Faith-Based Nonprofits Documents

Faith-Based Nonprofits

Sponsorship Letter Template for Nonprofits

This file provides customizable sponsorship letter templates for events and sports. Ideal for nonprofits seeking corporate sponsorships. Use it to effectively communicate your needs to potential sponsors.

Faith-Based Nonprofits

Spark Good Space Request Tool Guide for Nonprofits

This guide provides instructions for using the Spark Good Space Request Tool. Nonprofits can learn how to request space for fundraising and community awareness campaigns. It covers the requirements and steps to successfully utilize the tool.

Faith-Based Nonprofits

California Nonprofit Organizations Tax Guide

This publication provides essential guidance on the sales and use tax law applicable to nonprofit organizations in California. It covers important regulations and tax exemptions that various nonprofit entities, including schools and religious institutions, should be aware of. Users are encouraged to reach out to the Customer Service Center for any inquiries or further assistance.

Faith-Based Nonprofits

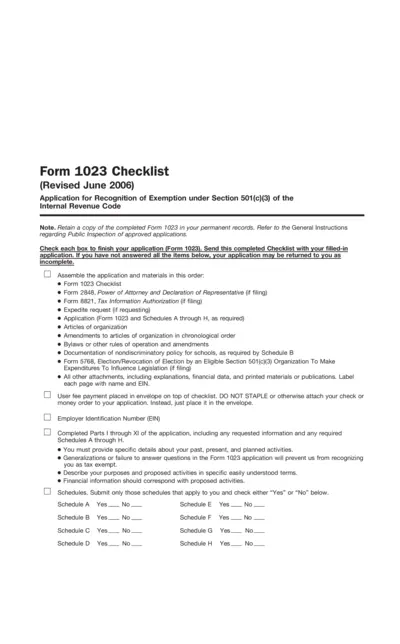

Form 1023 Checklist for 501(c)(3) Exemption

The Form 1023 Checklist provides essential instructions for organizations applying for recognition of exemption under Section 501(c)(3) of the Internal Revenue Code. It includes a detailed list of required documents and proper assembly guidelines to ensure a complete application. This file is crucial for entities seeking tax-exempt status.

Faith-Based Nonprofits

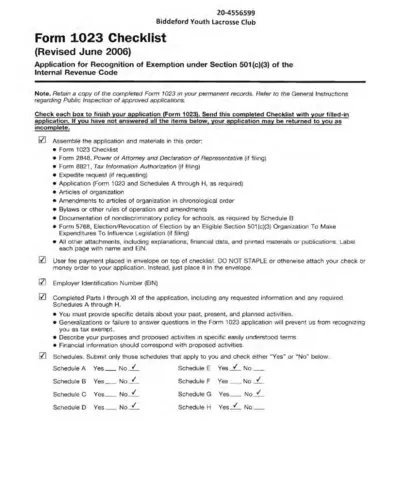

Form 1023 Checklist for 501(c)(3) Exemption

This document provides a comprehensive checklist for completing Form 1023 for the recognition of exemption under Section 501(c)(3). It includes essential components, submission instructions, and important updates to the form. Ideal for organizations seeking tax-exempt status under the IRS regulations.

Faith-Based Nonprofits

Kroger Community Giving Request Instructions

This file provides detailed instructions for requesting donations from Kroger. It outlines eligibility criteria, types of donations, and how non-profit organizations can apply. Learn how Kroger supports community initiatives through its charitable programs.

Faith-Based Nonprofits

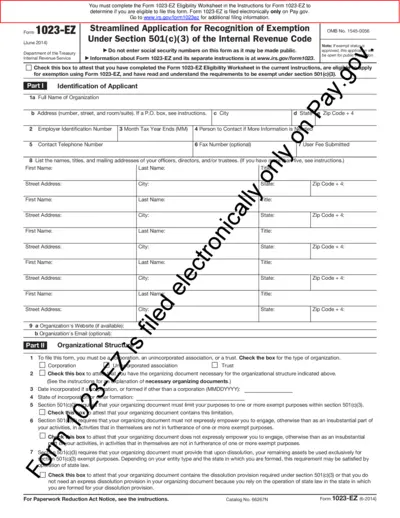

Form 1023-EZ Eligibility and Filing Guide

Form 1023-EZ is a streamlined application for recognition of exemption under Section 501(c)(3) of the Internal Revenue Code. This document helps qualifying organizations determine their eligibility and provides filing instructions. Ensure to complete the eligibility worksheet before submitting your application online.

Faith-Based Nonprofits

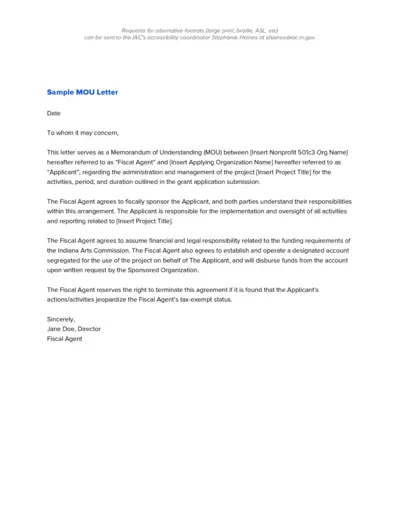

Memorandum of Understanding Sample Agreement

This document outlines the guidelines for a Memorandum of Understanding (MOU) between organizations. It includes responsibilities, administrative processes, and financial management. Ideal for nonprofits looking to align with fiscal agents for project management and funding.

Faith-Based Nonprofits

Nonprofit Risk Management Plan Sample File

This file provides a comprehensive risk management plan template for nonprofits to ensure safety and compliance. It outlines responsibilities and operational strategies for risk management. Organizations can utilize this guide to mitigate potential risks and safeguard their missions.