Personal Finance Documents

Tax Forms

Illinois Amended Individual Income Tax Return Form

The Illinois Form IL-1040-X is used to amend your individual income tax return. It allows taxpayers to correct errors or make changes to their previously filed returns in Illinois. Complete the form accurately to ensure compliance with state tax regulations.

Banking

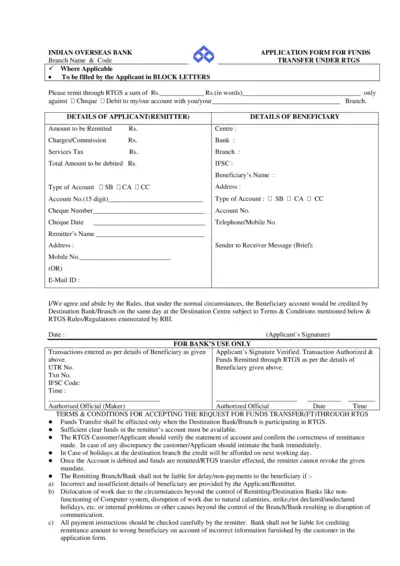

Indian Overseas Bank Funds Transfer Application Form

This application form is required for transferring funds through RTGS at Indian Overseas Bank. It collects details of the remitter and beneficiary for successful transactions. Complete the form accurately to ensure your funds are remitted without delay.

Tax Forms

How to Complete Form 3911 for Payment Tracing

This file provides detailed instructions on how to fill out Form 3911 to trace a missing 2021 Economic Impact Payment and Advanced Child Tax Credit Payment. It includes essential steps and contact information for the IRS. Follow these guidelines to ensure your form is filled out correctly.

Tax Forms

NC-4 Employee Withholding Allowance Certificate

The NC-4 form is essential for employees in North Carolina to adjust their state tax withholding. It allows employees to claim withholding allowances based on their financial situation. Completing this form accurately helps ensure the correct amount of state income tax is withheld from your pay.

Tax Forms

Instructions for Form 4136 - Credit for Federal Tax Paid on Fuels

This file contains the instructions needed to complete Form 4136 for claiming credits related to fuel taxes. Users will find details about specific credits available for biodiesel, renewable diesel, and certain nontaxable uses. It's an essential resource for anyone eligible for fuel tax credits.

Tax Forms

Credit for Prior Year Minimum Tax Corporations Form

Form 8827 is used by corporations to calculate the minimum tax credit from previous tax years. It assists in determining any carryforward of minimum tax credits for use in the current tax period. This form is essential for corporations needing to comply with Internal Revenue Service regulations regarding minimum tax liabilities.

Tax Forms

PA-8453 Pennsylvania Individual Income Tax Form

The PA-8453 form is necessary for Pennsylvania taxpayers who are electronically filing their Individual Income Tax returns. It serves as a declaration for electronic filing, ensuring accuracy in submitted tax information. Proper completion of this form is crucial for a successful tax filing process, enabling smooth processing of refunds or payments due.

Tax Forms

Massachusetts Sales and Use Tax Return ST-9 Instructions

This document provides instructions for filing the Massachusetts Sales and Use Tax Return, Form ST-9. It includes detailed guidelines for calculating gross sales, taxable sales, and total sales tax owed. Perfect for Massachusetts businesses engaging in sales or rentals of tangible personal property.

Tax Forms

Schedule A 2023 Form 1040-NR Itemized Deductions

Schedule A for Form 1040-NR provides details on itemized deductions for non-resident individuals. This essential tax form helps you declare qualifying deductions to reduce your taxable income. Follow the instructions carefully to ensure accurate reporting.

Banking

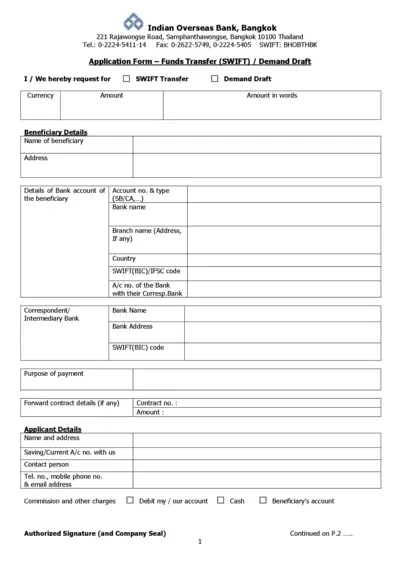

Indian Overseas Bank Funds Transfer Application

This application form is used to request funds transfer at Indian Overseas Bank in Bangkok. It includes sections for filling beneficiary and applicant details, as well as bank account information. Ensure all required fields are completed accurately to avoid delays.

Tax Forms

Oregon Individual Income Tax Payment Voucher Instructions

Form OR-40-V provides essential instructions for making payments to the Oregon Department of Revenue. This guide is ideal for those filing individual income tax in Oregon. Learn how to correctly fill out the payment voucher for timely processing.

Tax Forms

IRS Form 8615 Instructions for Tax on Children's Income

IRS Form 8615 is used to calculate the tax for certain children who have unearned income. This form is essential for parents filing tax returns for their children. Follow the detailed instructions to ensure accurate completion.