Personal Finance Documents

Tax Forms

Form 8857 Instructions for Innocent Spouse Relief

This document provides detailed instructions for filling out Form 8857, Request for Innocent Spouse Relief. It covers important deadlines, eligibility criteria, and how to navigate the filing process. Understanding these instructions is essential for any taxpayer seeking to relieve themselves of joint tax liability.

Tax Forms

North Carolina Withholding Return Form NC-5 Instructions

This file contains detailed instructions for filling out the North Carolina Withholding Return Form NC-5. It guides employers on tax withholding requirements and penalties for non-compliance. Essential for businesses managing payroll in North Carolina.

Banking

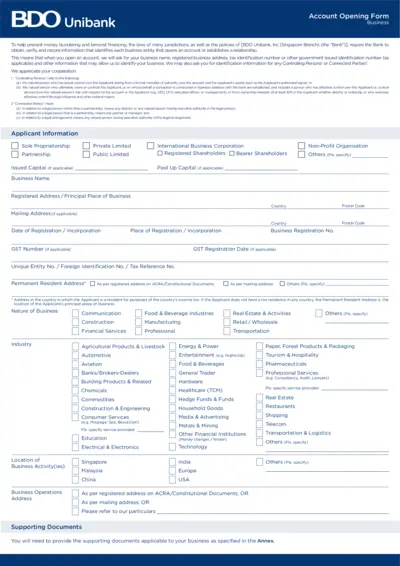

BDO Unibank Account Opening Form Business Guidelines

This document outlines the necessary steps to open a business account with BDO Unibank. It includes important information for business entities, such as required identification and supporting documents. Understanding these guidelines will help facilitate a smooth account opening process.

Banking

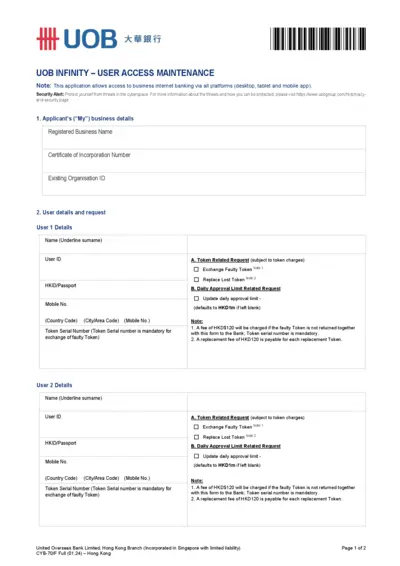

UOB INFINITY User Access Maintenance Form

This file contains the necessary application for accessing UOB's business internet banking effectively. It also provides important security alerts and instructions for user access maintenance. Ensure to fill in your business and user details accurately for a smooth process.

Banking

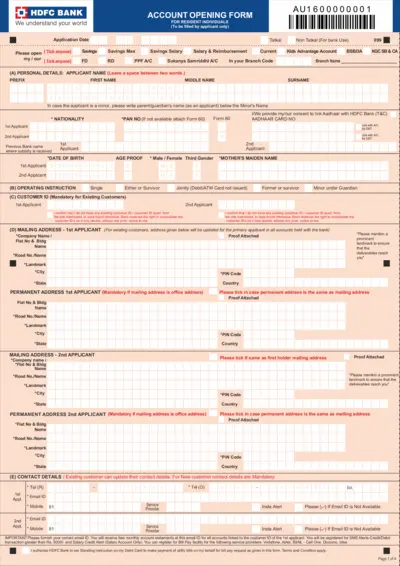

HDFC Bank Account Opening Form for Residents

This document is an account opening form for residents who wish to open an account with HDFC Bank. It provides all necessary details and instructions required to complete the application process smoothly. The form is essential for resident individuals looking to avail banking services.

Tax Forms

Missouri Form MO-1040A Tax Filing Instructions

This document provides comprehensive instructions for filing the Missouri Form MO-1040A. It includes details on electronic filing options, deadlines, and tax assistance resources. Ideal for residents filing their individual income tax returns.

Tax Forms

Georgia Department of Revenue G-1003 Instructions

This file provides important instructions for the G-1003 form required by the Georgia Department of Revenue. It outlines how to complete and submit the form accurately. Ensure you follow these guidelines to avoid penalties and ensure compliance.

Tax Forms

Tennessee Sales and Use Tax Return Instructions

This document provides detailed instructions for preparing and filing the Tennessee Sales and Use Tax Return. It outlines the necessary steps and guidelines to ensure compliance with state tax regulations. Useful for both individuals and businesses who need to submit their tax returns accurately.

Tax Forms

Wisconsin Sales and Use Tax Exemption Certificate

The Wisconsin Sales and Use Tax Exemption Certificate allows users to claim tax exemption in various situations. Designed for both individuals and organizations, it streamlines sales tax processes in Wisconsin. This document is essential for understanding your tax responsibilities regarding tangible personal property and services.

Tax Forms

Form 8825 Rental Real Estate Income and Expenses

Form 8825 is used to report rental real estate income and expenses. It is essential for partnerships and S corporations involved in rental activities. This form allows entities to track their rental income and deductible expenses efficiently.

Tax Forms

Kansas Fiduciary Income Tax Return Instructions

This document provides essential information and instructions for completing the Kansas Fiduciary Income Tax Return. It is designed for fiduciaries of resident and nonresident estates or trusts. Ensuring compliance with Kansas tax regulations is crucial for accurate filing and avoiding penalties.

Tax Forms

Form 1310 Claim Refund for Deceased Taxpayer

Form 1310 allows individuals to claim a refund on behalf of a deceased taxpayer. This form is essential for surviving spouses or personal representatives handling the tax affairs of the deceased. Ensure to follow the instructions carefully to facilitate a smooth refund process.