Finance Documents

Annual Reports

Telenor Annual Authority Request Disclosure Report

This document outlines Telenor's annual efforts to handle authority requests regarding customer data. It details the governance and policies in place to ensure privacy. Users can find comprehensive insights on how Telenor engages with authorities in various countries.

Tax Forms

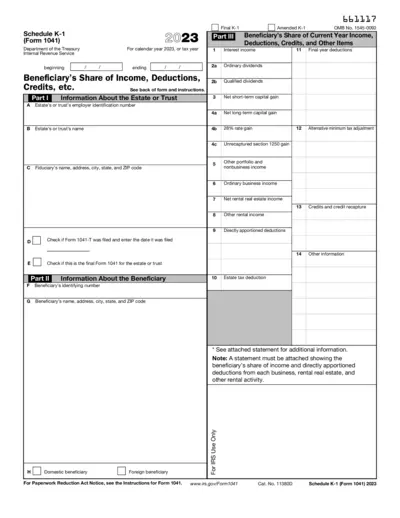

Schedule K-1 Form 1041 2023 Tax Return Instructions

This file provides essential details and instructions for beneficiaries of estates or trusts who receive Schedule K-1 (Form 1041). It outlines how to report income, deductions, and credits on tax returns. Users will find necessary information to accurately complete their tax forms.

Banking

Request for Change of Address Form - Punjab National Bank

This document is the Request for Change of Address Form for Punjab National Bank. It provides information on how cardholders can update their address details. Follow the included instructions for a seamless address change process.

Annual Reports

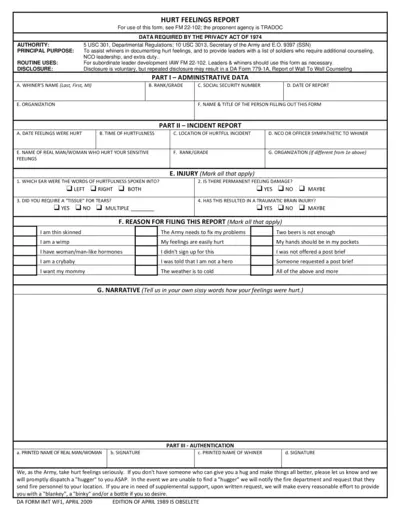

Hurt Feelings Report Form - Army Counseling

This form is designed to document hurt feelings experienced by soldiers. It serves as a tool for leaders to identify those needing counseling. Utilize this form to ensure proper emotional support is provided.

Tax Forms

Indiana Sales Tax Exemption Certificate ST-105

The Indiana Form ST-105 is a General Sales Tax Exemption Certificate utilized by state registered businesses. It enables exempt purchases to support legitimate commercial transactions in compliance with Indiana tax codes. Ensure all sections are completed to validate the exemption.

Banking

Undertaking cum Indemnity for Electronic Execution

This file serves as an undertaking and indemnity for the electronic execution of banking documents. It outlines the responsibilities and liabilities of the account holder when engaging in electronic banking with Meezan Bank. Users must adhere to the guidelines set forth in this document to ensure compliance and security.

Tax Forms

Application Form for Income Tax Convention Relief

This form allows recipients of royalties to claim relief from Japanese Income Tax and Special Income Tax for Reconstruction based on treaties. It's essential for foreign entities receiving payments from Japanese sources. Ensure to follow the detailed instructions while filling out this form to benefit from tax exemptions.

Banking

Wire Transfer Instructions for University Federal Credit Union

This document provides essential wire transfer instructions for members of University Federal Credit Union (UFCU). It includes information on how to properly complete and submit wire transfers to ensure funds are credited to your account. Follow the guidelines for a successful transfer process.

Tax Forms

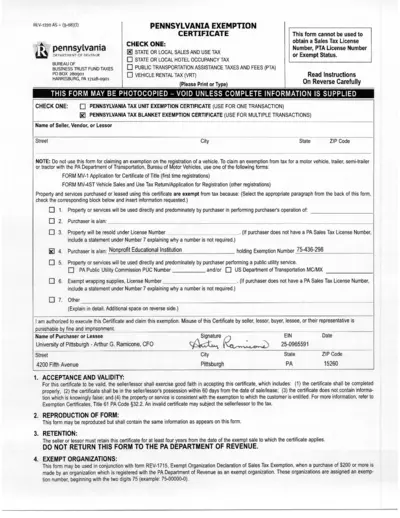

Pennsylvania Exemption Certificate Form REV-1220 AS

This Pennsylvania Exemption Certificate form is required for various tax exemption purposes. It enables purchasers to declare their exemptions for specific transactions. Ensure to follow the instructions carefully to avoid issues.

Tax Forms

Ohio IT-501 Employer's Payment of Withheld Tax

The Ohio IT-501 form is used by employers to report and pay withheld Ohio income taxes. Complete the form with accurate information to ensure compliance with Ohio tax regulations. It's essential for maintaining proper tax records for your business.

Tax Forms

2018 Form 1040 Social Security Benefits Worksheet

This file contains the instructions for filling out the 2018 Form 1040 regarding Social Security benefits. It details the process of determining the taxability of your benefits and provides guidelines for completing the relevant lines on the Form 1040. This worksheet simplifies the calculations needed for reporting your Social Security income.

Banking

Allied Bank Settlement Form for Dispute Resolution

This file contains a settlement form for Allied Bank customers to dispute transactions. Users can fill out this form to address issues related to unauthorized transactions or discrepancies. The form includes detailed sections for personal and transaction information.