Personal Finance Documents

Tax Forms

Schedule C Form 8995-A for Business Income Loss

Schedule C (Form 8995-A) is used to report income or loss from your business. This form is essential for taxpayers claiming qualified business income deductions. Make sure to follow the instructions carefully to ensure accurate filing.

Tax Forms

South Carolina Employee Withholding Allowance Certificate

The SC W-4 form is a South Carolina withholding allowance certificate for employees. It helps determine how much state tax to withhold from employee paychecks. This form is essential for compliance with South Carolina tax regulations.

Banking

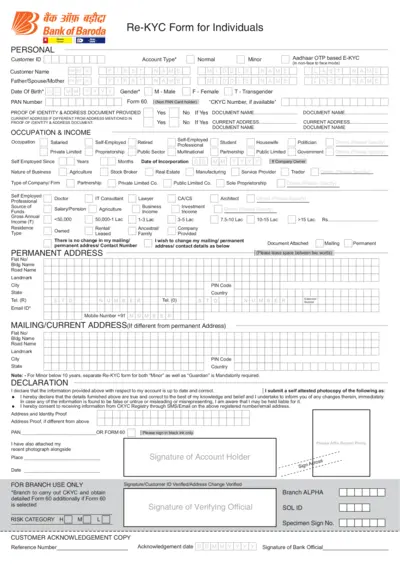

Bank of Baroda Re-KYC Form for Individuals

This Re-KYC Form is essential for individuals banking with Bank of Baroda. It gathers necessary details to ensure compliance with banking regulations. Use this form to update your personal information easily.

Tax Forms

IL-2210 Computation of Penalties for Individuals

The IL-2210 form is used to calculate penalties for individuals in Illinois related to underpayment of estimated taxes. It provides detailed instructions on how to complete the form correctly. It is essential for anyone who needs to report their penalties accurately and avoid additional charges.

Banking

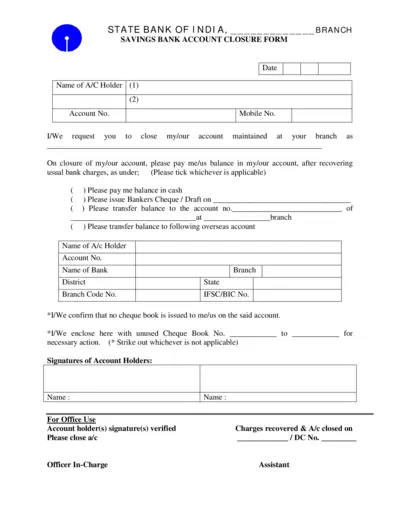

State Bank of India Savings Account Closure Form

The State Bank of India Savings Account Closure Form allows account holders to close their accounts conveniently. This form ensures that the balance is settled as per the customer's preference. Follow the instructions carefully to ensure a smooth closure process.

Tax Forms

Payment Voucher Form FTB 3588 Instructions for LLCs

This document provides the instructions for completing Form FTB 3588, which is required for LLCs to pay estimated fees. Ensure compliance with the legal requirements and pay timely to avoid penalties. Follow the outlined steps for accurate completion to secure your financial obligations.

Banking

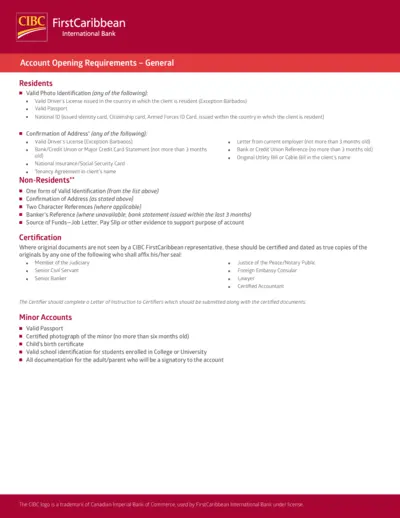

CIBC FirstCaribbean Account Opening Requirements

This file outlines the account opening requirements for CIBC FirstCaribbean. It includes necessary documents for both residents and non-residents. Ensure you meet the criteria before submitting your application.

Tax Forms

Instructions for Forms 8804, 8805, and 8813

This file provides detailed instructions for Forms 8804, 8805, and 8813, including updates and reminders about filing. It is essential for partnerships dealing with effectively connected income and foreign partners. Review this document for compliance and correct submission practices.

Tax Forms

Summary of W-2 Statements for New York State

This file contains the Summary of W-2 Statements for New York State, crucial for tax returns. It provides guidance on filing IT-2 and relevant employer information. Utilize this document to accurately report earnings and withholdings.

Tax Forms

Connecticut Sales and Use Tax Resale Certificate

This file contains the Sales and Use Tax Resale Certificate for the state of Connecticut. It is essential for businesses involved in wholesale, retail, or manufacturing. Proper completion of this certificate ensures tax-exempt purchases for resale or lease.

Loans

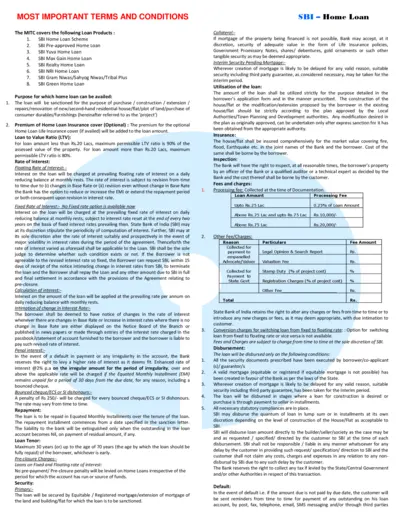

State Bank of India Home Loan Terms and Conditions

This document outlines the terms and conditions of various home loan products offered by the State Bank of India (SBI). It includes details on loan amounts, interest rates, and repayment options. Ideal for potential borrowers seeking comprehensive information on SBI's home loan offerings.

Banking

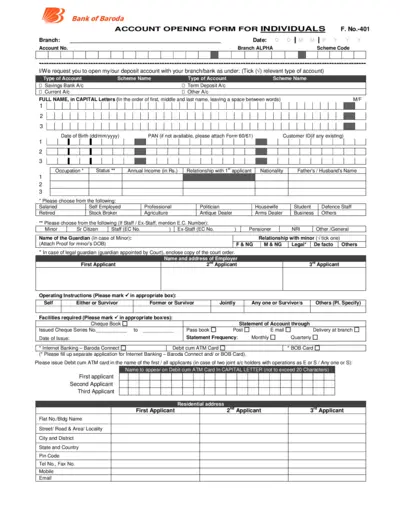

Bank of Baroda Account Opening Form Instructions

This document provides a detailed account opening form for individuals at the Bank of Baroda. It includes all necessary fields and instructions required for filling out the form. Ensure all sections are completed correctly to facilitate smooth processing of your application.