Edit, Download, and Sign the Return for Credit Form - Unitron Product Returns

Form

eSign

Add Annotation

Share Form

How do I fill this out?

To fill out this form, you need to provide your customer information, select the reason for return, and list the details of the instruments being returned. Ensure that all required fields are completed accurately. Follow the instructions provided to avoid any issues with your return.

How to fill out the Return for Credit Form - Unitron Product Returns?

1

Begin by filling out your customer information including your Ship To Account Number, Date, Address, City, State, and Zip.

2

Select the reason for the return from the provided options.

3

List the model name, serial number, and patient name for each instrument being returned.

4

Ensure the instruments are in their original condition and include a copy of the original invoice.

5

Use the pre-paid FedEx return labels to send the instruments back to Unitron.

Who needs the Return for Credit Form - Unitron Product Returns?

1

Customers returning Unitron products due to acoustic/sound quality issues.

2

Customers returning products that are not functioning properly.

3

Customers returning products due to cosmetic reasons.

4

Customers returning products due to poor fit.

5

Customers returning products due to order fulfillment errors.

How PrintFriendly Works

At PrintFriendly.com, you can edit, sign, share, and download the Return for Credit Form - Unitron Product Returns along with hundreds of thousands of other documents. Our platform helps you seamlessly edit PDFs and other documents online. You can edit our large library of pre-existing files and upload your own documents. Managing PDFs has never been easier.

Edit your Return for Credit Form - Unitron Product Returns online.

With PrintFriendly, you can easily edit this PDF by opening it in our PDF editor. Make the necessary changes to the form directly within the editor. Save and download the edited version once you're done.

Add your legally-binding signature.

PrintFriendly allows you to sign the PDF directly within our platform. Open the file in our PDF editor and use the signature tool to add your signature. Save the signed PDF and download it for your records.

Share your form instantly.

You can easily share this PDF using PrintFriendly. Open the file in our PDF editor and make any necessary edits. Use the share options to send the file via email or other sharing methods.

How do I edit the Return for Credit Form - Unitron Product Returns online?

With PrintFriendly, you can easily edit this PDF by opening it in our PDF editor. Make the necessary changes to the form directly within the editor. Save and download the edited version once you're done.

1

Open the PDF file in the PrintFriendly PDF editor.

2

Fill in the required fields directly on the form.

3

Make any necessary changes or updates to the information.

4

Save your changes once you're done.

5

Download the edited version of the PDF.

What are the instructions for submitting this form?

Submit the completed form with the instruments in their original condition and a copy of the original invoice. Use the provided pre-paid FedEx return labels to send the return package to Unitron at 444 Commerce Street, Aurora, IL 60504, USA. You can also fax the form to 800.521.5400 or email it to orders@unitron.com. Ensure all fields are accurately filled to avoid processing delays.

What are the important dates for this form in 2024 and 2025?

Ensure that your return form is submitted within 90 days of the invoice date to receive full credit. This applies to all returns processed in 2024 and 2025.

What is the purpose of this form?

The purpose of the Return for Credit Form is to streamline the process of returning Unitron products for credit. By providing all necessary information such as customer details, reason for return, and instrument information, the form ensures that returns are processed efficiently. Following the provided instructions and using the correct return labels will help you avoid any potential issues with your return.

Tell me about this form and its components and fields line-by-line.

- 1. Customer Information: Includes fields for Ship To Account Number, Date, Address, City, State, and Zip.

- 2. Reason for Return: Options such as Acoustic/sound quality, Not functioning, Cosmetic, etc.

- 3. Instrument Information: Fields for Model Name, Serial Number, and Patient Name for each instrument.

What happens if I fail to submit this form?

If you fail to submit the form, your return may not be processed correctly and you may not receive full credit.

- Delayed Processing: The return process may be delayed if the form is not submitted on time.

- Loss of Credit: You may not receive full credit if the form is not submitted within 90 days.

How do I know when to use this form?

- 1. Product Malfunction: Return products that are not functioning properly.

- 2. Cosmetic Issues: Return products with cosmetic defects.

- 3. Order Fulfillment Error: Return products received in error.

- 4. Patient/Medical Problem: Return products due to patient or medical problems.

- 5. Overstock Return: Return products due to overstock issues.

Frequently Asked Questions

How do I fill out the Return for Credit Form?

