Cross-Border Taxation Documents

Cross-Border Taxation

Completing Form 42 - HMRC Guide and FAQs

This document provides essential guidance on completing Form 42 for reportable events about Securities and Options. Designed for employees and employers, it clarifies important rules and procedures. Follow the outlined steps to ensure accurate submissions.

Cross-Border Taxation

Hawaii Withholding Tax Return Form HW-14

The HW-14 form is the official Hawaii withholding tax return. It is required to report wages and tax withheld. Ensure timely submission to avoid penalties.

Cross-Border Taxation

Philadelphia Late Filing Abatement Instructions

This file provides guidance on filing a nunc pro tunc petition for late real estate tax abatement in Philadelphia. It outlines key steps, necessary forms, and important deadlines for applicants. Understanding these instructions is essential for taxpayers who wish to navigate the filing process effectively.

Cross-Border Taxation

Instructions for Form 2553 Election by Small Business Corp

This file contains the official instructions for completing and filing Form 2553. It provides important details for corporations wishing to elect S corporation status. Ensure compliance with IRS requirements by referring to this comprehensive guide.

Cross-Border Taxation

PA-41 Payment Voucher Instructions for 2022 Tax

The PA-41 Payment Voucher is a crucial document for fiduciaries to remit tax payments. This form is intended for estates or trusts needing to make fiduciary income tax payments. Ensure you follow the instructions carefully to complete the form accurately.

Cross-Border Taxation

Form 9423 Collection Appeal Request IRS Document

Form 9423 is the IRS Collection Appeal Request form used by taxpayers to appeal collection actions. It provides guidance on how to fill it out and details the appeal process. This form is crucial for anyone disputing IRS collection actions such as levies or liens.

Cross-Border Taxation

Application for Registration BIR Form 1902

This document is the Application for Registration for individuals earning purely compensation income in the Philippines. It is essential for local and alien employees to obtain their Tax Identification Number (TIN) from the Bureau of Internal Revenue. Filling out this form correctly ensures compliance with taxation laws.

Cross-Border Taxation

IA 1040X Amended Iowa Individual Income Tax Return

The IA 1040X is a form used to amend your Iowa Individual Income Tax Return. It allows taxpayers to correct mistakes or report changes in their income. Completing this form ensures that your tax records are accurate and up-to-date.

Cross-Border Taxation

Maximize Deductions: Understanding NOL Examples

This file provides a comprehensive guide to understanding Net Operating Loss (NOL) examples. It includes specific scenarios and calculations to help taxpayers optimize their deductions. Designed for both consumers and tax professionals, this resource is invaluable for effective tax planning.

Cross-Border Taxation

Digital C-Form User Manual for Madhya Pradesh

This user manual provides detailed instructions on applying for the Digital C-Form via the MPCTD web portal. It guides users through the necessary steps to validate their digital signature and manage related forms. Essential for registered dealers in Madhya Pradesh.

Cross-Border Taxation

Application for Tax Directive Gratuities IRP3(a)

The Application for a Tax Directive (IRP3(a)) is essential for taxpayers who are seeking tax directives for gratuities. It provides instructions for filling out the form correctly and details the necessary information required for processing. This document is vital for ensuring compliance with South African tax regulations.

Cross-Border Taxation

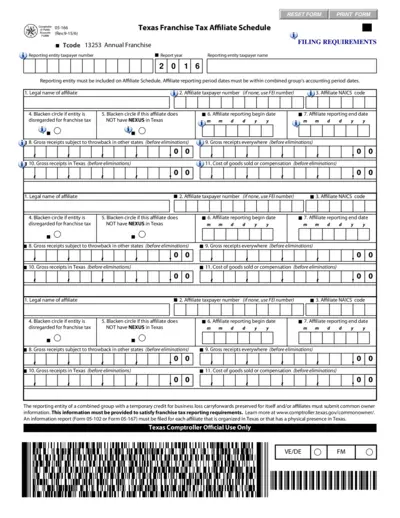

Texas Franchise Tax Affiliate Schedule Form 05-166

The Texas Franchise Tax Affiliate Schedule Form 05-166 is a crucial document for businesses involved in franchise taxation in Texas. It provides detailed instructions and requirements for affiliate reporting, helping companies stay compliant with state regulations. Utilize this form to accurately report affiliate information and ensure proper franchise tax handling.