Personal Finance Documents

Tax Forms

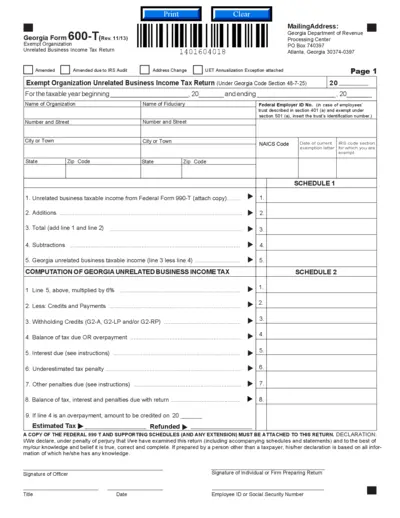

Georgia Form 600-T Exempt Org UBIT Tax Return

The Georgia Form 600-T is an Exempt Organization Unrelated Business Income Tax Return. This form is necessary for exempt organizations with unrelated business income in Georgia. It is essential for compliance with state tax laws.

Tax Forms

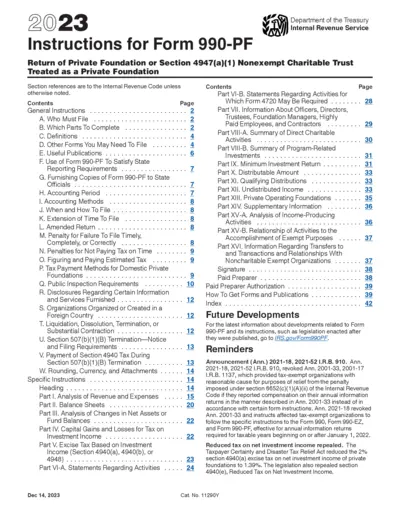

Instructions for Form 990-PF for 2023

This document provides detailed instructions and guidelines for completing Form 990-PF, which is used by private foundations. It includes essential information about filing requirements, tax calculations, and important deadlines. It's an invaluable resource for organizations looking to comply with their tax obligations efficiently.

Tax Forms

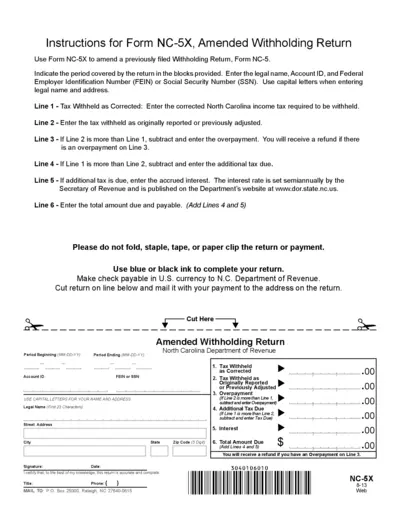

Form NC-5X Amended Withholding Return Instructions

This file provides detailed instructions for completing the NC-5X Amended Withholding Return. It includes necessary guidelines for entering data accurately. Use this guide to ensure proper submission of your amended return.

Banking

Foreign Telegraphic Transfer Application Form

This application form is used for requesting a foreign telegraphic transfer through the State Bank of India. It includes instructions for filling out the necessary information to ensure a smooth transfer process. Users can submit the form to initiate fund transfers to beneficiaries overseas.

Banking

Cash Withdrawal Slip Instructions and Details

This cash withdrawal slip is essential for withdrawing funds from your account at CRÉDIT AGRICOLE. It provides clear guidance for filling out the slip correctly to ensure a smooth transaction. Utilize this resource to facilitate your banking needs efficiently.

Tax Forms

Instructions for Form 8594 Asset Acquisition Statement

This file provides essential instructions for Form 8594, which is necessary for reporting asset acquisitions under Section 1060. It outlines the general requirements, exceptions, and filing guidelines for both sellers and purchasers involved in a trade business asset transfer. Understanding these instructions is crucial for compliant tax reporting and avoiding potential penalties.

