Payroll Tax Documents

Payroll Tax

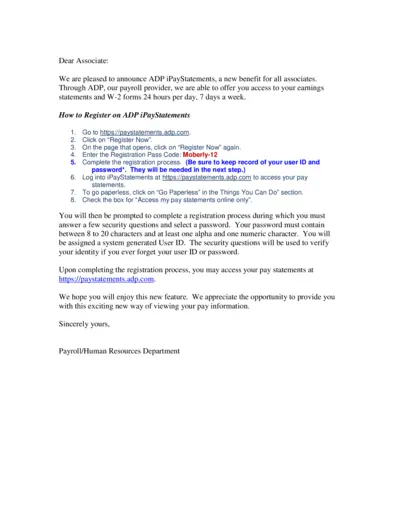

Access Your Pay Statements Anytime with ADP iPayStatements

The ADP iPayStatements provides associates with 24/7 access to earnings statements and W-2 forms. This guide outlines the registration process and beneficial features. Streamline your payroll experience with easy online access to your pay information.

Payroll Tax

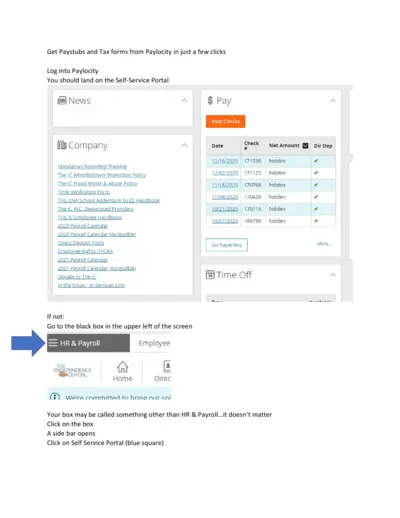

Retrieve Paystubs and Tax Forms from Paylocity Easily

This file provides a comprehensive guide on accessing paystubs and tax forms through Paylocity. Users can quickly navigate the Self-Service Portal and download necessary documents with simple instructions. Ideal for employees looking to manage their payroll information efficiently.

Payroll Tax

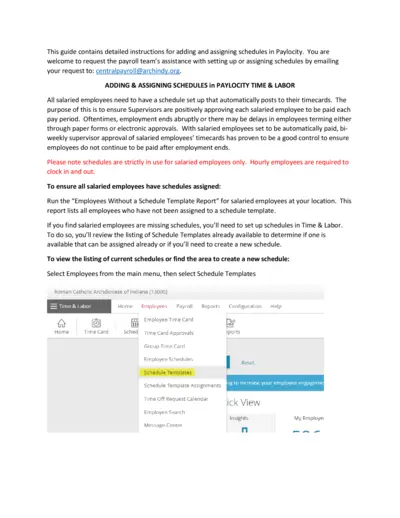

Adding and Assigning Schedules in Paylocity

This guide provides comprehensive instructions for adding and assigning schedules in Paylocity. It is designed to assist salaried employees in ensuring their work schedules are posted correctly. Contact the payroll team for further support.

Payroll Tax

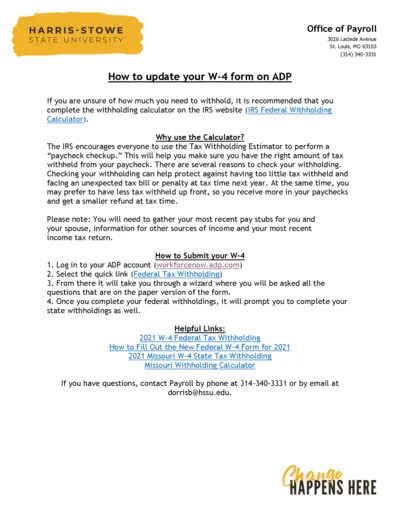

How to Update Your W-4 Form on ADP

This file provides detailed instructions on updating your W-4 form using ADP. It includes information about tax withholding and the importance of using the IRS calculator. Users will find step-by-step guidance for submission and links to helpful resources.

