Business Tax Documents

Payroll Tax

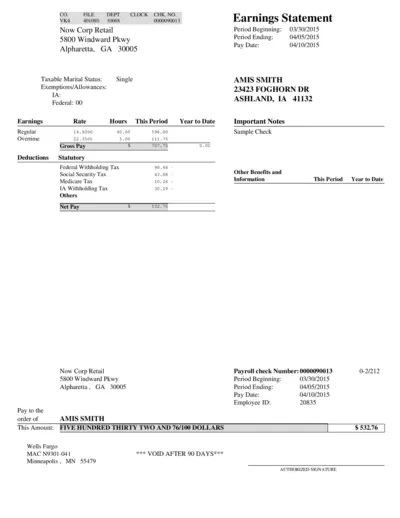

Earnings Statement and Pay Information for Employees

This document is an Earnings Statement that details the pay information for employees. It provides a summary of earnings, deductions, and net pay. Use it to understand your compensation and tax withholdings for the reporting period.

Payroll Tax

Time Sheet Import and RUN Powered by ADP Instructions

This file provides comprehensive guidance on importing time sheets using ADP's payroll application. Users will find detailed instructions on setting up their time sheet import file. It's essential for businesses looking to streamline their payroll processes with ADP.

Payroll Tax

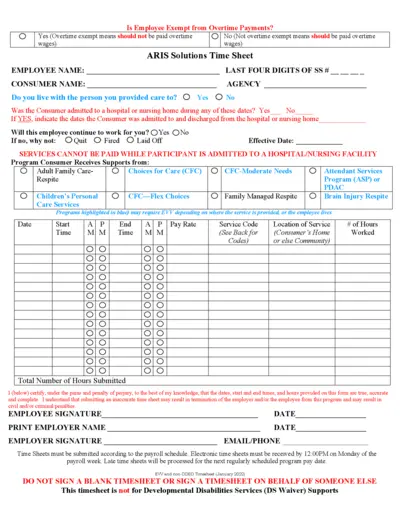

Employee Overtime Payment Exemption Form Guide

This file contains essential information about employee exemptions from overtime payments, including important instructions for filling out the associated time sheets. It's crucial for both employers and employees to understand their rights and responsibilities regarding overtime compensation. This guide also provides a step-by-step approach to ensure accurate submission of time sheets.

Payroll Tax

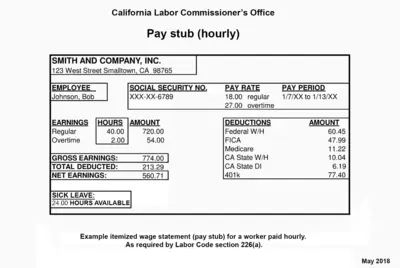

California Labor Commission Pay Stub Example

This file provides a sample pay stub for hourly employees. It outlines important earnings and deductions. Use it to understand your wage statements better.

Sales Tax

Sales Orders and Cash Sales Guide for NetSuite

This document provides comprehensive instructions and guidelines for managing sales orders and cash sales in NetSuite. Users will find step-by-step directions on entry, approval, and billing procedures. Ideal for finance and operations personnel seeking to streamline sales transactions.

Sales Tax

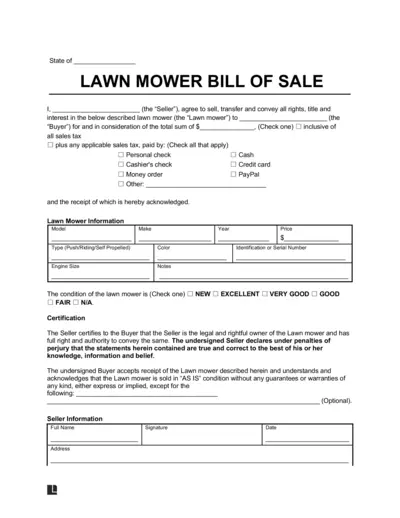

Lawn Mower Bill of Sale Document

The Lawn Mower Bill of Sale is a legal document used for the sale and transfer of ownership of a lawn mower. This form ensures that all pertinent information, including the condition and specifications of the mower, is clearly documented for both buyer and seller. It is crucial for maintaining a record of the transaction and protecting both parties' rights.

Payroll Tax

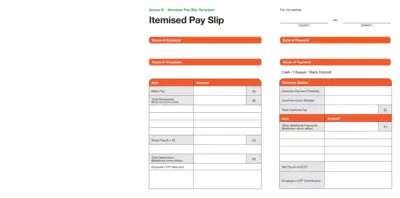

Itemised Pay Slip Template for Employers and Staff

This document provides a detailed itemised pay slip template for employers and employees. It helps to outline salaries, deductions, and overtime pay clearly. Perfect for businesses looking to maintain transparency in payroll processes.