Retirement Plans

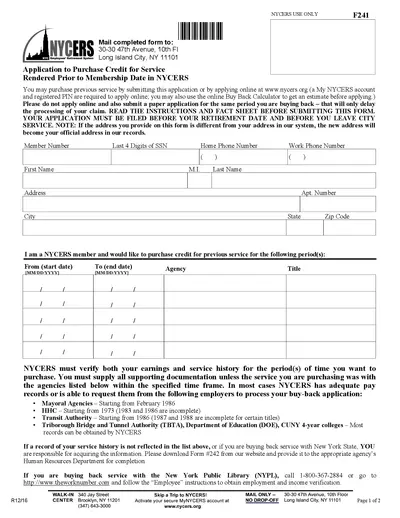

NYCERS Application for Purchase of Service Credit

This file contains the application form for NYCERS members wishing to purchase service credit for time worked before their membership. It outlines the eligibility criteria, required documentation, and submission instructions. Users can apply through a secure online portal or by mail for their convenience.

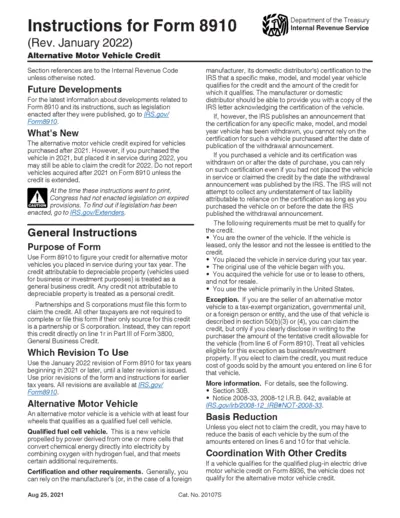

Tax Forms

Form 8910 Instructions for Alternative Motor Vehicle Credit

This file provides detailed instructions for Form 8910 related to the Alternative Motor Vehicle Credit. Users can learn about eligibility, submission, and guidelines. It is essential for tax year 2022 and beyond for certain vehicle owners.

Banking

TD Bank ACH Electronic Funds Transfer Authorization

The TD Bank ACH/Electronic Funds Transfer Authorization Form allows vendors to authorize direct deposits to their bank accounts. This document is essential for ensuring timely and accurate payments. Complete the form accurately to facilitate smooth transactions.

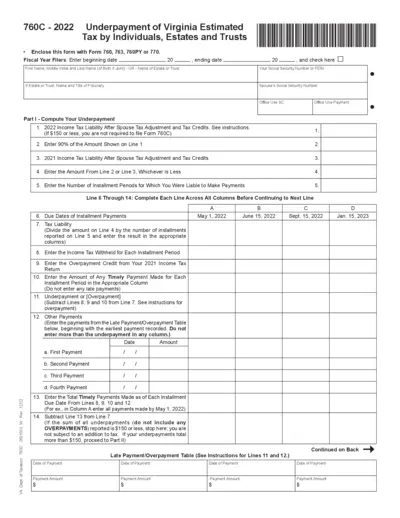

Tax Forms

Virginia Estimated Tax Underpayment Form 760C

The Virginia Estimated Tax Underpayment Form 760C is essential for individuals, estates, and trusts that have underpaid their estimated taxes. This form helps in determining the underpayment and calculates any potential additions to tax. It provides detailed instructions for accurate filling.

Tax Forms

Instructions for Form 1042 - IRS Annual Withholding Tax

Form 1042 is essential for reporting taxes withheld on income earned by foreign persons in the U.S. It provides vital instructions for U.S. withholding agents and intermediaries. This form ensures compliance with IRS regulations regarding U.S. source income.

Tax Forms

Form 8898 Bona Fide Residence Statement IRS

Form 8898 is the IRS statement for individuals declaring their bona fide residence in a U.S. possession. It is crucial for tax residents to notify the IRS of their status. Proper completion ensures compliance and avoids issues with taxation.