.S. shareholders of Passive Foreign Investment Companies (PFICs). Ensure compliance with the latest tax regulations outlined herein.