Legal Documents

Property Taxes

Connecticut Sales and Use Tax Return Instructions

This document provides detailed instructions for completing the Connecticut Sales and Use Tax Return, Form OS-114. It outlines filing requirements, payment methods, and guidelines for accurate tax reporting. Ideal for businesses reporting sales activity in Connecticut.

Business Formation

Filing Requirements for Regulation D Offerings

This document outlines the filing requirements for Regulation D offerings in California. It provides instructions for submitting Form D to the Commissioner of Business Oversight and offers guidance on ensuring compliance with state laws. This resource is essential for companies looking to secure exemptions from securities registration.

Business Formation

How to Obtain a Copy of Your EIN Certificate Easily

This file provides essential steps for obtaining a copy of your EIN certificate in case it is lost. It outlines various methods to retrieve this important document. Ideal for business owners needing verification for tax or banking purposes.

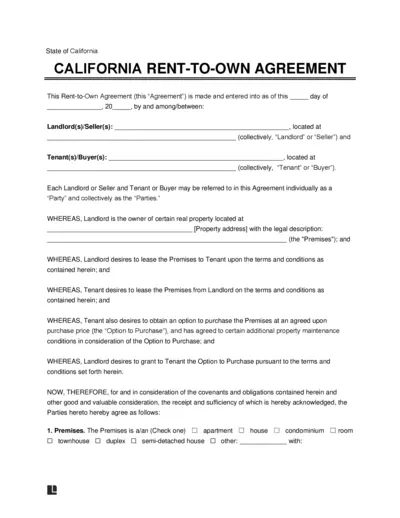

Real Estate

California Rent-to-Own Agreement

The California Rent-to-Own Agreement provides a structured path for tenants who wish to rent with an option to buy. This legally binding document outlines the rights and responsibilities of both landlords and tenants. It includes terms for lease duration, rental amounts, and conditions for purchasing the property.

Contracts

2023 SAG-AFTRA Codified Basic Agreement Summary

This document summarizes the 2023 Tentative Successor Agreement for SAG-AFTRA. It includes important information about wages, terms, and conditions for performers. Familiarize yourself with the details and requirements outlined for this agreement.

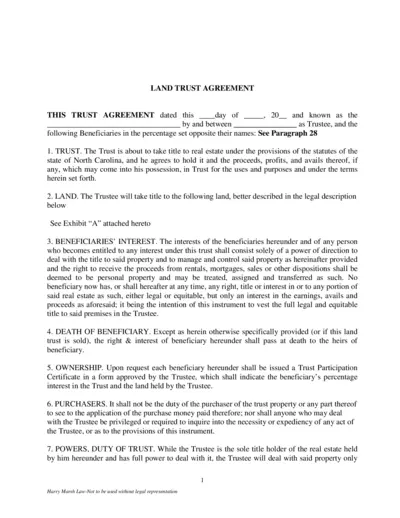

Real Estate

Land Trust Agreement Guide for North Carolina Users

This Land Trust Agreement provides critical guidelines for real estate management in North Carolina. It outlines the roles of trustees and beneficiaries in a trust structure. Users can leverage this agreement for effective property management and legal compliance.

Property Taxes

2022 Automatic Filing Extension for Colorado Tax Return

This file provides instructions and forms for the 2022 Automatic Filing Extension for Composite Nonresident Income Tax Return in Colorado. Users can find important deadlines and guidelines for filing their tax returns. The file also details how to make additional payments and the process to claim the extension.

Business Formation

Form R-3 Instructions for Business Changes

This document provides essential instructions on how to complete Form R-3 for making changes to registered business or tax accounts. It covers updating contact information, closing a business, and changing responsible officer details. Ensure to follow the guidelines provided for an accurate and efficient submission.

Business Formation

Alabama Corporation Annual Report Submission

This file is the Alabama Secretary of State Corporation Annual Report for tax year 2023. It is essential for C-corporations and S-corporations to comply with state regulations. Be sure to fill it out correctly to avoid any delays in processing.

Property Taxes

Maryland Form 502INJ Injured Spouse Claim Form 2023

The Maryland Form 502INJ is used by injured spouses to claim their portion of a joint tax refund. It provides the necessary information required to allocate income and deductions accurately between spouses. Completing this form is essential for ensuring the rightful receipt of tax refunds.

Property Taxes

Step-by-Step Guide on Filing Auto-Populated VAT Return

This comprehensive guide provides detailed instructions on how to fill out the auto-populated VAT return in iTax. Tailored for taxpayers in Kenya, it simplifies the filing process, enhancing compliance and transparency. It also addresses common concerns and outlines important dates for submission.

Property Taxes

Michigan Department of Treasury Installment Agreement

This file contains the Michigan Department of Treasury's Installment Agreement form for individuals and businesses seeking to establish a payment plan. It outlines the necessary instructions for completing the form and essential guidelines for submission. Proper completion of this form is crucial for managing outstanding debts with the Michigan Department of Treasury.