Payroll Tax

Acumen Fiscal Agent Pay Selection Options

This file outlines the pay selection options available for employees at Acumen. Users can choose between direct deposit, pay card, or paper check for receiving their paychecks. Detailed instructions for completing the form and submitting your choice are also included for your convenience.

Payroll Tax

Verizon Global Payroll Login Instructions

This document provides comprehensive instructions for logging into the Verizon Work History site. It includes troubleshooting tips and self-service options for former employees. Users will find detailed steps to ensure a successful login and access to their historical paychecks and tax documents.

Payroll Tax

Authorization for Employee Check Pick-Up

This file allows designated individuals to pick up payroll checks on behalf of employees. It requires employee information, identification, and specific signatures for authorization. Ensure to adhere to the outlined instructions for a smooth check-pick up process.

Payroll Tax

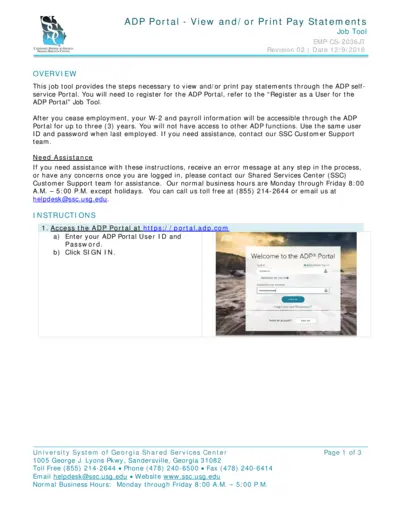

ADP Portal View and Print Pay Statements Guide

This file provides detailed instructions on how to view and print pay statements through the ADP Portal. It is essential for employees needing access to their payroll information. Follow the provided steps for a seamless experience.

Payroll Tax

Payroll Processing Instructional and Informational Guide

This file provides detailed instructions and guidance on using Payroll4Free for payroll processing. Users will find essential information on batch entry, reports, and check management. It serves as a comprehensive resource for efficient payroll management.

Payroll Tax

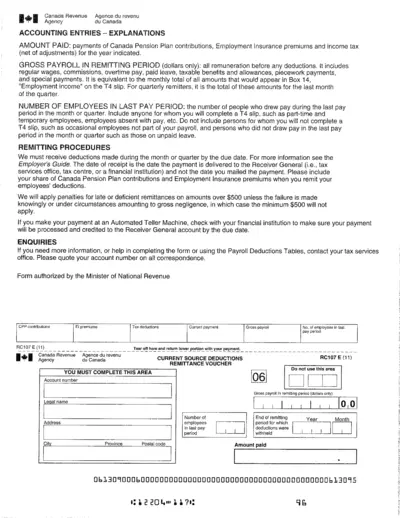

Canada Revenue Agency Accounting Entries Explanations

This file provides detailed explanations regarding accounting entries relevant to Canada Revenue Agency. It includes instructions for payroll remittances and how to report deductions. A must-have resource for employers handling payroll in Canada.

Payroll Tax

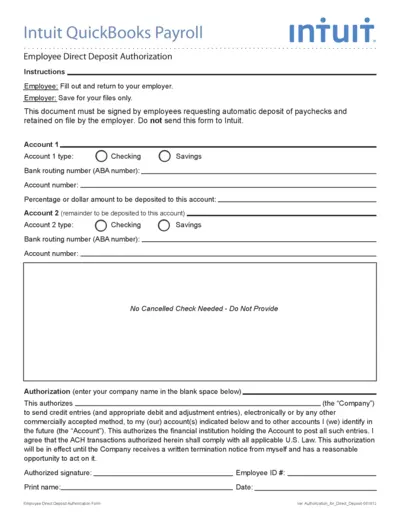

Intuit QuickBooks Payroll Direct Deposit Authorization

This file is the Employee Direct Deposit Authorization form provided by Intuit QuickBooks Payroll. It allows employees to authorize direct deposit of their paychecks into their bank accounts. This form must be filled out and returned to the employer for processing.