Faith-Based Nonprofits Documents

Faith-Based Nonprofits

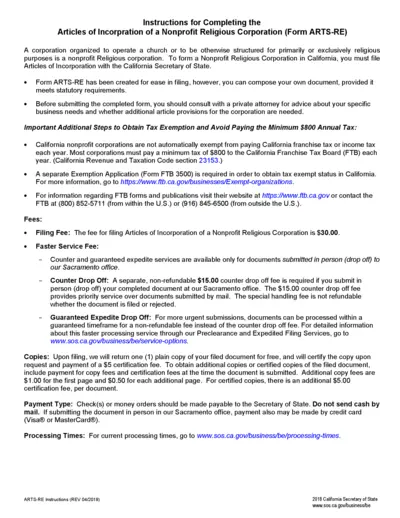

Instructions for Articles of Incorporation Nonprofit

This file provides essential instructions for completing the Articles of Incorporation for a Nonprofit Religious Corporation in California. It outlines the requirements, fees, and application process necessary for filing. Users can navigate through the steps for proper completion and submission of the form.

Faith-Based Nonprofits

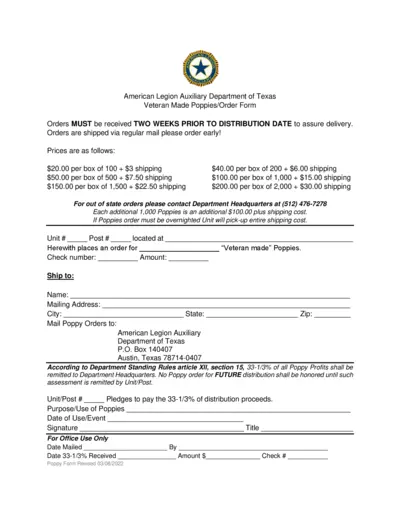

American Legion Auxiliary Poppy Order Form

This form provides detailed instructions for ordering Veteran Made Poppies. It includes pricing, ordering guidelines, and necessary information for your order. Make sure to follow the instructions carefully to ensure prompt delivery.

Faith-Based Nonprofits

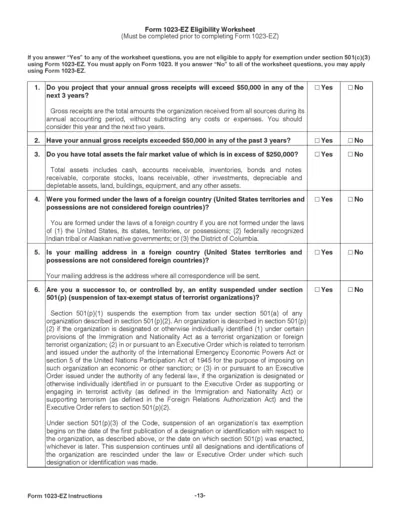

Form 1023-EZ Eligibility Worksheet Instructions

This file contains the eligibility worksheet required for applying for tax exemption under section 501(c)(3). It outlines essential questions to determine eligibility and instructions for filling out the form. Ensure all criteria are met before proceeding.

Faith-Based Nonprofits

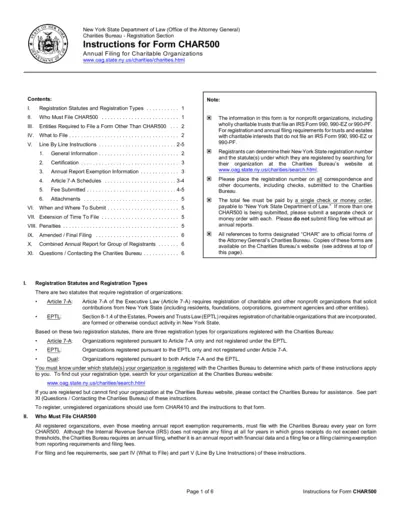

Instructions for Form CHAR500 Annual Filing

This document provides detailed guidance for charitable organizations in New York State on how to complete and file Form CHAR500. It includes important filing requirements and deadlines. Nonprofit organizations must adhere to these instructions to maintain compliance with state regulations.

Faith-Based Nonprofits

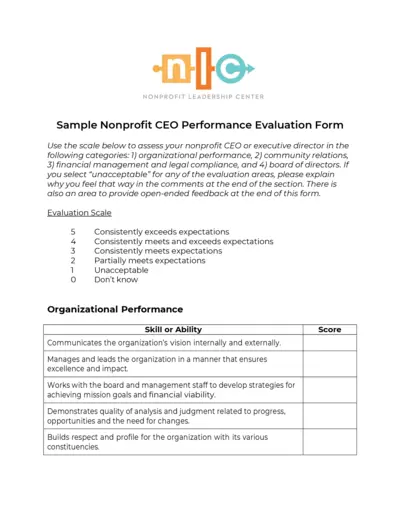

Sample Nonprofit CEO Performance Evaluation Form

This form assists nonprofit organizations in evaluating the performance of their CEO or executive director across key areas. It includes sections on organizational performance, community relations, financial management, and governance. Use this evaluation to identify strengths and areas for growth.

