Payroll Tax Documents

Payroll Tax

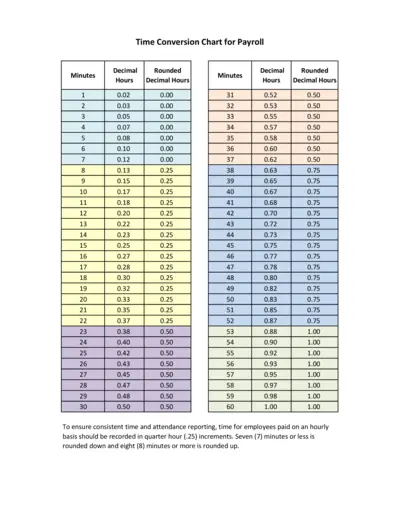

Time Conversion Chart for Payroll

This file provides a time conversion chart for payroll, converting minutes into decimal hours. It aids in accurate and consistent time reporting. Ideal for employees paid on an hourly basis.

Payroll Tax

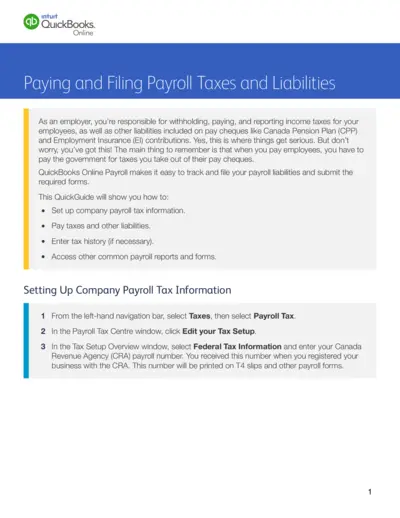

QuickBooks Online Payroll Taxes and Liabilities Guide

This file provides comprehensive instructions on how to set up, pay, and file payroll taxes and liabilities using QuickBooks Online. Employers can track and report income taxes, CPP, and EI contributions. The guide also covers entering tax history and accessing various payroll forms and reports.

Payroll Tax

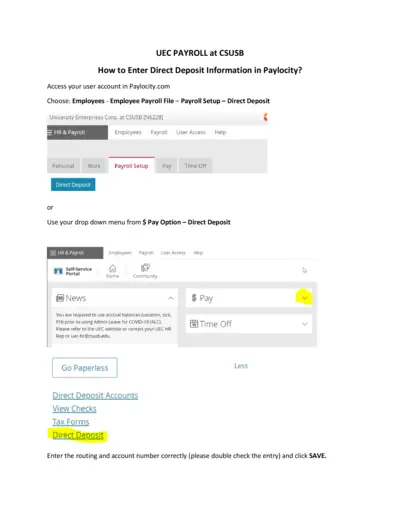

Direct Deposit Information Entry in Paylocity

This file provides detailed instructions for entering direct deposit information in Paylocity. It is useful for employees of CSUSB needing to set up their payment details. This guide ensures accurate submissions for efficient payroll processing.

Payroll Tax

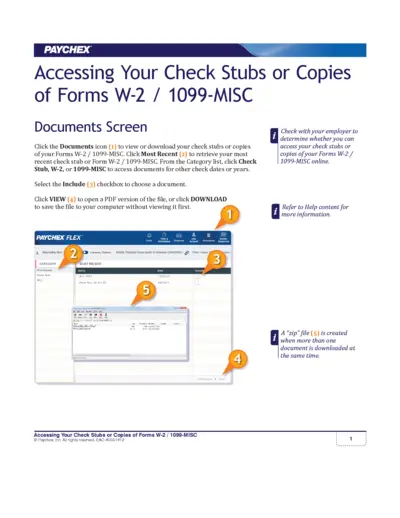

Access Your Paychex Check Stubs and W-2 Forms

This file provides step-by-step instructions for accessing your Paychex check stubs and W-2 forms. Users can learn how to view, download, and manage their payroll documents efficiently. Ensure you have your credentials ready to follow the instructions detailed within.

Payroll Tax

Paychex Flex App User Instructions for Employees

This file provides essential instructions for employees using the Paychex Flex app. It covers registration, app features, and security measures. Follow these guidelines to make the most of your Paychex experience.

Payroll Tax

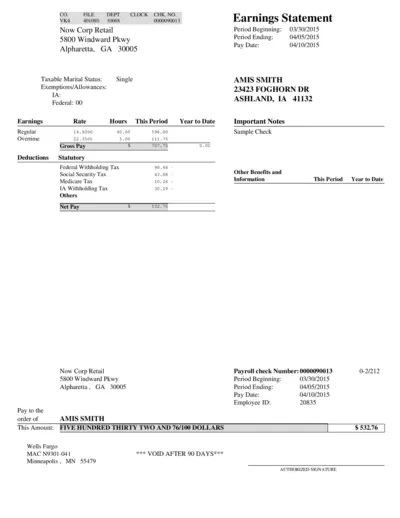

Earnings Statement and Pay Information for Employees

This document is an Earnings Statement that details the pay information for employees. It provides a summary of earnings, deductions, and net pay. Use it to understand your compensation and tax withholdings for the reporting period.