Provide your customer information, select the reason for return, and list the details of the instruments being returned.

Can I edit the form on PrintFriendly?

Yes, you can edit the form using our PDF editor.

How do I sign the form on PrintFriendly?

Use the signature tool in our PDF editor to add your signature.

Can I share the edited form?

Yes, you can share the edited form using various sharing methods available on PrintFriendly.

What happens if I don't return the form within 90 days?

You may not receive full credit for the return if the form is not submitted within 90 days.

Are there any items that cannot be returned?

Yes, Earmolds, SlimTips, RSF Molds, and cShells are not returnable.

What should I do if I lose the original invoice?

Contact Unitron customer service for assistance with your return.

Can I return non-Unitron devices using this form?

No, ensure that only Unitron devices and accessories are included in the return.

What shipping method should I use for the return?

Use the pre-paid FedEx return labels provided by Unitron.

Who do I contact for further assistance?

You can contact Unitron customer service at 800.888.8882 or email orders@unitron.com.

Related Documents - Return for Credit Form

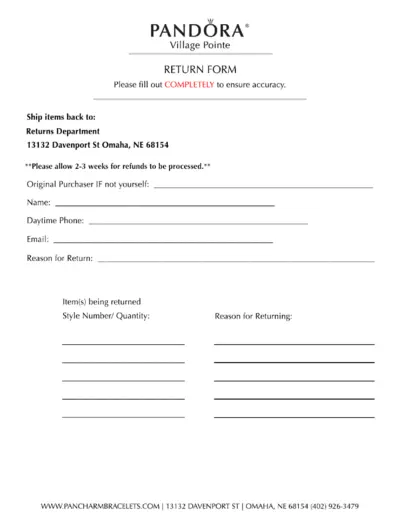

PANDORA Village Pointe Return Form Instructions

This file provides the return form for PANDORA Village Pointe. It includes sections to fill out the original purchaser information, return reason, and item details. Ensure all fields are completed accurately before sending.

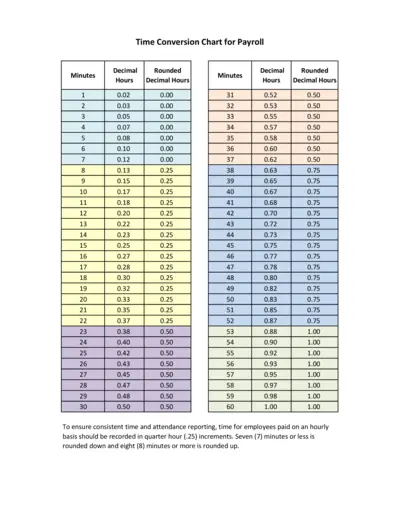

Time Conversion Chart for Payroll

This file provides a time conversion chart for payroll, converting minutes into decimal hours. It aids in accurate and consistent time reporting. Ideal for employees paid on an hourly basis.

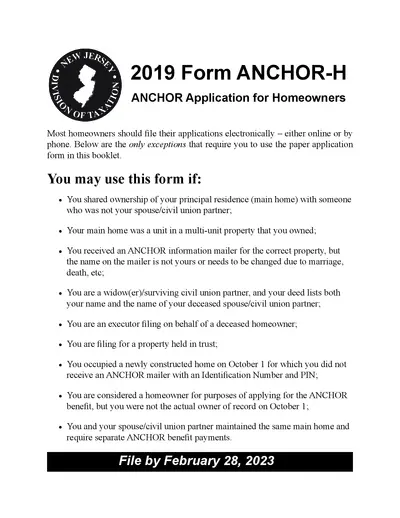

2019 ANCHOR Application for Homeowners - New Jersey

The 2019 ANCHOR Application for Homeowners provides eligibility details and instructions for applying for the New Jersey ANCHOR benefit. Learn how to file, eligibility requirements, and submission guidelines. This document ensures proper benefit distribution for eligible homeowners.

