Finance Documents

Tax Forms

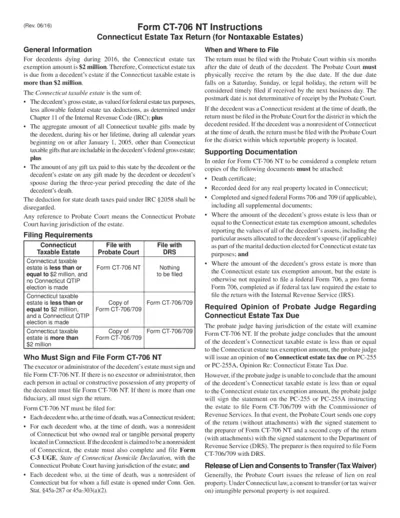

Connecticut Estate Tax Return Form CT-706 NT

This form provides comprehensive instructions for filing the Connecticut Estate Tax Return for nontaxable estates. It outlines requirements, filing processes, and documentation needed. Ideal for executors, administrators, and legal beneficiaries.

Tax Forms

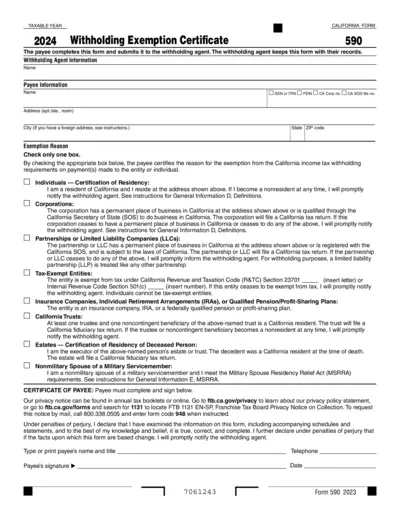

California Withholding Exemption Certificate Form 590

The California Withholding Exemption Certificate Form 590 is designed for individuals and entities to certify their exemption status from California income tax withholding. This form must be completed and submitted to the withholding agent to maintain compliance with state tax regulations. Understanding how to accurately fill out this form is crucial for residents and businesses operating in California.

Tax Forms

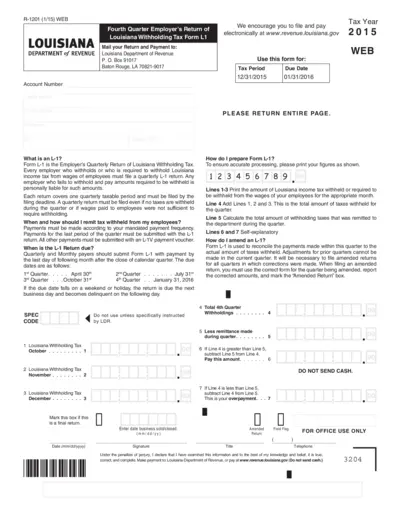

Louisiana Withholding Tax Form L1 Instructions

Form L-1 is the Employer's Quarterly Return for Louisiana Withholding Tax. Employers must file this return if withholding taxes are taken from employee wages. This document provides essential guidelines for accurate submission and payment.

Tax Forms

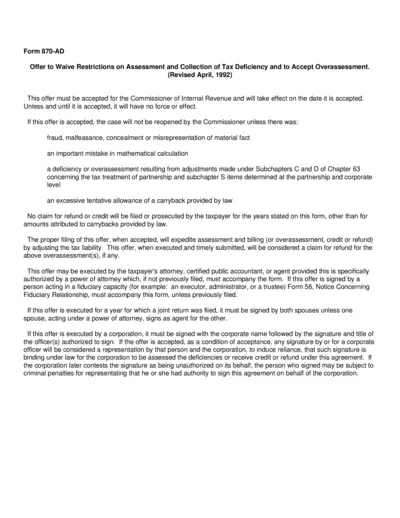

Form 870-AD Offer to Waive Tax Deficiency Restrictions

Form 870-AD is used to waive restrictions on the assessment and collection of tax deficiencies. This form must be accepted by the Commissioner of Internal Revenue to take effect. Proper submission expedites tax liability adjustment and claims for refunds.

Liability Insurance

Maker Shop Product Liability Disclaimer & Terms

This document outlines the product liability disclaimer and terms of use for Maker Shop Products. It provides essential details on warranties, return policies, and user responsibilities. Understanding these terms is vital for safe usage and compliance.

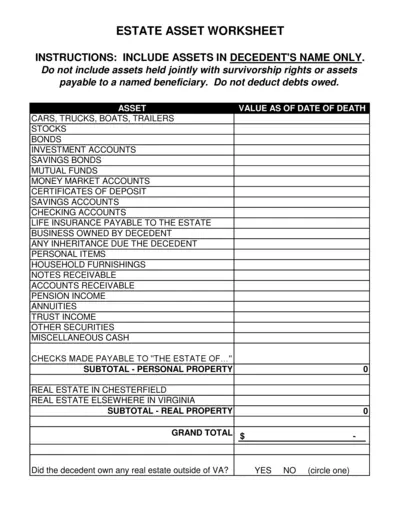

Estate Planning

Estate Asset Worksheet for Effective Decedent Management

This Estate Asset Worksheet is designed to help executors and administrators list all assets owned by a decedent. This document ensures a comprehensive assessment for estate settlement. Follow the guidelines carefully to ensure all relevant assets are included.

