Finance Documents

Tax Forms

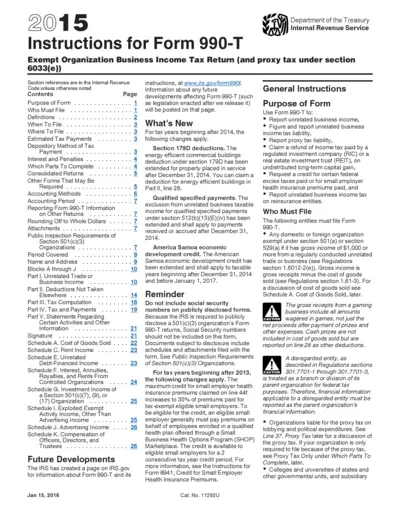

Instructions for Form 990-T Exempt Organizations

This file contains instructions for completing Form 990-T, an income tax return for exempt organizations. It provides guidelines for organizations to report unrelated business income. Users will find essential information regarding who must file, how to fill out the form, and important dates.

Tax Forms

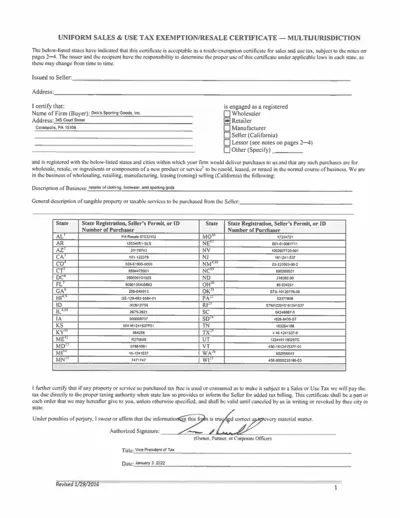

Uniform Sales & Use Tax Exemption Certificate

The Uniform Sales & Use Tax Exemption Certificate is a multi-jurisdictional form accepted by various states. This certificate allows buyers to claim tax exemption for eligible purchases. Ensure to provide accurate information and check state-specific guidelines.

Tax Forms

W-3 Transmittal of Wage and Tax Statements 2024

This file is the W-3 Transmittal of Wage and Tax Statements for 2024. It provides essential details for employers filing W-2 forms. Use this form to report wages and tax information to the SSA.

Tax Forms

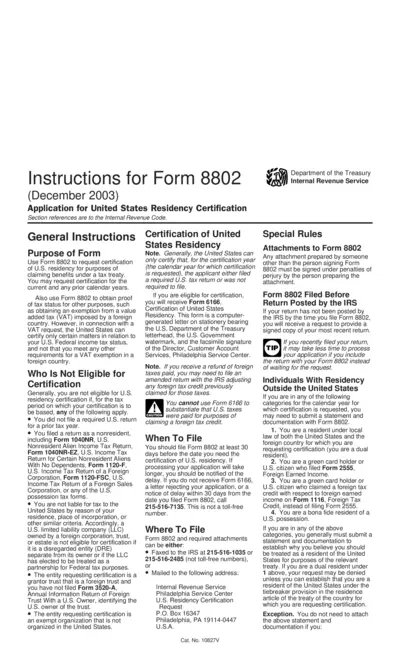

Instructions for Form 8802 Application for Residency Certification

Form 8802 helps individuals request certification of U.S. residency for tax treaty benefits. This form is essential for verifying tax status to claim exemptions, especially from foreign taxes. It is applicable for the current and any prior calendar years.

Banking

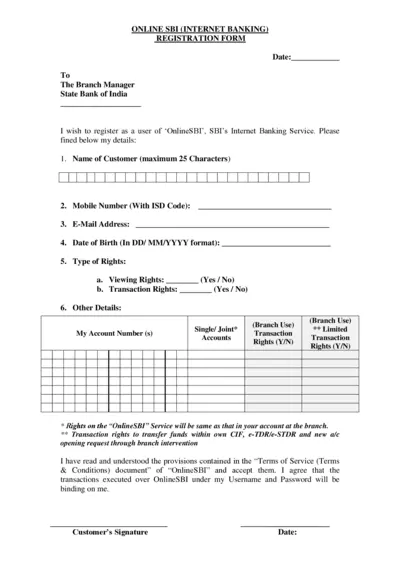

SBI Online Banking Registration Form

This document is a registration form for OnlineSBI, SBI's Internet Banking Service. Fill in your details including name, mobile number, and account information. Ensure to review the Terms of Service before submission.

Tax Forms

Form 8621 - Shareholder Information Return

This file is the IRS Form 8621, used by shareholders to report income from passive foreign investment companies. It is essential for tax compliance regarding foreign investments. Complete this form accurately to avoid penalties and ensure proper tax reporting.

