Income Tax Documents

Income Tax

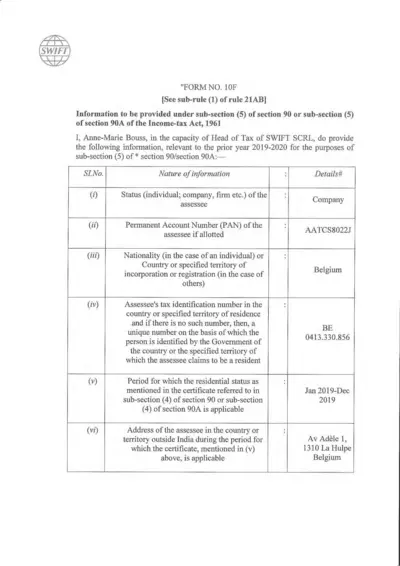

Form 10F: Information under Section 90/90A of Income-tax Act

Form 10F is used to provide information under sub-section (5) of section 90 or 90A of the Income-tax Act, 1961. It is relevant for the prior year 2019-2020 for SWIFT SCRL in Belgium. This form includes details about the assessee's status, account numbers, residency period, and address.

Tax Returns

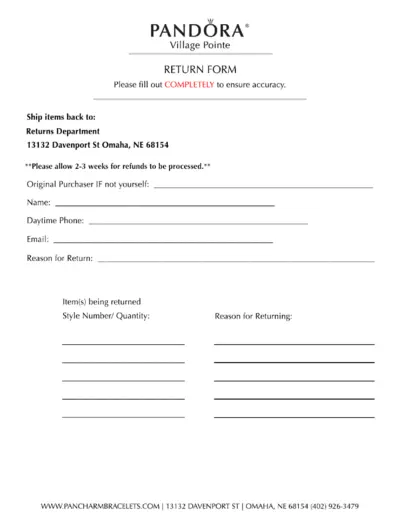

PANDORA Village Pointe Return Form Instructions

This file provides the return form for PANDORA Village Pointe. It includes sections to fill out the original purchaser information, return reason, and item details. Ensure all fields are completed accurately before sending.

Income Verification

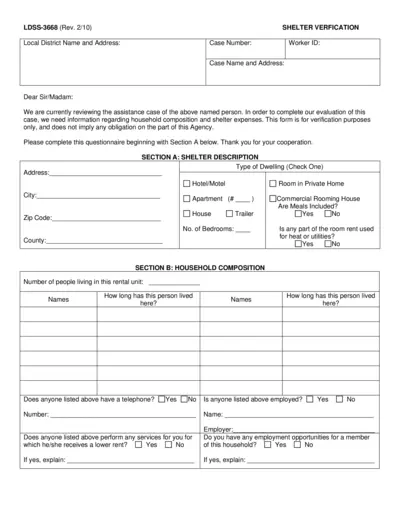

Shelter Verification Form for Assistance Evaluation

This form is used to verify household composition and shelter expenses for assistance evaluation purposes. It includes sections for shelter description, household composition, and shelter expenses. Complete the questionnaire for accurate verification.

Tax Returns

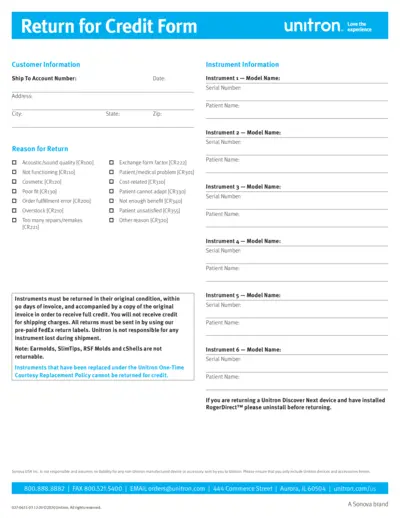

Return for Credit Form - Unitron Product Returns

The Return for Credit Form is used for customers to return Unitron products. It captures customer information, reason for return, and details about the instruments being returned. Follow the instructions to ensure your return is processed smoothly.

Tax Returns

American Airlines Lands' End Returns Procedure

This file provides instructions on how to make returns and exchanges for American Airlines uniforms via Lands' End. It includes detailed steps for completing the return form, packaging the items, and shipping them back. Additionally, it covers return policies and contact information for customer support.

Income Verification

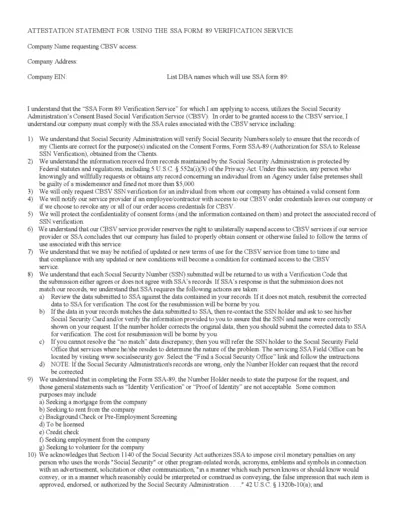

Attestation Statement for SSA Form 89 Verification

This file contains the attestation statement for using the SSA Form 89 Verification Service. It includes the rules and requirements for accessing the CBSV service. Additionally, it outlines the responsibilities for safeguarding Personal Identifiable Information (PII).

