Personal Finance Documents

Tax Forms

Texas Agricultural Sales and Use Tax Exemption

This form is used by agricultural producers in Texas to claim a sales and use tax exemption when purchasing qualifying items. It details the necessary information required for proper completion and submission. Ensure accuracy to avoid complications in tax exemptions.

Tax Forms

Form 1125-A Cost of Goods Sold Instructions

Form 1125-A is used to calculate and report cost of goods sold for tax purposes. It is essential for businesses to accurately report their expenses related to inventory. Users must ensure they follow the IRS guidelines for compliance.

Tax Forms

Instructions for Form 1065 U.S. Return of Partnership Income

This document provides detailed instructions for filing Form 1065, which reports the income, gains, losses, deductions, and credits of a partnership. It includes essential guidelines for partnerships to fulfill their tax obligations. Understanding this form is crucial for accurate tax reporting.

Tax Forms

Partner's Instructions for Schedule K-1 Form 1065

This file provides detailed guidance on how partners can correctly fill out Schedule K-1 (Form 1065). It includes instructions on reporting income, deductions, and credits from partnerships. Understanding these instructions is essential for accurate tax reporting.

Tax Forms

IRS Form 4562 Instructions for Depreciation and Amortization

This document provides detailed instructions on how to fill out IRS Form 4562 for claiming depreciation and amortization. It includes information on eligibility, filing guidelines, and definitions of key terms. Perfect for taxpayers and businesses seeking to understand their tax obligations related to depreciation.

Tax Forms

California Earned Income Tax Credit Form 3514

This document outlines the California Earned Income Tax Credit for the year 2021. It includes eligibility requirements and instructions for completing the form. Be sure to provide necessary personal information to effectively claim your credits.

Investment Accounts

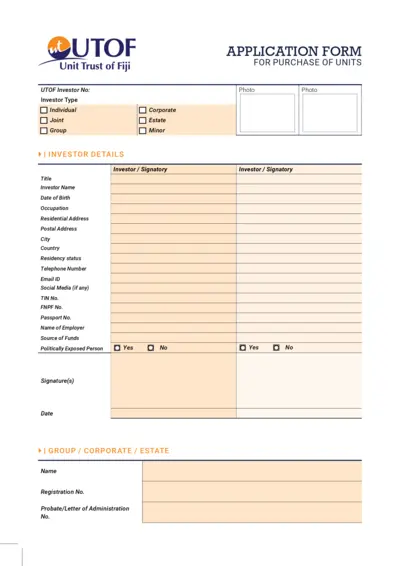

UTOFC Application Form for Unit Purchase

The UTOF Application Form enables individuals and groups to apply for the purchase of units in various investment plans. This form requires personal details, investment preferences, and compliance with regulatory requirements. Properly filling out this form is essential for successful unit acquisition in the Unit Trust of Fiji.

Banking

CIMB Bank Remittance Application Form Instructions

This document provides users with the necessary details to fill out the CIMB Bank Remittance Application Form. It includes information on how to complete the form accurately and provides guidance for different types of users. Essential for anyone looking to transfer funds through CIMB Islamic Bank or CIMB Bank.

Tax Forms

Schedule G Form 1120 Instructions for Corporations

This file details the instructions for Schedule G of Form 1120, which is necessary for corporations regarding stock ownership. It outlines the requirements for reporting entities and individuals with significant ownership. The form is essential for compliance with IRS regulations.

Banking

UOB Personal Internet Banking Information Update Form

This document is the UOB Personal Internet Banking Information Update Form. It allows users to update their details and manage their online banking access. Complete the form carefully to ensure accurate processing of your requests.

Banking

KCC Bank Account Opening Form Instructions

This document contains instructions and details for filling out the KCC Bank account opening form. It's essential for both individuals and businesses looking to open a savings account with KCC Bank. Follow the guidelines carefully to ensure a smooth application process.

Tax Forms

Massachusetts S Corporation Return Form 355S Instructions

This document provides essential instructions for completing the Massachusetts S Corporation Return Form 355S. It includes filing requirements, important dates, and contact information for assistance. Perfect for business owners navigating their tax obligations.