Faith-Based Nonprofits

Nonprofit Leadership Lab Board Report Template

This file offers a comprehensive template for creating an outstanding board report for nonprofit organizations. It includes key insights into effective communication with board members and strategic reporting. Perfect for executive directors and board members seeking to enhance engagement and accountability.

Faith-Based Nonprofits

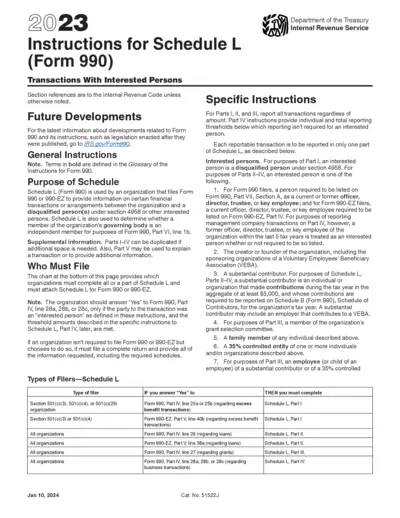

Instructions for Schedule L Form 990 IRS 2023

This document provides detailed instructions for filing Schedule L of Form 990 with the IRS. It includes necessary information about transactions with interested persons. Nonprofit organizations will find guidelines for compliance and reporting requirements.

Faith-Based Nonprofits

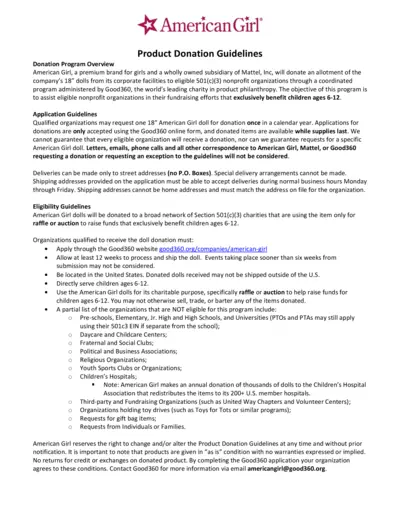

American Girl Product Donation Guidelines

This document contains the guidelines for the American Girl product donation program, including eligibility requirements and application instructions. It aims to assist eligible nonprofit organizations in obtaining dolls for fundraising that benefits children aged 6-12. Organizations must follow the application guidelines to be considered for the donations.

Faith-Based Nonprofits

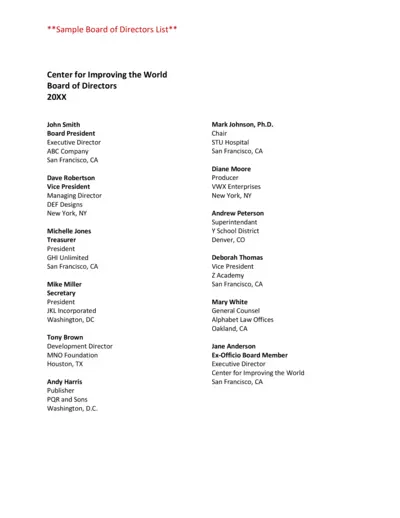

Sample Board of Directors List for 20XX

This document provides a comprehensive list of the Board of Directors for the Center for Improving the World for the year 20XX. Users can reference this document to understand the leadership structure and contact information for board members. It is a valuable resource for stakeholders, partners, and those looking to connect with the organization.

Faith-Based Nonprofits

DARPAN Registration User Guide for NGOs

This user guide provides essential instructions for NGOs to register on the DARPAN portal. Follow the detailed steps to ensure successful registration. Gain access to various resources and support through the DARPAN initiative.

Faith-Based Nonprofits

Customer Success Report on Volunteer Management Software

This file contains a detailed Customer Success Report focused on Volunteer Management Software. It provides insights into effective volunteer management practices for nonprofits. The report includes rankings and methodologies for assessing software based on customer success.

Faith-Based Nonprofits

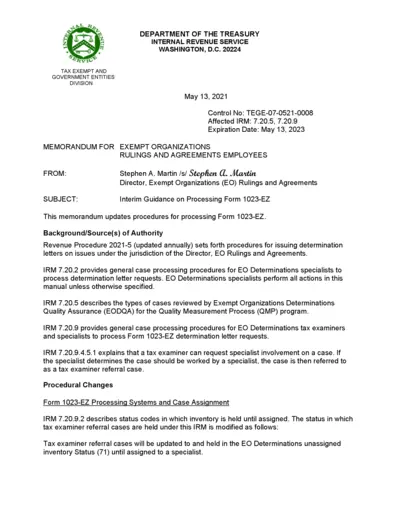

Interim Guidance on Processing Form 1023-EZ

This file provides interim guidance for processing Form 1023-EZ by the IRS. It contains valuable information for tax examiners and specialists. Users can find procedures, time frames, and requirements for filing this form.