Legal Documents

Property Taxes

Maryland Tax Connect User Guide for Filing Forms

This guide provides detailed steps for filing Maryland state tax forms through Maryland Tax Connect. It covers filing for different tax types and includes essential information for users. Ideal for both consumers and business users wishing to navigate their tax obligations.

Real Estate

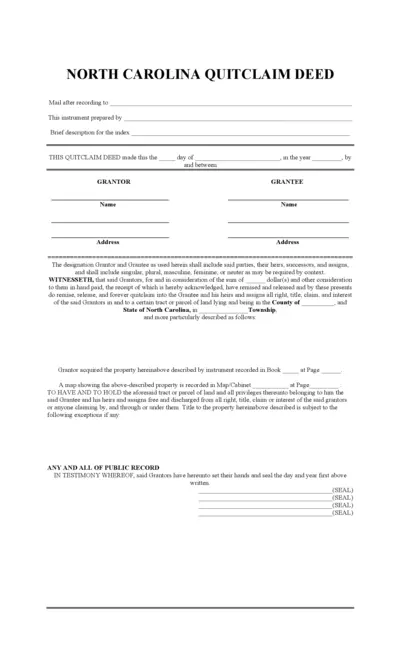

North Carolina Quitclaim Deed Form Instructions

This Quitclaim Deed allows a property owner to transfer their interest in real estate to another party. It's essential for legal property transactions in North Carolina. Ensure all fields are filled out accurately to avoid issues.

Property Taxes

IRS Schedule D Form 1040 Capital Gains and Losses

This file contains the IRS Schedule D Form 1040 used for reporting capital gains and losses for tax purposes. It provides detailed instructions and forms necessary for accurate tax reporting. Ensure you follow the guidelines closely for successful submission.

Property Taxes

VAT Refund Request Instructions for IKEA

This VAT refund request form for IKEA helps individuals and businesses reclaim VAT. Proper completion and submission are essential for successful refunds. Follow the instructions carefully to ensure your application is processed promptly.

Real Estate

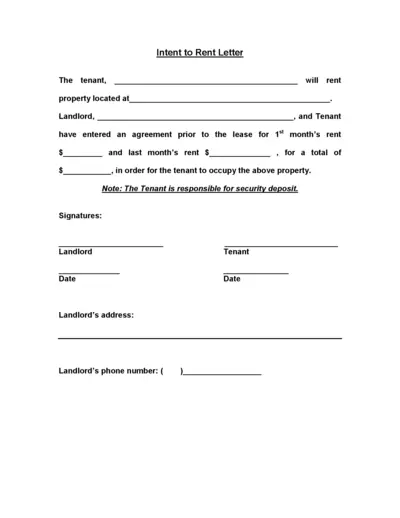

Intent to Rent Letter for Tenants and Landlords

This Intent to Rent Letter serves as a formal agreement between the landlord and tenant regarding the rental property. It outlines the terms including the first and last month's rent, as well as security deposit obligations. Use this document to ensure clear communication and agreement before leasing a property.

Property Taxes

IRS Form 4810 Request for Prompt Tax Assessment

IRS Form 4810 is used to request a prompt assessment of tax under Section 6501(d). It must be accompanied by specific documentation. Make sure to fill this form accurately to avoid delays.

Business Formation

LARA Corporations Online Filing Annual Statement 2022

This file is the Annual Statement for Domestic Limited Liability Companies. It provides essential information needed for compliance with state regulations. Use this document to ensure that your company maintains its good standing.

Property Taxes

2023 Instructions for Schedule I Form 1041 - AMT Tax

This file provides detailed instructions for completing Schedule I of Form 1041, used to calculate Alternative Minimum Tax for estates and trusts. It covers who needs to file this form, records required, and special notes for the 2023 tax year. This guide is essential for CPAs, tax preparers, and fiduciaries handling estates or trusts.

Real Estate

DDA Flats Freehold Conversion Scheme Guide

This file provides detailed instructions about the conversion of residential flats from leasehold to freehold under the DDA scheme. It includes eligibility criteria, application procedures, and important documents needed for submission. Users seeking to convert their DDA flats will find this guide essential.

Real Estate

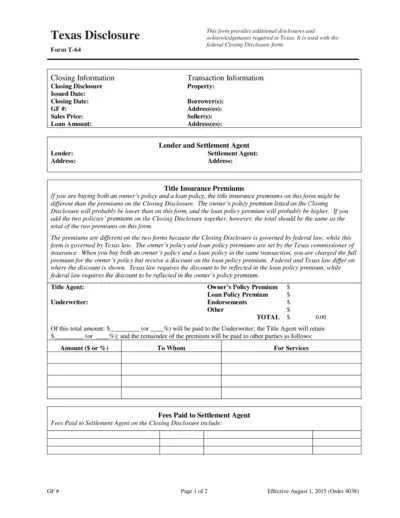

Texas Disclosure Form T-64 Disclosures and Acknowledgements

The Texas Disclosure Form T-64 provides essential disclosures and acknowledgments required when closing real estate transactions in Texas. It works alongside the federal Closing Disclosure form to ensure compliance with state and federal regulations. This document is crucial for buyers, sellers, and real estate professionals involved in property transactions.

Property Taxes

North Carolina Individual Income Tax Form D-400 Instructions

This document provides essential instructions for filing North Carolina's Individual Income Tax Form D-400. It includes updates for 2011, details on e-filing, and critical filing information. Users will find valuable tips on deductions, tax credits, and electronic filing options.

Business Formation

Form 304 Application for Foreign LLC Registration

The Form 304 is for registering a foreign limited liability company in Texas. It details the requirements and instructions for filing. Ensure compliance with Texas regulations to avoid penalties.