Legal Documents

Property Taxes

Form 540-ES 2024 Instructions for Estimated Tax

This document provides instructions for completing Form 540-ES for estimated tax payments in California for 2024. It outlines who must make payments, deadlines, and payment methods. Use this guide to help determine your estimated tax obligations and the required forms.

Property Taxes

Australian Tax Return Application for Working Holiday Visa

This file contains the application form for claiming your Australian tax refund as a working holiday visa holder. Follow the instructions to fill out the form correctly. Ensure all required documents are attached for a smoother process.

Property Taxes

Alabama Individual Tax Return Form 40 Booklet

This form provides residents and part-year residents of Alabama with the necessary instructions and details to file their individual income tax returns. It includes comprehensive information on filing methods, deadlines, and common queries related to Alabama state taxes. Users can find helpful tips on secure filing and information on taxpayer service centers throughout Alabama.

Business Formation

Personal Net Worth Statement for DBE/ACDBE

This form is essential for individuals seeking certification in the Disadvantaged Business Enterprise (DBE) Programs. It gathers financial information required to assess economic disadvantage in accordance with U.S. Department of Transportation regulations. Proper completion of this form is vital for ensuring eligibility in the DBE and ACDBE programs.

Property Taxes

IFTA Fuel Tax Report Supplement Form 56-102

The IFTA Fuel Tax Report Supplement Form 56-102 is essential for reporting fuel tax for different fuel types. This form aids in calculating tax liabilities based on miles traveled in various jurisdictions. It is crucial for both individuals and businesses involved in interstate travel.

Property Taxes

Appeals Procedures for First Time Abatement Relief

This file provides comprehensive guidance on Appeals procedures related to First Time Abatement (FTA) Penalty Relief for international penalties. It outlines the exceptions and instructions for Appeals technical employees to consider granting FTA relief. Familiarizing yourself with this file is essential for understanding how to navigate international penalty cases.

Real Estate

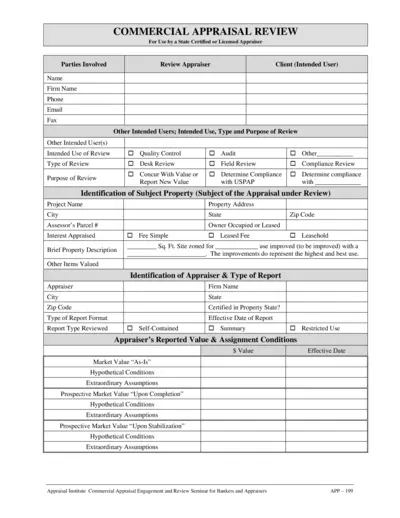

Commercial Appraisal Review Form for Appraisers

This Commercial Appraisal Review form is designed for state-certified and licensed appraisers. It includes necessary information for review appraisal alignment, compliance, and procedures. Suitable for both compliance reviews and general appraisal evaluations.

Property Taxes

Texas Franchise Tax No Tax Due Report Form

The Texas Franchise Tax No Tax Due Report Form is designed for eligible entities to report no tax due. This streamlined form allows taxpayers to comply with Texas tax regulations. Easily fill out and submit your report electronically.

Property Taxes

Form 8854 Expatriation Statement for 2023

The Form 8854 is an Initial and Annual Expatriation Statement required by the IRS. It must be filed by individuals who have expatriated in 2023 or earlier. This form helps determine the tax consequences of expatriation.

Property Taxes

Instructions for California Earned Income Tax Credit

This file contains essential instructions for the 2015 California Earned Income Tax Credit (EITC) form. It outlines eligibility criteria, how to complete the form, and important tax information. Use this guide to maximize your tax benefits if you have earned income in California.

Property Taxes

Form W-7 COA IRS Taxpayer Identification Number

Form W-7 (COA) certifies the accuracy of documentation for ITIN applicants. This form is essential for Certifying Acceptance Agents submitting for IRS ITIN. Complete the form accurately to avoid processing delays.

Zoning Regulations

Army Cybersecurity Regulation 25-2 Overview

This document serves as the regulation for Army Cybersecurity management. It outlines the necessary responsibilities and policies for safeguarding Army's information technology. Effective from April 4, 2019, it addresses compliance with defense directives.