Personal Finance Documents

Tax Forms

Kansas Withholding Form K-4 Instructions and Info

The Kansas Withholding Form K-4 is essential for employees in Kansas to accurately report their withholding allowances. Ensure compliance with state tax laws by completing this form as soon as employment begins. This guide provides all necessary details for filling out the form and understanding its implications.

Tax Forms

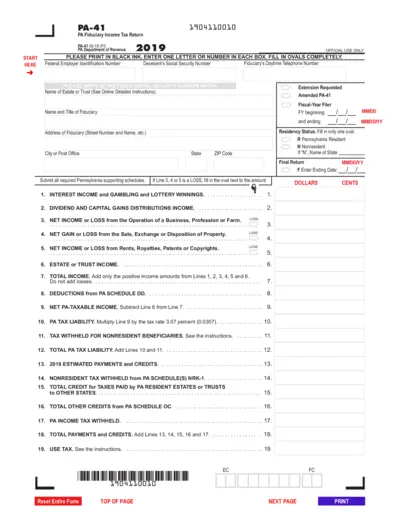

PA Fiduciary Income Tax Return Instructions 2019

The PA-41 Fiduciary Income Tax Return is used to report the income and expenses of an estate or trust in Pennsylvania. It helps in determining the tax liability based on the income earned by the estate or trust. Proper filling of this form ensures compliance with Pennsylvania tax laws.

Credit Cards

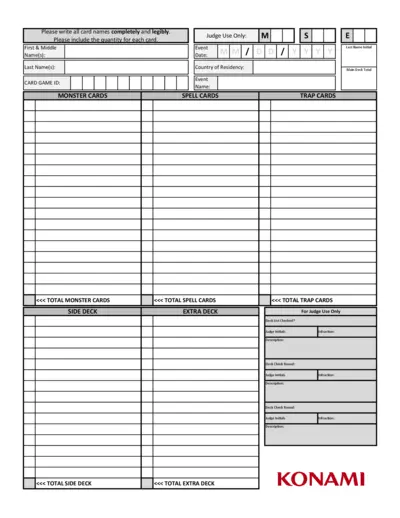

Complete Guide to Filling Out Deck Check Form

This file provides a comprehensive guide on how to accurately fill out the Deck Check Form. It includes detailed instructions, tips, and best practices for successful completion. Ideal for event participants and judges alike.

Tax Forms

Form 8883 Instructions Asset Allocation Statement

This document provides detailed instructions on how to fill out Form 8883, Asset Allocation Statement Under Section 338. It outlines filing requirements, the purpose of the form, and essential details required for submission. Ideal for corporations involved in acquisitions and stock purchases.

Banking

BMO Electronic Business Deposit Slip Instructions

This file provides instructions for filling out the BMO electronic Business Account Deposit Slip. It is essential for managing deposits made via branches and ABM. Follow the step-by-step guide to ensure accurate submissions.

Tax Forms

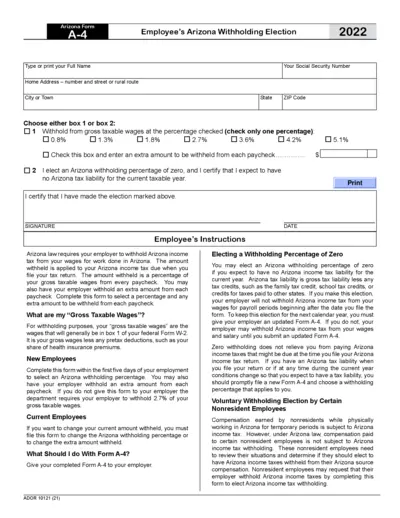

Arizona Form A-4 Employee Withholding Election 2022

The Arizona Form A-4 is essential for employees in Arizona to declare their state income tax withholding preferences. This form allows for selecting a withholding percentage or opting for zero withholding if no tax liability is expected. Completing this form accurately ensures proper tax deductions from wages.

