Personal Finance Documents

Tax Forms

Louisiana Department of Revenue Tax Forms Request

This file provides a comprehensive list of tax forms available from the Louisiana Department of Revenue. It includes instructions for requesting various forms and additional information on tax filing. Ideal for Louisiana residents and businesses needing accurate tax documents.

Tax Forms

North Carolina Sales Use Tax Return Form E-500

The North Carolina Sales and Use Tax Return Form E-500 is essential for businesses reporting sales tax. This form must be accurately filled out to comply with North Carolina tax regulations. It ensures businesses report gross receipts and pay any applicable taxes.

Tax Forms

Kentucky Single Member LLC LLET Return Form 725-EZ

The Kentucky Single Member LLC LLET Return Form 725-EZ is a tax return specifically designed for single-member limited liability companies. This form simplifies the tax filing process for LLCs owned by a single individual, ensuring compliance with Kentucky tax regulations. Properly completing this form allows business owners to fulfill their tax obligations efficiently.

Tax Forms

Schedule 2 Form 1040 2023 Additional Taxes Instructions

Schedule 2 of Form 1040 provides essential information related to additional taxes for individuals. This document guides users in reporting specific taxes, including alternative minimum tax and many others. It serves as an important attachment for accurate and complete tax returns.

Tax Forms

Understanding Form 1099-R for Rollovers & Disability

This document provides crucial information concerning Form 1099-R, specifically focusing on rollovers and disability benefits. It outlines the steps necessary to properly fill out the form, ensuring compliance with IRS regulations. Ideal for taxes and retirement planning, this guide is essential for taxpayers and financial professionals alike.

Tax Forms

Instructions for Form 8994 Employer Credit for Family Leave

Form 8994 provides employers with instructions for claiming the credit for paid family and medical leave. This document outlines eligibility criteria, procedures for calculating the credit, and key definitions. It serves to guide eligible employers through the requirements necessary to claim these credits accurately.

Banking

Standard Chartered NRI Application Form Instructions

This file provides detailed instructions for opening a Non Resident Indian Account with Standard Chartered Bank. Follow the step-by-step guidelines to complete your application smoothly. Ensure all necessary documents are attached to avoid delays in processing.

Banking

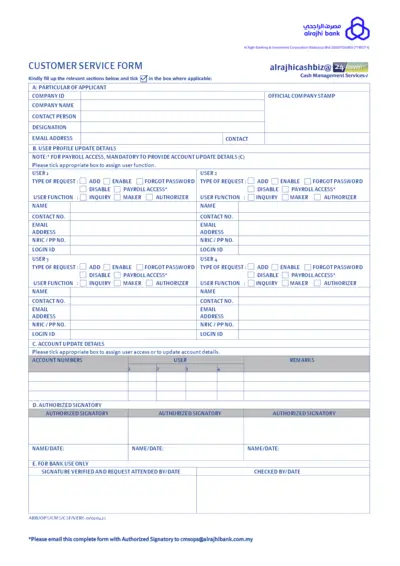

Al Rajhi Bank Customer Service Form Instructions

This document contains essential instructions for filling out the Al Rajhi Bank Customer Service Form. It provides all necessary details for users to complete the form accurately. Ensure you follow the guidelines for a smooth submission process.

Tax Forms

Nontaxable Transaction Certificates Overview and Usage

This document provides detailed descriptions of various types of Nontaxable Transaction Certificates (NTTCs) applicable for different purchases. It's a vital resource for manufacturers, service providers, and organizations needing clarity on NTTC execution. Understanding NTTCs ensures compliance and optimal use of available certificates.

Banking

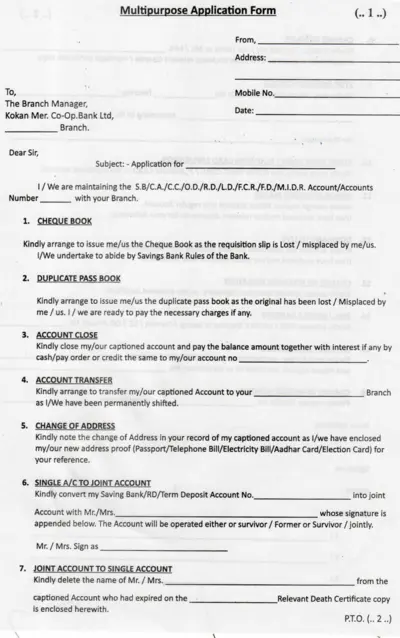

Multipurpose Application Form for Banking Services

This file provides a comprehensive multipurpose application form for use with banking services. Users can apply for cheque books, duplicate passbooks, account transfers, and more. Ideal for individuals needing banking documentation.

Loans

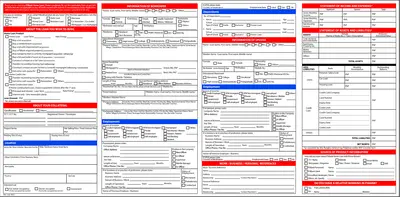

PSBank Home Loan Application Form Instructions

This file provides detailed instructions for completing the PSBank Home Loan application form. It includes necessary fields and mandatory information for borrowers and co-borrowers. Additionally, it outlines the purpose of the loan and application submission procedures.

Tax Forms

Income Tax Rules 1962 Form No 15H Declaration

Form No 15H is a declaration made under Income Tax Rules, 1962 for individuals aged 60 and above. It helps individuals claim certain incomes without tax deduction. This form is essential for proper tax handling and compliance.