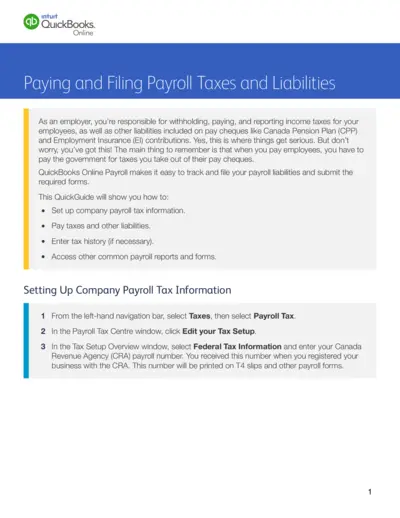

QuickBooks Online Payroll Taxes and Liabilities Guide

This file provides comprehensive instructions on how to set up, pay, and file payroll taxes and liabilities using QuickBooks Online. Employers can track and report income taxes, CPP, and EI contributions. The guide also covers entering tax history and accessing various payroll forms and reports.

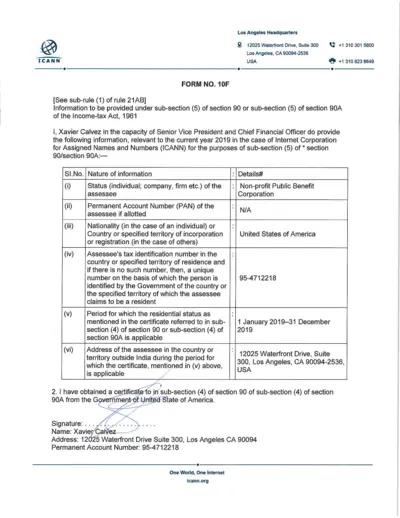

ICANN Income Tax Form 2019 for Tax Compliance

This file contains the information required under sub-section (5) of section 90 or 90A of the Income-tax Act, 1961 for ICANN. It includes details about tax identification, residential status, and a verification declaration for the year 2019. The information is provided by Xavier Calvez, the Senior Vice President and Chief Financial Officer at ICANN.

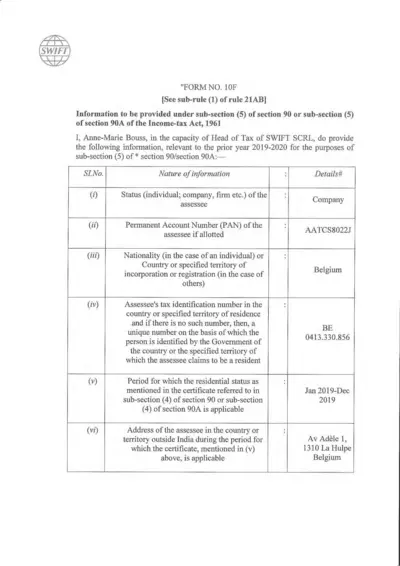

Form 10F: Information under Section 90/90A of Income-tax Act

Form 10F is used to provide information under sub-section (5) of section 90 or 90A of the Income-tax Act, 1961. It is relevant for the prior year 2019-2020 for SWIFT SCRL in Belgium. This form includes details about the assessee's status, account numbers, residency period, and address.

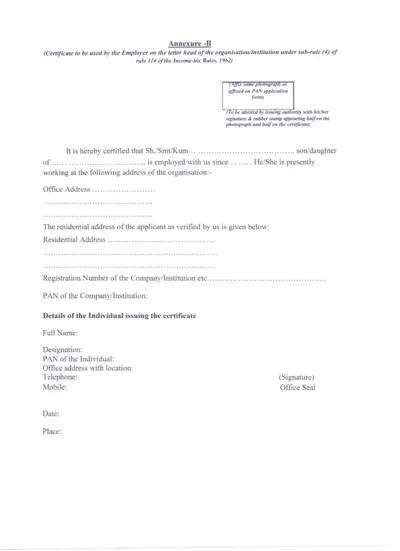

Employer Certificate for PAN Application - Income-tax Rules

This certificate is used by the employer to certify the employment status of an individual for PAN application under Income-tax Rules, 1962. It includes organization details, employee verification, and needs to be attested.

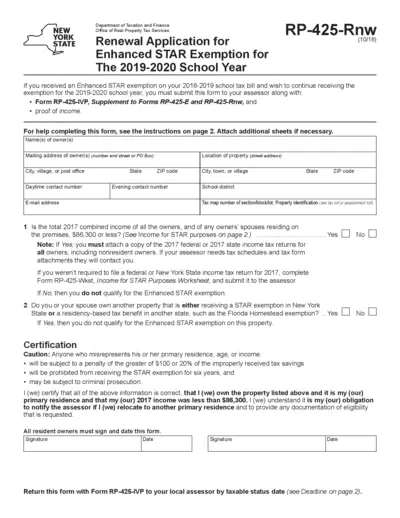

Renewal Application for Enhanced STAR Exemption 2019-2020

The form is used to reapply for the Enhanced STAR exemption on school taxes for the 2019-2020 school year. It requires income proof and the completion of Form RP-425-IVP. Submission is necessary to the local assessor by the taxable status date.

