Personal Finance Documents

Tax Forms

Maine Employee Withholding Allowance Certificate W-4ME

Form W-4ME is used by employees in Maine to determine state income tax withholding. Proper completion ensures accurate tax deductions from your paycheck. It's essential for maintaining compliance with state tax laws and managing withholdings effectively.

Tax Forms

Form 8332 Release of Claim to Exemption

Form 8332 is used by custodial parents to release tax exemptions for their children to noncustodial parents. This form allows for the transfer of tax exemption rights for the current year and future years. It's essential for ensuring accurate tax filings and compliance with IRS regulations.

Savings Accounts

Huntington Consumer Deposit Account Agreement

This document outlines the terms and conditions of your Huntington Consumer Deposit Account. It includes important details about account usage, fees, and what to expect. Review this agreement to fully understand your rights and obligations.

Tax Forms

IRS Form 709 Gift Tax Return Instructions

Form 709 is the United States Gift and Generation-Skipping Transfer Tax Return. This form is used to report gifts made during the calendar year. Be sure to follow the IRS guidelines for accurate reporting.

Tax Forms

Instructions for Form 8283 Noncash Charitable Contributions

This file provides detailed instructions for filling out Form 8283, required for reporting noncash charitable contributions. It includes essential guidelines, who must file, and various sections to complete based on the donation amount. Use this comprehensive guide to navigate the requirements and ensure compliance with IRS regulations.

Tax Forms

G-7 Quarterly Tax Return Instructions for Georgia

This PDF file contains instructions for completing the G-7 Quarterly Tax Return required by the Georgia Department of Revenue. It outlines the filing process, important details about tax submissions, and necessary information needed for successfully filing the return. This form is essential for businesses and individuals complying with Georgia tax regulations.

Tax Forms

VITA/TCE Security Plan Form 15272 Instructions

This file provides the VITA/TCE Security Plan for volunteers. It details the responsibilities related to taxpayer information security. It also includes guidelines for compliance with IRS Publication 4299.

Retirement Plans

Paychex Employee Rollover Form Instructions

This document provides essential information for employees looking to rollover their retirement savings into a Paychex account. It includes step-by-step instructions on how to fill out the rollover form and submit it correctly. Ensure your financial future by following this guide carefully.

Tax Forms

One-Time Penalty Abatement Form - California

The FTB 2918 form allows individuals to request a one-time penalty abatement. This form helps taxpayers who have timely filed but incurred penalties. Complete the necessary information to submit your request for consideration.

Tax Forms

Instructions for Form 1042 IRS Annual Withholding Tax

This file contains comprehensive instructions for filling out Form 1042, which is the IRS Annual Withholding Tax Return for U.S. Source Income of Foreign Persons. It provides essential information for withholding agents to ensure compliance with U.S. tax regulations. Whether you are a foreign partner, trustee, or an intermediary, this form guides you through the necessary steps for tax withholding.

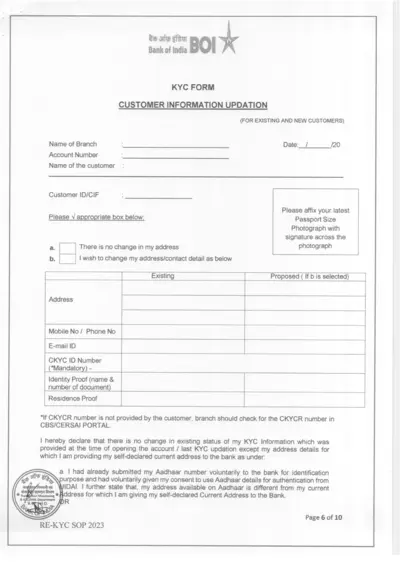

Banking

Bank of India KYC Form Customer Information Update

This file contains the Bank of India KYC form for customer information updation. It aims to assist both existing and new customers in providing updated details. Follow the provided instructions to complete the form accurately.

Loans

Union Bank of India Retail Loan Application

This file is a Common Retail Loan Application Form for Union Bank of India. It contains necessary details to apply for a retail loan. This form is essential for both salaried and self-employed individuals seeking financing.