Tax Forms

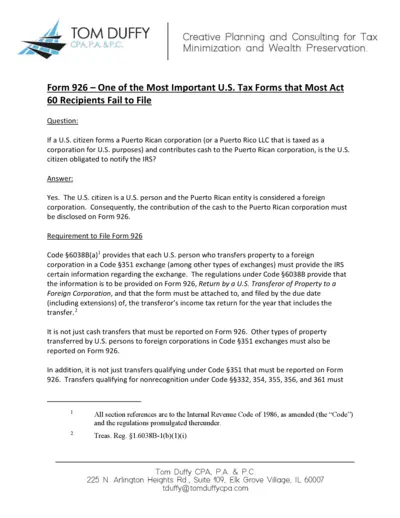

Form 926 Instructions for US Citizens and Corporations

This file contains crucial instructions for filing Form 926 for U.S. citizens forming Puerto Rican corporations. It outlines who needs to file, how to complete the form, and the consequences of non-compliance. Essential for understanding tax obligations related to foreign corporations.

Tax Forms

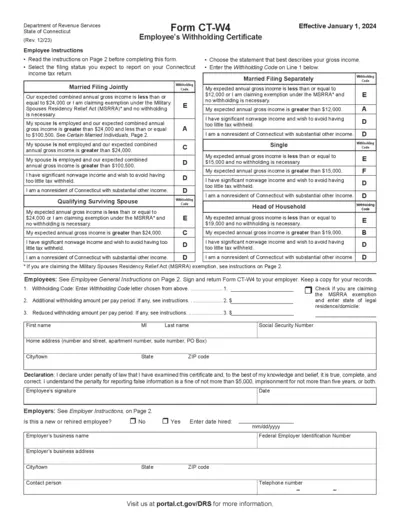

Connecticut Employee's Withholding Certificate (CT-W4)

The Connecticut Employee's Withholding Certificate (CT-W4) is essential for employees to accurately report their income tax withholding. It ensures the correct amount of state income tax is withheld from wages based on filing status and projected income. Accurate completion helps avoid underwithholding or overwithholding of taxes.

Tax Forms

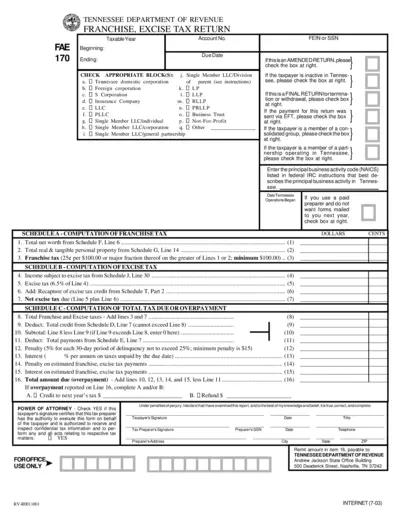

Tennessee Franchise Excise Tax Return Instructions

This file outlines the details for the Tennessee Franchise and Excise Tax Return. It includes guidelines on how to fill out the return along with necessary schedules. This document serves as a crucial resource for individuals and businesses required to file taxes in Tennessee.

Tax Forms

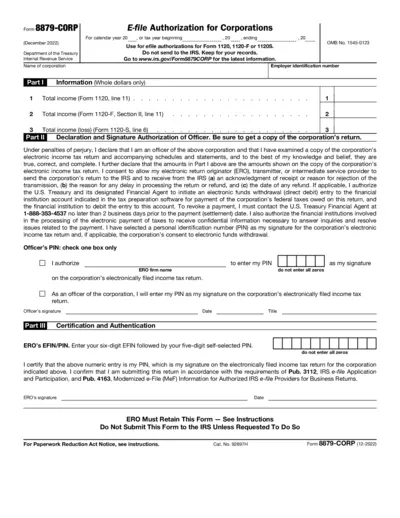

Form 8879-CORP E-file Authorization for Corporations

Form 8879-CORP is essential for corporate officers who want to electronically sign the corporation’s income tax return. It enables the use of a personal identification number (PIN) for e-file authorization. This form must be retained for record-keeping and is not submitted to the IRS.

Loans

Kimisitu Sacco Loan Application Form

This file contains the Kimisitu Sacco loan application and agreement form. It includes necessary instructions, requirements, and personal information fields. Ideal for prospective borrowers looking to apply for a loan.

Banking

Bank Customer Verification Letter Template

This file is a template for creating a bank customer verification letter. It outlines the essential details necessary for formal verification. Users can customize this document to confirm their customer relationship with the bank.