Payroll Tax

Time Sheet Import and RUN Powered by ADP Instructions

This file provides comprehensive guidance on importing time sheets using ADP's payroll application. Users will find detailed instructions on setting up their time sheet import file. It's essential for businesses looking to streamline their payroll processes with ADP.

Payroll Tax

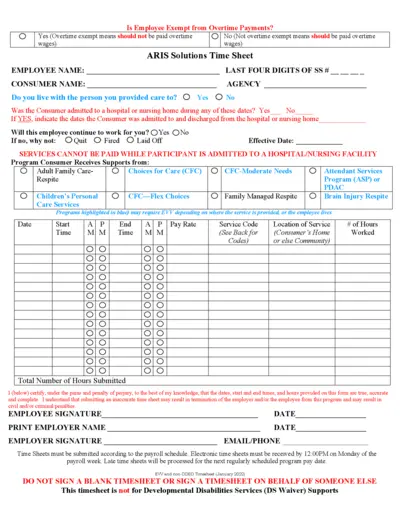

Employee Overtime Payment Exemption Form Guide

This file contains essential information about employee exemptions from overtime payments, including important instructions for filling out the associated time sheets. It's crucial for both employers and employees to understand their rights and responsibilities regarding overtime compensation. This guide also provides a step-by-step approach to ensure accurate submission of time sheets.

Payroll Tax

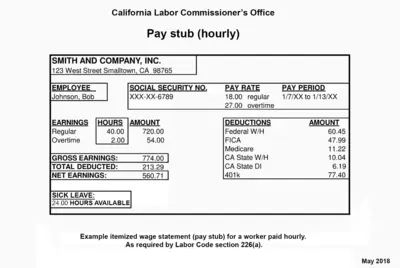

California Labor Commission Pay Stub Example

This file provides a sample pay stub for hourly employees. It outlines important earnings and deductions. Use it to understand your wage statements better.

Payroll Tax

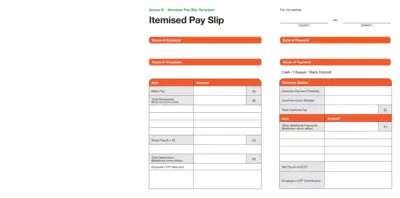

Itemised Pay Slip Template for Employers and Staff

This document provides a detailed itemised pay slip template for employers and employees. It helps to outline salaries, deductions, and overtime pay clearly. Perfect for businesses looking to maintain transparency in payroll processes.

Payroll Tax

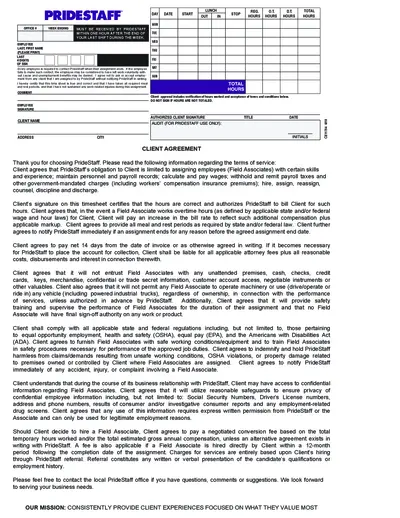

PrideStaff Employee Timesheet and Client Agreement

This document contains the PrideStaff Employee Timesheet and Client Agreement instructions. It is essential for employees to report their work hours accurately. Proper completion is required for payroll processing and compliance.

Payroll Tax

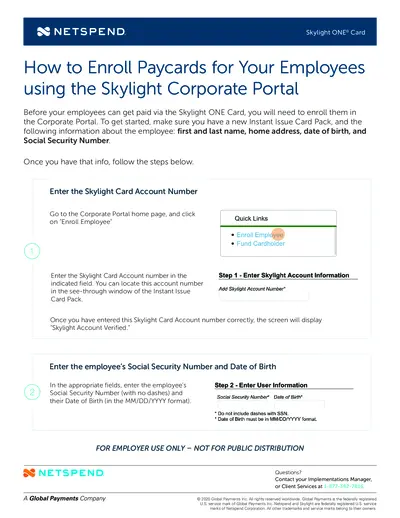

NETSPEND Skylight ONE Card Enrollment Instructions

This file provides detailed instructions on how to enroll employees for the Skylight ONE Card using the Corporate Portal. It includes necessary information for enrollment, step-by-step guidance, and contact details for support. Perfect for employers looking to streamline payment processes for their employees.