Tax Refunds

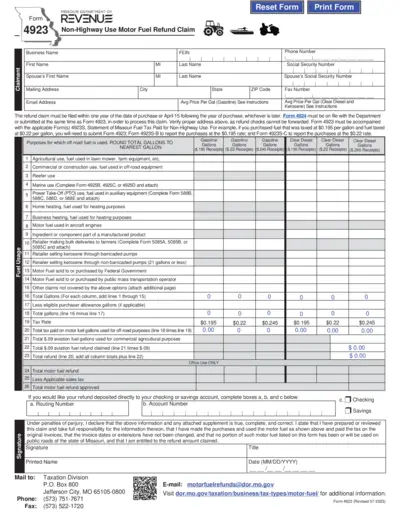

Missouri Non-Highway Use Motor Fuel Refund Form

This form is used by Missouri residents to claim a refund on motor fuel taxes paid for fuel used for exempt non-highway purposes. It must be filed within one year of the date of purchase or April 15 following the year of purchase. Various categories of fuel use and documentation requirements are outlined in the form.

Income Verification

Landlord Verification Form Instructions and Details

The Landlord Verification Form is used to verify your residency and rent/utility expenses. It provides proof of residency for various benefits. Completing this form may help you receive more benefits.

Tax Returns

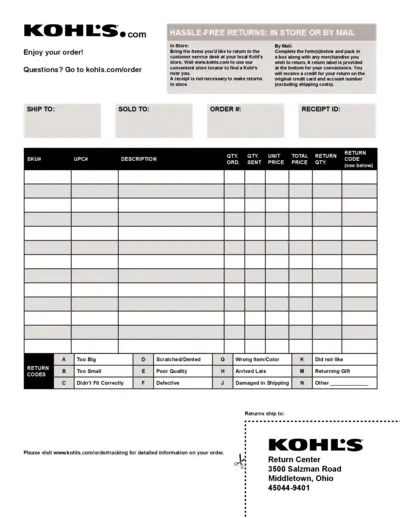

Kohl's Return Instructions and Order Details

This file contains instructions on how to return items to Kohl's, both in-store and by mail. It includes return codes, shipping information, and directions on how to receive a refund. Ensure you follow the steps accurately to process your return.

State Tax Forms

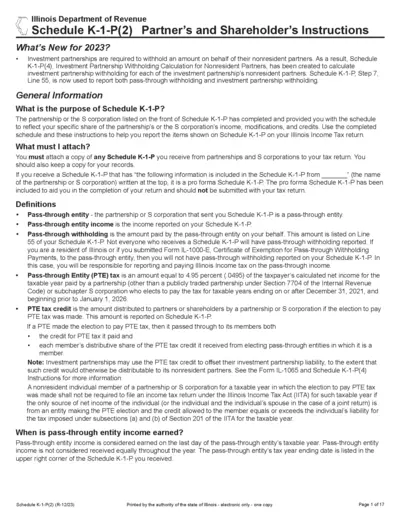

Illinois Schedule K-1-P Instructions for 2023

This document provides comprehensive instructions for Schedule K-1-P, which reflects your share of income, modifications, and credits from partnerships or S corporations. It includes essential information for both residents and non-residents of Illinois. Use this guide to ensure accurate completion of your Illinois income tax return.

Tax Returns

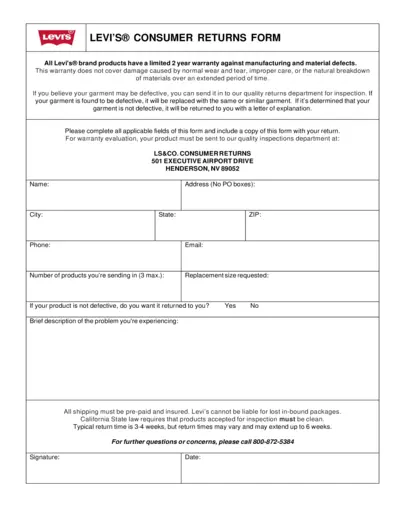

Levi's Consumer Returns Form Instructions

This file contains important information about Levi's consumer returns process. It details the warranty policy and provides a returns form for products. Users can find instructions on how to complete and submit the form.

Tax Returns

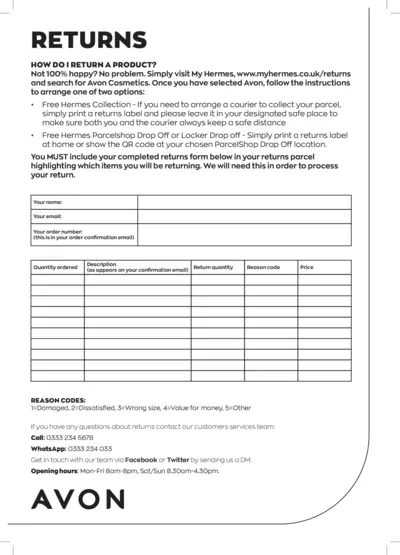

Return Instructions for Avon Cosmetics Products

This file provides comprehensive instructions on how to return Avon Cosmetics products. It includes details about filling out the returns form and the various return options available. Utilize this guide to ensure a smooth return process.