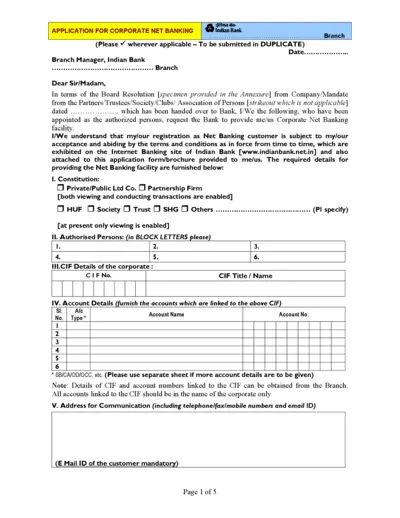

Banking

Corporate Net Banking Application Form - Indian Bank

This form is required for companies seeking Corporate Net Banking facilities provided by Indian Bank. It outlines the necessary information and authorization needs for corporate users. Proper completion of this application ensures prompt processing and access to bank services.

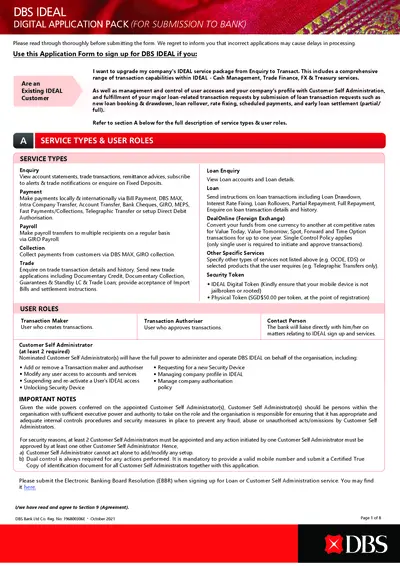

Banking

DBS IDEAL Digital Application Pack for Bank Submission

This file contains the DBS IDEAL Digital Application Pack, essential for businesses to sign up or upgrade their IDEAL services. It includes detailed instructions and service types available under the IDEAL platform. Users are advised to read the form thoroughly before submission to avoid delays.

Estate Planning

Estate Organizer Form Instructions and Guide

This Estate Organizer form is designed to help you compile essential information for your estate. Use it to communicate your wishes and arrangements clearly. Keep this document updated annually for the most accurate representation of your intentions.

Tax Forms

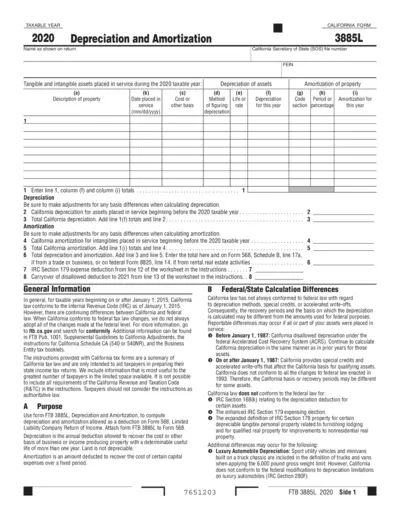

California Form 3885L Depreciation and Amortization

The California Form 3885L is used for reporting depreciation and amortization allowed as a deduction on Form 568 for the 2020 tax year. This form helps taxpayers accurately compute their depreciation for qualified property and ensure compliance with California tax laws. Utilize this guide to navigate the details of your assets and deductions effectively.

Cryptocurrency

Who Sells Cryptocurrency Insights and Trends

This file provides an empirical analysis of cryptocurrency sellers, detailing their demographics and activities. It serves as a resource for policymakers and researchers interested in understanding the current landscape of cryptocurrency regulation. Key findings highlight the evolving characteristics of cryptocurrency users over time.

Tax Forms

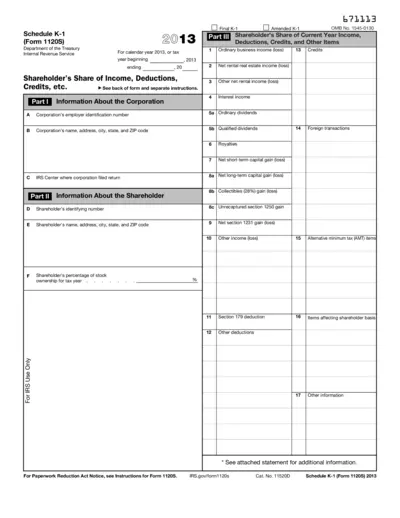

Schedule K-1 Form 1120S Instructions 2013

This file contains the Schedule K-1 (Form 1120S) for the year 2013 detailing shareholders' incomes, deductions, and credits. It provides essential information for tax reporting and filing for shareholders of S corporations. Users can refer to this document for guidance on filling out their tax returns accurately.