Payroll Tax

PrideStaff Employee Timesheet and Client Agreement

This document contains the PrideStaff Employee Timesheet and Client Agreement instructions. It is essential for employees to report their work hours accurately. Proper completion is required for payroll processing and compliance.

Payroll Tax

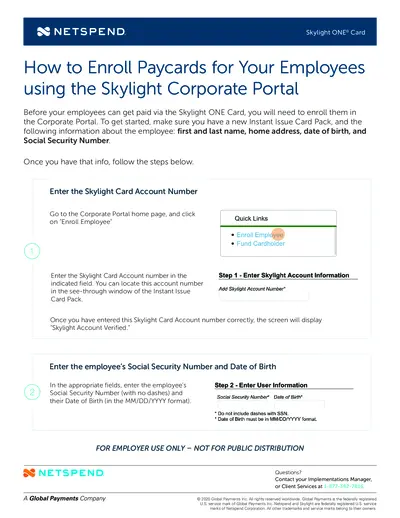

NETSPEND Skylight ONE Card Enrollment Instructions

This file provides detailed instructions on how to enroll employees for the Skylight ONE Card using the Corporate Portal. It includes necessary information for enrollment, step-by-step guidance, and contact details for support. Perfect for employers looking to streamline payment processes for their employees.

Payroll Tax

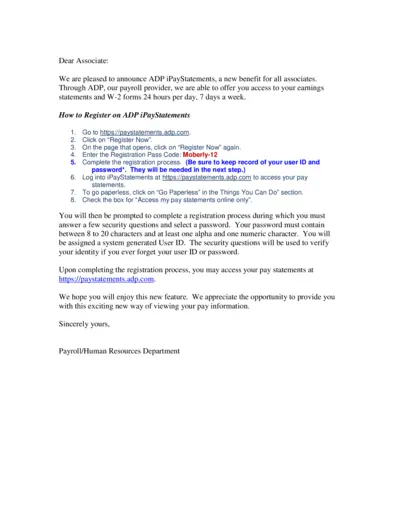

Access Your Pay Statements Anytime with ADP iPayStatements

The ADP iPayStatements provides associates with 24/7 access to earnings statements and W-2 forms. This guide outlines the registration process and beneficial features. Streamline your payroll experience with easy online access to your pay information.

Payroll Tax

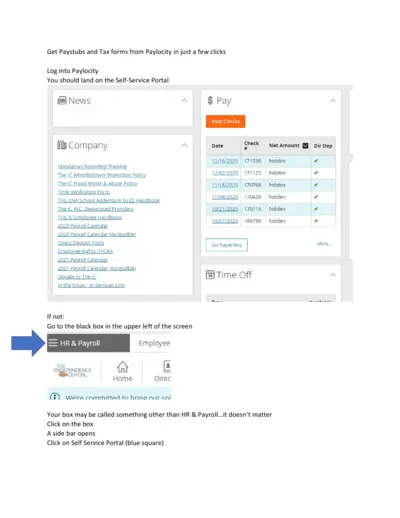

Retrieve Paystubs and Tax Forms from Paylocity Easily

This file provides a comprehensive guide on accessing paystubs and tax forms through Paylocity. Users can quickly navigate the Self-Service Portal and download necessary documents with simple instructions. Ideal for employees looking to manage their payroll information efficiently.

Tax Credits

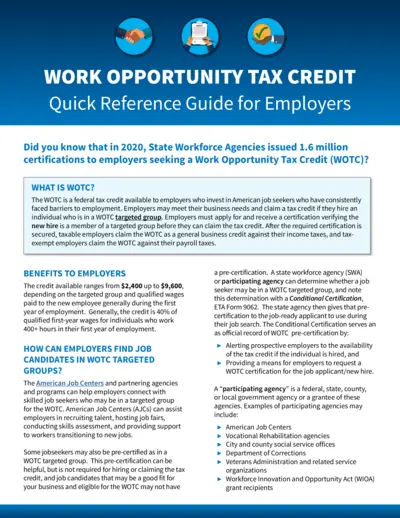

Work Opportunity Tax Credit Quick Reference Guide

This guide provides essential information about the Work Opportunity Tax Credit (WOTC) available to employers. It outlines the benefits, application process, and resources for finding eligible job candidates. Enhance your hiring practices and learn how to maximize your tax credits with WOTC.