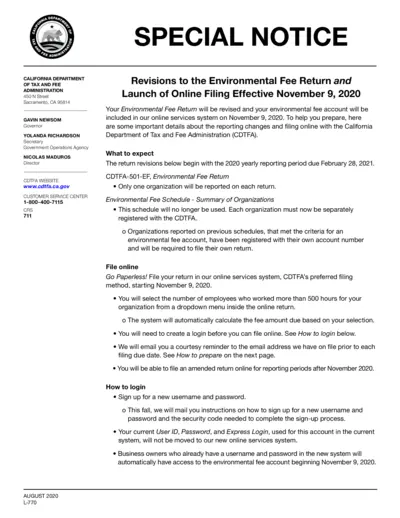

Revisions to Environmental Fee Return & Online Filing

This file details the revisions to the environmental fee return and the launch of online filing effective November 9, 2020. It includes important information on what to expect, how to login, and how to prepare for filing. The instructions provided are essential for organizations required to file the Environmental Fee Return.

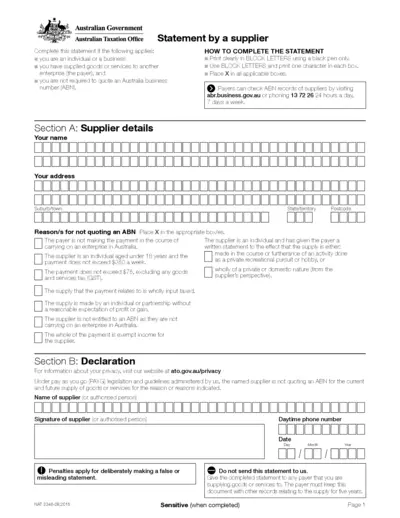

Statement by a Supplier - Australian Taxation Office Form

This form is used by individuals or businesses supplying goods or services without quoting an Australian Business Number (ABN). It helps in providing reasons for not quoting an ABN. The payer must keep this completed form for their records for five years.

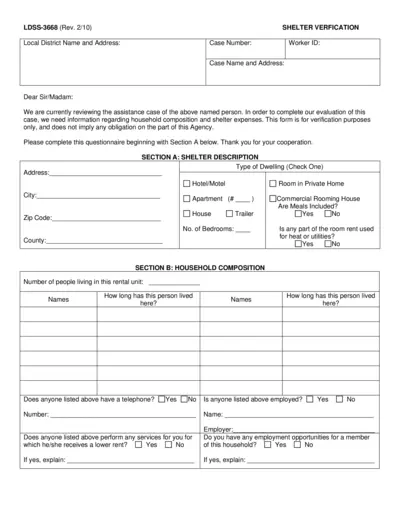

Shelter Verification Form for Assistance Evaluation

This form is used to verify household composition and shelter expenses for assistance evaluation purposes. It includes sections for shelter description, household composition, and shelter expenses. Complete the questionnaire for accurate verification.

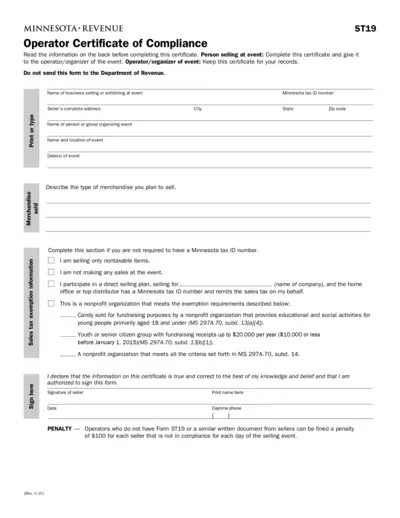

Minnesota ST19 Operator Certificate of Compliance

The Minnesota ST19 Operator Certificate of Compliance is required by law for sellers and event operators to certify compliance with sales tax regulations. The form must be completed by the seller and provided to the operator of the event. Penalties apply for non-compliance.