Banking

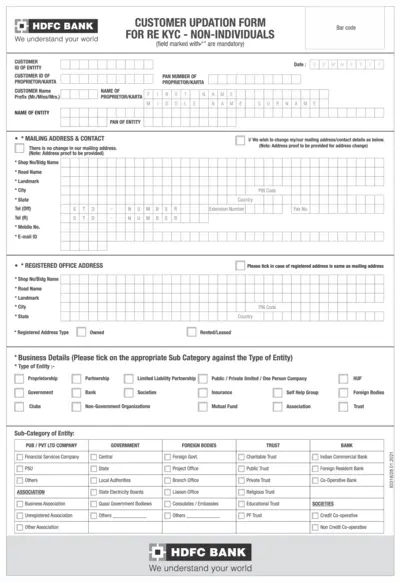

Customer Updation Form for Re KYC Non-Individuals

This file is the Customer Updation Form required for Re KYC for non-individual entities. It gathers essential details for identification and compliance. Fill it out to update your details with HDFC Bank.

Tax Forms

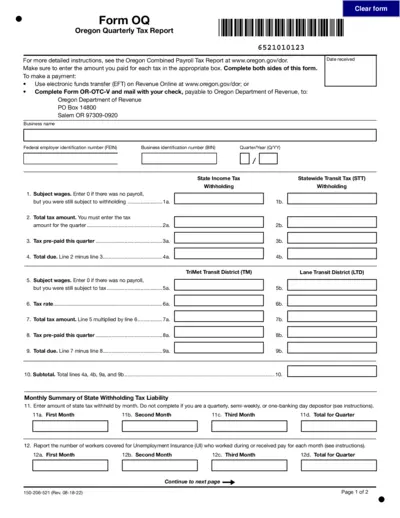

Oregon Quarterly Tax Report Form OQ Instructions

The Oregon Quarterly Tax Report Form OQ is essential for businesses to report and pay quarterly taxes. This form facilitates the correct calculation and remittance of state taxes, including income and employment taxes. Ensure compliance by accurately completing this form each quarter.

Banking

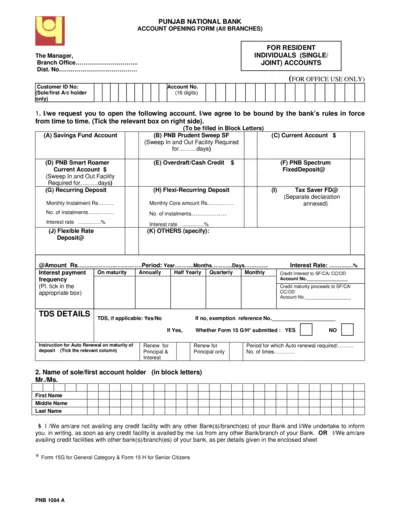

Punjab National Bank Account Opening Form

This form is required for opening an account at Punjab National Bank. It includes details for both individual and joint accounts. Make sure you fill out all relevant sections accurately.

Tax Forms

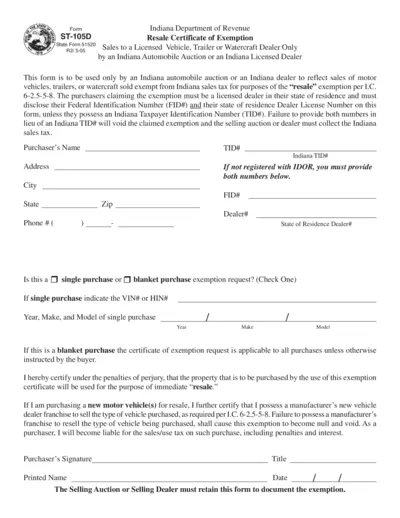

Indiana Resale Certificate Exemption Form ST-105D

The Indiana Resale Certificate of Exemption Form ST-105D is used by licensed dealers to exempt sales from Indiana sales tax. It serves as proof for automobile auctions and dealers making tax-exempt sales for resale purposes. Complete this form accurately to avoid taxes on eligible transactions.

Tax Forms

Form 8992 Instructions for U.S. Shareholder GILTI

Form 8992 provides instructions for U.S. shareholders regarding the calculation of Global Intangible Low-Taxed Income (GILTI). It is essential for compliance with tax laws set by the IRS. Understanding these instructions ensures accurate reporting and claims for deductions.

Tax Forms

Delaware Corporation Income Tax Return Form 1100

The Delaware Corporation Income Tax Return Form 1100 is essential for corporations operating in Delaware. This form needs to be filled out for accurate tax reporting. Ensure you adhere to the instructions for compliance and avoid penalties.